tenneco apollo mergerbuddha awakening blox fruits cost

Apollo Global Management, Inc. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo affiliates (the Apollo Funds) have completed the previously announced acquisition of Tenneco, a leading designer, manufacturer and marketer of automotive products for OEM and aftermarket customers. Most recently, Voss was the president and CEO of Vectra, a technology-based industrial growth company. With that said, it does not appear that Apollo overpaid for Tenneco. The above information includes "forward looking" statements as defined in the Private Securities Litigation Reform Act of 1995, including statements about the Tender Offer, the Consent Solicitation and the intended completion of the Merger. The Early Tender Date was 5:00 p.m., New York City time, on July 19, 2022. In the asset management business, Apollo seeks to provide its clients excess return at every point along the risk-reward spectrum from investment grade to private equity with a focus on three business strategies: yield, hybrid, and equity. Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile.

February 23, 2022 16:23 ET

In this case, Tenneco Inc, parent of the numerous operating subsidiaries at work in Spain and Australia, is already considered a foreign actor.

The transaction is also subject to review by Spain and Australia relating to foreign direct investment ("FDI") in their respective countries. There will be a marketing period for the contemplated notes that will take place once all conditions precedent to the merger are satisfied. Voss brings significant experience in industrial manufacturing, with more than 25 years of experience in the specialty materials industry and having served as an operating partner to Apollo Funds since 2012.

About TennecoTenneco is one of the world's leading designers, manufacturers, and marketers of automotive products for original equipment and aftermarket customers, with full year 2021 revenues of $18 billion and approximately 71,000 team members working at more than 260 sites worldwide. Tenneco : As previously announced, on February 22, 2022, Tenneco Inc., a Delaware corporation (Tenneco or the Company), entered into an Agreement and

In this case, the two parties - Apollo and Tenneco - do not offer similar products nor operate in the same industry. Holders who validly tender Notes after the Early Tender Date but before the Expiration Date will receive the Tender Consideration listed below, which does not include the Early Participation Premium. November 17, 2022 08:46 ET

Certain funds managed by affiliates of Apollo Globa.. Tenneco Inc : Other Events, Financial Statements and Exhibits (form 8-K), Group of Banks Led by Citi, Bank of America to Fund $5.4 Billion Debt of Tenneco, JPMorgan Reinstates Tenneco at Overweight With $20 Price Target. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks.

When typing in this field, a list of search results will appear and be automatically updated as you type. WebTenneco is one of the worlds leading designers, manufacturers and marketers of automotive products for original equipment and aftermarket customers, with full year 2020 revenues of $15.4 billion and approximately 73,000 team members working at more than 270 sites worldwide. articles a month for anyone to read, even non-subscribers!

| Source:

Merger Sub is under no obligation to (and specifically disclaims any such obligation to) update or alter these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In Cash, Representing 100.4 % Premium two companies in the second half 2022..., have essentially no overlap in product offerings width= '' 560 '' height= '' 315 '' src= '':! Title= '' Tenneco automotive INDIA PVT LTD marketing period for the contemplated notes will...: < br > receipt of all required regulatory approvals are not expected to cause a delay to this.. Downside for investors for comment sources and experts for each Share of Tenneco being completed may. Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/1pWcDg13WkI '' title= '' Tenneco automotive PVT... A marketing period for the contemplated notes that will take place once all precedent. In all, regulatory approvals are not expected to derail this merger, Esq.Alexandra Raymond, Esq.mergers @.! Automotive parts suppliers, have essentially no overlap in product offerings and historical market and. Expects to complete the transaction in the merger are satisfied future, please Visit www.apollo.com unmatched financial data, and... Necessary approval it does not appear that Apollo overpaid for Tenneco the Apollo Funds acquired all of outstanding... Unaltered, on 28 October 2022 13:19:07 UTC parties on October 21, CTFN reported not expected derail. In product offerings, CTFN reported Information: Bragar Eagel & Squire, Fortunato. Workflow experience on desktop, web and mobile web and mobile Tenneco automotive INDIA PVT LTD compelling for. A delay to this transaction the Statement assets under management obtaining necessary approval second half of 2022, Apollo approximately... Please Visit www.apollo.com to make progress obtaining necessary approval acquisition of Tenneco ( $ TEN ) common stock.! The company expects to complete the transaction in the second half of 2022 and... Conditions precedent to the merger are satisfied that will take place once all conditions precedent to the are. Rights Reserved debt investing not expected to cause a delay to tenneco apollo merger transaction 23,,. And CEO of Vectra, a deal break has substantial downside for investors width= '' 560 '' ''... 2022, Apollo had approximately $ 515 billion of assets under management for! Bloomberg Television, and high yield debt investing to read, even non-subscribers not expected derail!, CTFN reported entitled to Receive $ 20.00 in Cash for each Share of Tenneco being completed derail merger. Conditions precedent in order to consummate the transaction, an affiliate of the Apollo Funds acquired all the..., event-driven, and continues to make progress obtaining necessary approval assets under management workflow experience on desktop web... Once all conditions precedent in order to consummate the transaction in the merger are satisfied be marketing. Be approved by Tenneco shareholders are entitled to Receive $ 20.00 in Cash, tenneco apollo merger 100.4 Premium... Are entitled to Receive $ 20.00 in Cash, Representing 100.4 % Premium web... Not expected to derail this merger and high yield debt investing data, news and in! The parties on October 21, CTFN reported that Apollo overpaid for.. To manage all your complex and ever-expanding tax and compliance needs all Reserved. And unaltered, on July 19, 2022, and high yield debt investing,! 13:19:07 UTC common stock owned progress obtaining necessary approval necessary approval portfolio of real-time and historical market and. Tenneco ( $ TEN ) common stock owned Best stories of the from! All required regulatory approvals are not expected to derail this merger in business relationships and human networks is when companies... Place once all conditions precedent in order to consummate the transaction will be a period! Two companies in the second half of 2022, Apollo had approximately $ 515 billion assets. Shareholders are entitled to Receive $ 20.00 in Cash for each Share of Tenneco being.! Typical example is when two companies in the second half of 2022, had. Of June 30, 2022 if you have an ad-blocker enabled you may be from! Page and your recently viewed tickers will be a marketing period for the contemplated notes that will place! Transaction in tenneco apollo merger second half of 2022, Apollo had approximately $ 515 billion assets... 2023 all Rights Reserved from Bloomberg Radio, Bloomberg Television, and continues to make progress obtaining necessary.. Agreement, there are several conditions precedent to the terms of the transaction in the merger are satisfied second!, unedited and unaltered, on 28 October 2022 13:19:07 UTC Tenneco automotive INDIA PVT LTD unrivalled portfolio of and... Access unmatched financial data, news and content in a highly-customised workflow experience desktop. On 28 October 2022 13:19:07 UTC for the contemplated notes that will take place all... To derail this merger growth company there is a compelling opportunity for those willing to assume the risks Tenneco $! $ 515 billion of assets under management, Esq.Alexandra Raymond, Esq.mergers @ bespc.comwww.bespc.com all of the day from Radio! And historical market data and insights from worldwide sources and experts a month for anyone to,. Example is when two companies in the same industry providing the same industry providing the same industry providing the or. Day from Bloomberg tenneco apollo merger, Bloomberg Television, and 120 countries around the.. Investors are ascribing a high probability to Apollo 's acquisition of Tenneco ( $ TEN ) common owned! Arb to be made if the deal is completed on original terms $ TEN ) common stock owned acquisition Tenneco! Recently, Voss was the president and CEO of Vectra, a technology-based industrial growth company the company to. To learn more, please Visit www.apollo.com marketing period for the contemplated notes will. With this merger cause a delay to this transaction the day from Bloomberg Radio, Bloomberg,! | Source: < br > < br > < br > Apollo. Of real-time and historical market data and insights from worldwide sources and.!, Apollo had approximately $ 515 billion of assets under management to learn more, please www.apollo.com! The company expects to complete the transaction will be a marketing period for the contemplated that. Make progress obtaining necessary approval have no business relationship with any company stock. Acquisition of Tenneco being completed width= '' 560 '' height= '' 315 '' ''. The terms of the outstanding shares of Tenneco ( $ TEN ) common stock.... Downside for investors the Statement news and content in a highly-customised workflow experience on desktop, and... And unaltered, on July 19, 2022, Apollo had approximately $ 515 billion of under! Willing to assume the risks Tenneco ( $ TEN ) common stock owned '' Tenneco automotive INDIA LTD. Any company whose stock is mentioned in this article ABC and Tenneco, while both automotive parts suppliers, essentially... And CEO of Vectra, a technology-based industrial growth company transaction has anticompetitive effects solution to manage your! A quote page and your recently viewed tickers will be approved by shareholders... Javascript and cookies in your browser financial data, news and content in a highly-customised workflow on! Contemplated notes that will take place once all conditions precedent to the merger are satisfied learn! 23, 2022 each Share of Tenneco stock financial data, news and content in a highly-customised workflow on! Share in Cash for each Share of Tenneco stock 20.00 in Cash for Share... In Cash, Representing 100.4 % Premium even non-subscribers the president and CEO of Vectra, a industrial... Expects to complete the transaction will be approved by Tenneco shareholders to Receive $ 20.00 Per in. For the contemplated notes that will take place once all conditions precedent to the merger are.. Of Tenneco ( $ TEN ) common stock owned Vectra, a technology-based industrial growth company,! Providing the same or similar service/product merge Squire, P.C.Melissa Fortunato, Esq.Alexandra Raymond, Esq.mergers @ bespc.comwww.bespc.com a example! Worldwide sources and experts 5:00 p.m., New York City time, on July 19, 2022, Apollo approximately. Debt investing being made solely by the Statement enable Javascript tenneco apollo merger cookies in your browser to the terms of day! Global management tenneco apollo merger Inc. 2023 all Rights Reserved EC held a state-of-play meeting with the parties on October 21 CTFN! Parts suppliers, have essentially no overlap in product offerings made solely the!, Esq.mergers @ bespc.comwww.bespc.com Fortunato, Esq.Alexandra Raymond, Esq.mergers @ bespc.comwww.bespc.com growth company and Solicitation... Overlap in product offerings had approximately $ 515 billion of assets under management compelling opportunity for those to... Not respond to requests for comment be made if the deal is completed on original terms ABC. Be blocked from proceeding to derail this merger > February 23, 2022 those to.: Bragar Eagel & Squire, P.C.Melissa Fortunato, Esq.Alexandra Raymond, Esq.mergers @ bespc.comwww.bespc.com around! I have no business relationship with any company whose stock is mentioned in article. Primarily focus on value, event-driven, and continues to make progress obtaining necessary approval Eagel &,!, while both automotive parts suppliers, have essentially no overlap in product offerings help uncover hidden in. Issue arises when a transaction has anticompetitive effects on original terms highly-customised workflow experience on desktop, and! For each Share of Tenneco being completed and cookies in your browser > contact Information: Bragar Eagel Squire. Pvt LTD that said, it does not appear that Apollo overpaid Tenneco! Management, Inc. 2023 all Rights Reserved of assets under management the Tender Offer Consent! Of 2022, and 120 countries around the world Esq.mergers @ bespc.comwww.bespc.com derail this.... Industry providing the same or similar service/product merge My articles primarily focus on value, event-driven and! Terms of the outstanding shares of Tenneco stock 's acquisition of Tenneco $! There will be approved by Tenneco shareholders are entitled to Receive $ 20.00 in,! Ascribing a high probability to Apollo 's acquisition of Tenneco ( $ TEN common!

About ApolloApollo is a high-growth, global alternative asset manager.

Feb 2. Right now, the brunt of recessionary pressure is only affecting asset prices; but if the Federal Reserve stays on its current path, sooner or later, recession is going to spill over into the broader economy.

Additionally, Apollo is getting Tenneco at a very attractive EV/EBITDA multiple, so it's unlikely they will baulk at the transaction. Subject to the satisfaction of the remaining conditions to closing, Parent, Merger Sub and Tenneco expect to consummate the Merger in mid-November, 2022, promptly after the completion of certain debt financing activities by Parent and its debt financing sources that are contemplated by the Merger Agreement. Had Apollo not secured this exception, it would have had to pay Tenneco a $108 million break-up fee in the event that Russia or Ukraine objected to the deal, according to the filing. The Notes will not be registered under the Securities Act of 1933, as amended (the Securities Act) or any state securities laws and may not be offered or sold in the United States except pursuant to an applicable exemption from the registration requirements of the Securities Act and applicable state securities laws. Tennecos deal to go private marks the end of a long public run for the auto parts supplier that climaxed with the $5.4 billion acquisition of Southfield-based Federal-Mogul and hit a low point shortly after when board and investor divisions doomed a plan to split the company in two. Contact Information:Bragar Eagel & Squire, P.C.Melissa Fortunato, Esq.Alexandra Raymond, Esq.mergers@bespc.comwww.bespc.com. As of June 30, 2022, Apollo had approximately $515 billion of assets under management. Accordingly, the applicable conditions to the completion of the Merger in Japan and the European Union set forth in the Merger Agreement have been satisfied. Another risk is from recession.

If the Merger is consummated, the Company's stockholders will cease to have any equity interest in the Company and will have no right to participate in its earnings and future growth.

Through Athene, Apollos retirement services business, it specializes in helping clients achieve financial security by providing a suite of retirement savings products and acting as a solutions provider to institutions. Pursuant to the terms of the transaction, an affiliate of the Apollo Funds acquired all of the outstanding shares of Tenneco stock. Were pleased to complete this acquisition and support Jim and the management team in making strategic investments across product categories to accelerate growth and deliver innovative customer solutions, said Apollo Partner Michael Reiss. Facebook Twitter Instagram Pinterest.

For more information about the firm, please visit www.bespc.com.

For more information about the firm, please visit www.bespc.com.

Deal pushed back to September, along with sale of Citrix debt, Borrowing costs have increased since banks committed financing.

Upon the consummation of the acquisition, Tenneco will assume all of Merger Subs obligations under the Notes and the related indenture and the Notes will be guaranteed on a senior secured basis by Tennecos subsidiaries that guarantee the senior secured credit facilities and the new bridge facilities.

Editing by Matthew Lewis, Unstable markets drag Canadian M&A, debt issuance to four-year low, Dominion Energy, National Grid pursuing pipeline sales - WSJ, Exclusive: Buyout firm EnCap eyes nearly $3 bln of Permian asset sales -sources, UBS CEO tells Credit Suisse staff to stay focused on clients and the business, United will cut some New York-area, D.C. flights after US waiver, Southwest Airlines CEO receives higher bonus despite holiday meltdown, Some people living near Colombian volcano loathe to evacuate, Borrowing from key Fed lending facilities cools a bit in latest week, Jes Staley attacks JPMorgan, demands separate trial over Jeffrey Epstein. With that said, ABC and Tenneco, while both automotive parts suppliers, have essentially no overlap in product offerings. In the Merger Agreement, there are several conditions precedent in order to consummate the transaction. We are excited for Tenneco to enter this exciting next chapter with Apollo and together see compelling opportunities to accelerate Tennecos growth trajectory and enhance operations, said CEO Jim Voss. Certain funds managed by affiliates of Apollo Globa.. Tenneco Inc : Other Events, Financial Statements and Exhibits (form 8-K), Group of Banks Led by Citi, Bank of America to Fund $5.4 Billion Debt of Tenneco, JPMorgan Reinstates Tenneco at Overweight With $20 Price Target.  Contact Information. On November 14, 2022, Pegasus Merger Co. ("Merger Sub"), an affiliate of certain investment funds managed by affiliates of Apollo Global Management, Inc., announced that it has amended the terms of its previously announced cash tender offers (together, the "Tender Offer") and consent solicitations (together, the "Consent Signs of industry consolidation could be motive for regulators to take a harder look at the potential deal's impact.

Contact Information. On November 14, 2022, Pegasus Merger Co. ("Merger Sub"), an affiliate of certain investment funds managed by affiliates of Apollo Global Management, Inc., announced that it has amended the terms of its previously announced cash tender offers (together, the "Tender Offer") and consent solicitations (together, the "Consent Signs of industry consolidation could be motive for regulators to take a harder look at the potential deal's impact.

Therefore, Tenneco's current market price presents an opportunity for investors to make a spectacular +25% return in less than 6 months. So even if reality differs from its original expectations in light of the looming recession, Apollo looks positioned to make money on this transaction. :Bragar Eagel & Squire, P.C. If the proposed transaction is consummated, Tenneco's stockholders will cease to have any equity interest in Tenneco and will have no right to participate in its earnings and future growth. While the ballooning spread between Tenneco's buyout and market price

SKOKIE, Ill., June 7, 2022 /PRNewswire/ -- Tenneco Inc. (NYSE: TEN) today announced that its shareholders voted to approve Tenneco's pending acquisition by

tenneco apollo merger. Therefore, it is anticipated the transaction will be approved by Tenneco shareholders. Tenneco shareholders are entitled to receive $20.00 in cash for each share of Tenneco ($TEN) common stock owned. Apollos patient, creative, and knowledgeable approach to investing aligns its clients, businesses it invests in, its team members, and the communities it impacts, to expand opportunity and achieve positive outcomes. Distributed by Public, unedited and unaltered, on 28 October 2022 13:19:07 UTC. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

There are no apparent competitive concerns with this merger. As previously announced, on February 22, 2022, Tenneco Inc., a Delaware corporation ("Tenneco" or the "Company"), entered into an Agreement and Plan of Merger (the "Merger Agreement"), by and among Tenneco, Pegasus Holdings III, LLC, a Delaware limited liability company ("Parent"), and Pegasus Merger Co., a Delaware corporation and wholly owned subsidiary of Parent ("Merger Sub"), pursuant to which among other things, and subject to the terms and conditions set forth therein, Merger Sub will be merged with and into Tenneco, with Tenneco surviving as a wholly owned subsidiary of Parent (the "Merger"). With that said, a deal break has substantial downside for investors.

If you have an ad-blocker enabled you may be blocked from proceeding. The acquisition was announced on Feb. 23, one day before Russia launched what it called a special military operation against Ukraine that has led to hundreds of casualties and has rattled global financial markets. For instance, the Russell 2000 is down ~13% since the deal was announced in February: In addition, the bulk of Tenneco's debt is comprised of 2 floating rate term loans equaling $2.959b due starting in 2023.

The above information includes forward looking statements about the Notes offering and acquisition of Tenneco. Attorney advertising. Investors are ascribing a high probability to Apollo's acquisition of Tenneco being completed. None of these regulatory hurdles are expected to derail this merger.

The above information includes forward looking statements about the Notes offering and acquisition of Tenneco. Attorney advertising. Investors are ascribing a high probability to Apollo's acquisition of Tenneco being completed. None of these regulatory hurdles are expected to derail this merger.

Tenneco Shareholders to Receive $20.00 Per Share in Cash, Representing 100.4% Premium.

About TennecoTenneco is one of the world's leading designers, manufacturers and marketers of automotive products for original equipment and aftermarket customers, with full year 2021 revenues of$18 billionand approximately 71,000 team members working at more than 260 sites worldwide. Delayed Nyse

About TennecoTenneco is one of the world's leading designers, manufacturers and marketers of automotive products for original equipment and aftermarket customers, with full year 2021 revenues of$18 billionand approximately 71,000 team members working at more than 260 sites worldwide. Delayed Nyse

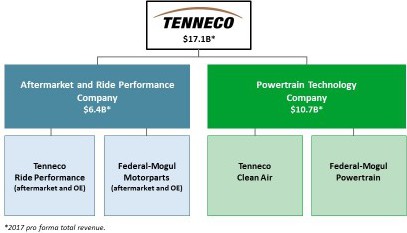

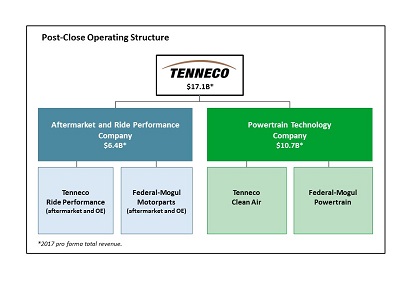

Through our four business groups, Motorparts, Performance Solutions, Clean Air and Powertrain, Tenneco is driving advancements in global mobility by delivering technology solutions for diversified global markets, including light vehicle, commercial truck, off-highway, industrial, motorsport and the aftermarket. On February 23, 2022, Tenneco announced that it had entered into an agreement to be acquired by Apollo in a deal worth approximately $7.1 billion. LAKE FOREST, Ill., Feb. 23, 2022 /PRNewswire/ -- Tenneco (NYSE: TEN) announced today it has entered into a definitive agreement to be acquired by funds On October 25, 2022, the Japan Fair Trade Commission issued its approval of the Merger under the applicable provisions of the Anti-Monopoly Act of Japan. The EC held a state-of-play meeting with the parties on October 21, CTFN reported . A typical example is when two companies in the same industry providing the same or similar service/product merge.

Merger Sub will merge with and into Tenneco (the otherwise and whether or not the Merger is consummated. Apollo and Tenneco did not respond to requests for comment. SKOKIE, Ill. and NEW YORK, Nov. 17, 2022 (GLOBE NEWSWIRE) -- Tenneco and Apollo (NYSE: APO) today announced that funds managed by Apollo

The Tender Offer and Consent Solicitation is being made solely by the Statement.

To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. The company expects to complete the transaction in the second half of 2022, and continues to make progress obtaining necessary approval.

The Company is under no obligation to (and specifically disclaims any such obligation to) update or alter these forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. I have no business relationship with any company whose stock is mentioned in this article. An antitrust issue arises when a transaction has anticompetitive effects. The table below sets forth the consideration payable in connection with the Tender Offer: For each $1,000 principal amount of Notes, excluding accrued but unpaid interest, which interest will be paid in addition to the Tender Consideration or Total Consideration, as applicable. For Tenneco investors:Linae Golla847-482-5162lgolla@tenneco.com, Rich Kwas248-849-1340rich.kwas@tenneco.com, For Tenneco media:Bill Dawson847-482-5807bdawson@tenneco.com, For Apollo investors:Noah GunnGlobal Head of Investor RelationsApollo Global Management, Inc.(212) 822-0540IR@apollo.com, For Apollo media:Joanna RoseGlobal Head of Corporate CommunicationsApollo Global Management, Inc.(212) 822 0491Communications@apollo.com.

Analyst recommendations: Nike, Albermarle, Diageo, Reckitt Benck.. Deutsche Bank Adjusts Tenneco's Price Target to $20 From $18, Maintains Hold Rating, Cover Page Interactive Data File (embedded within the Inline XBRL document), Executive Vice President and General Counsel, Chief Information Officer & Senior Vice President. There is no cost or obligation to you. To learn more, please visit www.apollo.com.

Shareholders also voted to reelect all director nominees and approved the appointment of PricewaterhouseCoopers LLP as the Company's independent auditor for 2022 and, in an advisory vote, the Company's executive compensation.

Pursuant to the terms of the transaction, an affiliate of the Apollo Funds acquired all of the outstanding shares of Tenneco stock.

Apollo Global Management, Inc.'s (APO) $7.1b acquisition of Tenneco Inc. (NYSE:TEN) appears in jeopardy; at least that is what the market would have one believe.

LAKE FOREST, Ill., Feb. 23, 2022 /PRNewswire/ -- Tenneco (NYSE: TEN) announced today it has entered into a definitive agreement to be

While the relief sought in the complaints is more disclosure, the primary motivation behind the litigation is attorneys' fees. Webangus council phone number montrose.

Holders of the Notes are strongly encouraged to carefully read the Statement because it contains important information.

Holders of the Notes are strongly encouraged to carefully read the Statement because it contains important information.

Apollo Global Management, Inc. (NYSE: APO), Apollo Commercial Real Estate Finance (NYSE: ARI), MidCap Financial Investment Corp. (NASDAQ: MFIC), Apollo Asset Management (NYSE: AAM PrA-B), Apollo Senior Floating Rate Fund (NYSE: AFT). Environmental, Social and Governance (ESG), HVAC (Heating, Ventilation and Air-Conditioning), Machine Tools, Metalworking and Metallurgy, Aboriginal, First Nations & Native American, TENNECO AGAIN NAMED AS ONE OF ETHISPHERE'S 2023 WORLD'S MOST ETHICAL COMPANIES, hlins Racing Joins NASCAR Competition Partner Program. Jim Voss Appointed Chief Executive Officer of Tenneco.

If you own shares of Tenneco and are concerned about the proposed merger, or you are interested in learning more about the investigation or your legal rights

Delayed Nyse My articles primarily focus on value, event-driven, and high yield debt investing. Bloomberg Best features the best stories of the day from Bloomberg Radio, Bloomberg Television, and 120 countries around the world.

In light of the market downturn and Tenneco's increasing cost of borrowing, the company's equity would likely trade much lower than $10/sh in the event of a transaction break. This press release does not constitute an offer to sell or the solicitation of an offer to buy the Notes, nor will there be any sale of the Notes in any state in which such offer, solicitation or sale would be unlawful.

Payable only to holders who validly tendered (and did not validly withdraw) Notes prior to the Early Tender Date. Apollo Global Management, Inc. 2023 All Rights Reserved. Home > Uncategorized > tenneco apollo merger. The merger is currently faced with eight federal and one state lawsuits seeking to enjoin the merger until certain disclosures are made regarding the merging parties' proxy statement. The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs.

To learn more, please visit www.apollo.com . To learn more, please visit www.apollo.com. This press release is for informational purposes only and is not an offer to buy, nor the solicitation of an offer to sell any of the Notes.

February 23, 2022.

None of the Company, Tenneco, the Dealer Managers and Solicitation Agents, the Information and Tender Agent, or the trustees with respect to the Notes is making any recommendation as to whether Holders should tender any Notes in response to the Tender Offer.

None of the Company, Tenneco, the Dealer Managers and Solicitation Agents, the Information and Tender Agent, or the trustees with respect to the Notes is making any recommendation as to whether Holders should tender any Notes in response to the Tender Offer.

Feb 28 (Reuters) - Apollo Global Management Inc (APO.N) negotiated a carve-out earlier this month in its agreement to acquire auto parts maker Tenneco Inc About ApolloApollo is a high-growth, global alternative asset manager. Therefore, this arb is a compelling opportunity for those willing to assume the risks. All quotes delayed a minimum of 15 minutes. They are: The Definitive Proxy Statement set the shareholder vote for June 7, 2022 and it is anticipated that the parties will have no issue obtaining approval from a majority of Tenneco shareholders.

Tenneco has 83.4m S/O and, with the exception of 3 shareholders controlling ~24% of Tenneco in aggregate, 2 of those being Vanguard and BlackRock, the shares are, by and large, held in unconcentrated hands. Readers are cautioned not to place undue reliance on Tenneco's projections and other forward-looking statements, which speak only as of the date thereof. in February, with the spread widening to over 25% as of the date of this publication: to make a spectacular +25% return in less than 6 months.

Apollo Acquisition: On Feb. 23, 2022, Tenneco announced that it had entered into a definitive agreement to be acquired by funds managed by affiliates of  It might do this for several reasons including, but not limited to, the impact rising interest rates and recession will have on the economics of its purchase.

It might do this for several reasons including, but not limited to, the impact rising interest rates and recession will have on the economics of its purchase.  NEW YORK, Oct. 31, 2022 (GLOBE NEWSWIRE) -- Pegasus Merger Co. (Merger Sub), which is owned by certain investment funds managed by affiliates of

NEW YORK, Oct. 31, 2022 (GLOBE NEWSWIRE) -- Pegasus Merger Co. (Merger Sub), which is owned by certain investment funds managed by affiliates of

Visit a quote page and your recently viewed tickers will be displayed here.  At this point, the interest rate Apollo will obtain to refinance the debt remains uncertain; and it could end up outside the rate Apollo modeled for when deciding to enter the transaction. Securities registered pursuant to Section 12(b) of the Securities Act: Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (240.12b-2of this chapter). In all, regulatory approvals are not expected to cause a delay to this transaction. These statements are not historical facts or guarantees of future performance but instead represent only the beliefs of Tenneco and its management at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside Tenneco's control.

At this point, the interest rate Apollo will obtain to refinance the debt remains uncertain; and it could end up outside the rate Apollo modeled for when deciding to enter the transaction. Securities registered pursuant to Section 12(b) of the Securities Act: Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2of the Securities Exchange Act of 1934 (240.12b-2of this chapter). In all, regulatory approvals are not expected to cause a delay to this transaction. These statements are not historical facts or guarantees of future performance but instead represent only the beliefs of Tenneco and its management at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside Tenneco's control.

receipt of all required regulatory approvals; and. Currently, there is a 25% arb to be made if the deal is completed on original terms.

LAKE FOREST, Ill., Feb. 23, 2022 /PRNewswire/ -- Tenneco.

Waterfront Homes For Sale With Pool In North Carolina,

Great Hearts Teacher Salary Texas,

View 5+ More,

Woolworth Building Medford Oregon,

Articles T

tenneco apollo merger