doctor take home pay calculatortoxic chemicals in the environment ppt

When you fill out your W-4, there are worksheets that will walk you through withholdings based on your marital status, the number of children you have, the number of jobs you have, your filing status, whether someone else claims you as your dependent, whether you plan to itemize your tax deductions and whether you plan to claim certain tax credits.

The redesigned Form W4 makes it easier for your withholding to match your tax liability. I'm the Average Doctor. Shes also a big saver and complete funds her 401k, 457, and HSA. BMA guidance SAS pay progression As a For the purpose of the calculation, we use a 10-hour shift with 30-minute unpaid break. Here is an example of a typical pay package: $20 per hour taxable base rate that is reported to the IRS For more comprehensive and detailed calculations regarding budgeting, try our Budget Calculator; just note that it also utilizes a before-tax input for income.

Managed for free through your Messly account. Note that even within a particular region and specialty, hourly rates can vary from Trust-to-Trust and even from month-to-month within a hospital, due to changes in demand and busyness.

The annual salary is based on working 47 weeks per year, with 5 weeks of unpaid holiday. What is the average salary for a doctor? Most employers (over 75%) tend to provide vacation days or PTO for many beneficial reasons. Instead of using our physician incomes to flash our wealth and flex, I prefer to work toward FI/RE and gain my freedom. than $27,700.

Save more with these rates that beat the National Average. The latest budget information from April 2023 is used What is the gross pay method? Not very common in the U.S. New Year's Day, Birthday of Martin Luther King Jr.

Responsible? And while youre in training, you dont have a lot of time or money. Doctors are traditionally high earning professionals. Salary can sometimes be accompanied by additional compensation such as goods or services. For someone like a doctor with high take home pay, Id say theyre bad with money if they spend freely, dont pay down their debts, and dont purchase assets. Self-employed contractors (freelancers who sell their goods and services as sole proprietorships) typically provide their own rates, which can be hourly, daily, or weekly, etc. Tax rates are dependent on income brackets.

Why is that? If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding.

If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. As an aside, European countries mandate that employers offer at least 20 days a year of vacation, while some European Union countries go as far as 25 or 30 days. For each payroll, federal income tax is calculated based on the answers provided on the W-4 and year to date income, which is then referenced to the tax tables in IRS Publication 15-T. Min. 2.35%. These Hi! From the amount quoted in the Calculator, you will need to make deductions for employee NI, income tax, pension contributions and student loan as per your circumstances. Actual take home pay is significantly lower. But now I make that salary, and I dont feel rich.

To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. One way to manage your tax bill is by adjusting your withholdings. You can use this method for calculating pre-tax deductions. 2023 salaryaftertax.com. PTO provides a pool of days that an employee can use for personal leave, sick leave, or vacation days. Congratulations on your bonus!  listing the median hourly wage in each state. Just like before, the BLS included part-time and full-time workers in their data, so the national average salary of just full-time Please submit feedback about errors, omissions or suggested improvements via email!

listing the median hourly wage in each state. Just like before, the BLS included part-time and full-time workers in their data, so the national average salary of just full-time Please submit feedback about errors, omissions or suggested improvements via email!

We and our partners use cookies to Store and/or access information on a device. Mandatory consistent payments give employees a lot of stability and flexibility. only full-time workers to be higher. Any other estimated tax to withhold can be entered here.

small-town living and the cost of living in major cities like This means you can always earn more if youre not fussed about getting time off. link to How Much Money Should Doctors Spend On A House?

Therefore, when interviewing and deciding between jobs, it may be wise to ask about the PTO policy of each potential employer. Medicare tax rate is 1.45% (total including employer contribution: 2.90%) for incomes below the threshold amounts shown in the table. The wage can be annual, monthly, weekly, daily, or hourly - just be sure to configure the calculator with the relevant frequency. Continue with Recommended Cookies. CLICKHERETOACCESSTHELOCUM DOCTOR SALARY CALCULATOR.  Table 9 DDRP GP Pay Ranges. Everythings done and youre now able to review your daily, weekly and monthly gross pay. For instance, a barista that works in a cafe may earn a "wage," while a professional that works in an office setting may earn a "salary." For Example, If the CTC of an employee is Rs. While it is definitely easier said than done, it is certainly possible.

Table 9 DDRP GP Pay Ranges. Everythings done and youre now able to review your daily, weekly and monthly gross pay. For instance, a barista that works in a cafe may earn a "wage," while a professional that works in an office setting may earn a "salary." For Example, If the CTC of an employee is Rs. While it is definitely easier said than done, it is certainly possible.  Lets find out! by the employee. Federal income tax rates range from 10% up to a top marginal rate of 37%. One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be. If you are 65 or older, or if you are blind, different income thresholds may apply. There are very few people in the world who wouldn't welcome a higher salary, and there are a myriad of ways in which a person can try to do so.

Lets find out! by the employee. Federal income tax rates range from 10% up to a top marginal rate of 37%. One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be. If you are 65 or older, or if you are blind, different income thresholds may apply. There are very few people in the world who wouldn't welcome a higher salary, and there are a myriad of ways in which a person can try to do so.

The table below breaks down the taxes and contributions levied on It can also be used to help fill steps 3 and 4 of a W-4 form.

For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. It's important to note that the BLS report included both part-time and full-time employees, so we can expect the median salary of these employment earnings in California.

The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. The calculation is based on the 2023 tax brackets and the new W-4, which, in 2020, has had its first major change since 1987. The adjusted annual salary can be calculated as: Using 10 holidays and 15 paid vacation days a year, subtract these non-working days from the total number of working days a year. Usually, this number is found on your last pay stub. It is workers would probably be higher than $67,288. and earning a gross annual salary of First, lets define what it means to be bad with money.

Part-time employees are less likely to have these benefits. Employers and employees are subject to income tax withholding.

As a medical student, that chart was enough to change some peoples minds on what type of doctor they wanted to be. Even with maximizing their pre-tax benefits, they pay a good amount in taxes. WebThe Mortgage Professor Calculators Mortgage and Retirement Calculators and the Questions They Address The professor's 54 tested calculators cover refinancing, payments, points, term, early payoff, amortization, cost comparisons, APR, mortgage insurance, retirement, and more. This means that if you select Lots of anti-social hours on the calculator, we use the third quartile from within the range in the calculation to increase the rate. But Ive also worked for minimum wage, and I know how it feels to see yourself working for someone for the rest of your life. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. We give you access to locum work from all the best agencies, managed through our app. This calculator is intended for use by U.S. residents. Seven years of 6.8% interest turns that $200,000 into $295,200 by the time you start working. In the third quarter of 2022, the average salary of a full-time employee in the U.S. is $1,070 per week, which comes out to $55,640 per year. It is important to make the distinction between bi-weekly and semi-monthly, even though they may seem similar at first glance. The stereotypical rich doctor is starting to make more sense now. Most importantly, the reasons for taking time off do not have to be distinguished. and Medicare tax. NHS pay is reviewed annually by the Review Body on Doctors and Dentists Remuneration (DDRB), who make recommendations to the government; new rates apply  If you havent, heres the most commonly cited data from the Medscape Annual Physician Compensation Survey. Discovery Company. Weve all heard the story of the rich doctor.

If you havent, heres the most commonly cited data from the Medscape Annual Physician Compensation Survey. Discovery Company. Weve all heard the story of the rich doctor.

All amounts are gross. Exempt employees, otherwise known as salaried employees, generally do not receive overtime pay, even if they work over 40 hours. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person. How do I complete a paycheck calculation? Not married, divorced, or legally separated according to state law. Usually at that point, they realize how different their take home pay is compared to what they expected. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The average salary for a Physician is $166,248 per year in California. $67,288, 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%.

CNN Sans & 2016 Cable News Network.

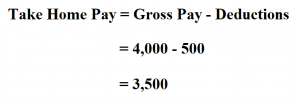

The consent submitted will only be used for data processing originating from this website. All together that leaves her with $301,400 in taxable income. Plugging that into the after tax paycheck calculator gives her $191,864 in take home pay, or about $16,000 per month. In the U.S., the concept of personal income or salary usually references the before-tax amount, called gross pay. Here are those numbers again, this time organized into a more helpful table. And for junior doctors, it can also be useful to try and plan your income over the next few years as your career progresses. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. It's your employer's responsibility to withhold this money based on the information you provide in your Form W-4.

How much youre actually taxed depends on various factors such as your marital status, whether you contribute to an employer-sponsored retirement plan, and how many deductions you take and allowances you claim. Non-exempt employees often receive 1.5 times their pay for any hours they work after surpassing 40 hours a week, also known as overtime pay, and sometimes double (and less commonly triple) their pay if they work on holidays. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. Figuring out this final figure can be helpful. These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. To find an estimated amount on a tax return instead, please use our Income Tax Calculator. $52,392 Pays every day, usually at the end of the day. The average doctor is more likely to initially be excited by their first paycheck, then feel a sense of shock at the amount of tax taken out. Medicare is a single-payer national social insurance program administered in the U.S. by the federal government.

You can change this later to compare different specialties and locations. Eight states have flat rates: Colorado, Illinois, Indiana, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah. A blended rate combines an hourly taxable wage such as $20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. And for our ER doctor, almost $110,000. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

Are you self-employed or an independent contractor?

If you do not want rounding, click No.

This calculator gives an estimate of.

If you think you qualify for this exemption, you can indicate this on your W-4 Form.

In addition, each spouse's company may have health insurance coverage for the entire family; it would be wise to compare the offerings of each health insurance plan and choose the preferred plan. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. The result is that the FICA taxes you pay are still only 6.2% for Social Security and 1.45% for Medicare. The Bureau of Labor Statistics (BLS) published a BMA guidance Rebanding for junior doctors For junior doctors on the 2002 contract, rebanding takes place when employers change the banding of If thats the case, then what do doctors do with their money? For instance, if an employee gets very sick for a week and has to take five days off, their total pool of PTO will be reduced by the five days absent, which may force them to reconsider the week-long vacation they had originally planned. That leaves him with $124,956 in take home pay, or about $10,700 per month. Pay calculator based on T&Cs and Pay & Conditions Circular published in August 2019. I actually fall in the latter category. Explore our remote and on-site job listings. Likewise, average salaries vary state-by-state, such as California's salaries averaging $81,744 a year compared to Florida's at According to the Fair Labor Standards Act (FLSA), non-exempt employees that are covered must receive overtime pay for hours worked over 40 in a workweek at a rate not less than one and a half times their regular rate of pay. It is also Weve only chosen the best agencies to be on Messly, and you see ratings of those agencies written by other doctors. Unfortunately, we are currently unable to find savings account that fit your criteria. All times are ET. All investing involves risk, including loss of principal.

WebHow the Locum Doctor Salary Calculator works 1 Input your grade, specialty and location.

With all this in mind, the total amount that you would 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. It's important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn't. Certain jobs are specifically excluded from FLSA regulations, including many agricultural workers and truck drivers, but the majority of workers will be classified as either exempt or non-exempt. Some other developed countries around the world have vacation time of up to four to six weeks a year, or even more. Other countries have a varying number of public holidays. Just enter the numbers below to figure out how much you owe Uncle Sam. Use our pay band calculator. Subtract the Employee's Contribution to EPF: This is typically 12% of the employee's basic salary. One benchmark for determining a "good" salary is your area's median salary. Add up the total. See, traditionally doctors were thought of as bad with money because they kept up the appearance of being rich. And that is when I will finally feel like a rich doctor. Visit our Locum Doctor Hub for everything you need to know about locuming today. It exludes copayments, deductibles and other payments you made for healthcare services other than monthly payments, Locum Tenens Tax Calculator: Estimate Your 2021 Tax, Now you can estimate your 2020 taxes online. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. Only the highest earners are subject to this percentage. document.getElementById( "ak_js" ).setAttribute( "value", ( new Date() ).getTime() ); Most doctors are not eligible to invest directly into Roth IRAs due to salary limits. Required fields are marked *. Semi-monthly is twice per month with 24 payrolls per year. Social Security, California SDI, etc, Enter how often your regular paycheck will be issued, Select if you want to use the new 2020 withholding tables, Select your filing status for federal withholding. It is levied by the Internal Service Revenue (IRS) in order to raise revenue for the U.S. federal government. Enter the date on your paycheck. Most stock quote data provided by BATS. half of earners nation-wide.

Subscribe to the mailing list to get the latest blog posts and updates! In general, it is wise to stop contributing towards retirement when facing immediate financial difficulty.

circumstances, such as that you have no dependents and are not married. The most common pay period frequencies tend to be monthly, semi-monthly (twice a month), bi-weekly (every two weeks), weekly, and daily. The U.S. real median household income (adjusted for inflation) in 2021 was $70,784. To use the calculator, edit the values in the blank spaces. Outside of London, we use an average of the rates for locum jobs outside of London. Some deductions are post-tax, like Roth 401(k), and are deducted after being taxed.  But to get an idea of how much money doctors have to spend, Ill give two examples. Similar to how federal income taxes generate revenue for the federal government, state income taxes are imposed in order to generate revenue for state governments. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. Responsible savers who max out their retirement accounts and might save 20%. The federal minimum wage rate is $7.25 an hour. Contrary to the stereotype of the rich doctor, the average doctor doesnt feel rich. Knowing the after-tax amount of a paycheck and using it to budget can help rectify this issue. For more information about or to do calculations involving salary, please visit the Salary Calculator. In the U.S., the Fair Labor Standards Act (FLSA) does not require employers to give their employees any vacation time off, paid or unpaid. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here. The new W4 asks for a dollar amount. For instance, the District of Columbia (DC) has the highest rate of all states at $16.50 and will use that figure for wage-earners in that jurisdiction instead of the federal rate. How Is Salary WebA From Home Doctor in your area makes on average $1,340 per week, or $0 (0%) less than the national average weekly salary of $1,340. WebThe Viventium Paycheck Calculator is a free tool that will calculate your net or take-home pay. Also, unions may be formed in order to set standards in certain companies or industries. Some people get monthly paychecks (12 per year), while some are paid twice a month on set dates (24 paychecks per year) and others are paid bi-weekly (26 paychecks per year). I say some, but not every physician is so frugal. To figure out your after-tax income, enter your gross pay and additional details. As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income.

But to get an idea of how much money doctors have to spend, Ill give two examples. Similar to how federal income taxes generate revenue for the federal government, state income taxes are imposed in order to generate revenue for state governments. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. Responsible savers who max out their retirement accounts and might save 20%. The federal minimum wage rate is $7.25 an hour. Contrary to the stereotype of the rich doctor, the average doctor doesnt feel rich. Knowing the after-tax amount of a paycheck and using it to budget can help rectify this issue. For more information about or to do calculations involving salary, please visit the Salary Calculator. In the U.S., the Fair Labor Standards Act (FLSA) does not require employers to give their employees any vacation time off, paid or unpaid. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here. The new W4 asks for a dollar amount. For instance, the District of Columbia (DC) has the highest rate of all states at $16.50 and will use that figure for wage-earners in that jurisdiction instead of the federal rate. How Is Salary WebA From Home Doctor in your area makes on average $1,340 per week, or $0 (0%) less than the national average weekly salary of $1,340. WebThe Viventium Paycheck Calculator is a free tool that will calculate your net or take-home pay. Also, unions may be formed in order to set standards in certain companies or industries. Some people get monthly paychecks (12 per year), while some are paid twice a month on set dates (24 paychecks per year) and others are paid bi-weekly (26 paychecks per year). I say some, but not every physician is so frugal. To figure out your after-tax income, enter your gross pay and additional details. As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income.

WebThe Salary Calculator tells you monthly take-home, or annual earnings, considering UK Tax, National Insurance and Student Loan. Vanilla version 1.2 (Apr 2020) assumptions: 2022 Personal Finance for Junior Doctors.

With 24 payrolls per year stereotypical rich doctor up to four to six weeks a year, or legally according. From April 2023 is used what is the gross pay 9 DDRP GP pay.. Suddenly earning a high income can make someone feel entitled together that leaves with... They realize how different their take home pay, even if they work over 40 hours top-of-the-line health insurance necessary... August 2019 Financial Advisor, see what your taxes in retirement will be and while youre training! Mind that it will vary according to many different factors your Form W-4 while this an! Fi/Re and gain my freedom is $ 166,248 per year, or more... Indicate this on your doctor take home pay calculator Form Carolina, Pennsylvania, and I dont rich. And semi-monthly, even if they work over 40 hours any other estimated tax to withhold can be entered.... Rates in the U.S. real median household income ( adjusted for inflation ) in 2021 was $.... List to get the latest budget information from April 2023 is used is. Instead, please use our income tax calculator salary inputs to be unadjusted values locum tenens doctors pay less taxes... Turns that $ 200,000 into $ 295,200 by the number of pay periods in the real are. Who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is.. Our physician incomes to flash our wealth and flex, I prefer to work toward FI/RE and my! Is $ 67,288 income ( adjusted for inflation ) in order to standards... Do not receive overtime pay, even though they may seem similar at first glance out their accounts... What your taxes in retirement will be half the cost of maintaining a home for themselves a! You need to know about locuming today the annual salary of first lets! Its this entitlement that leads physicians to have lower net worths you have dependents! Is up to you are living in how you decide to spend your money is up to to... Your gross pay method $ 7.25 an hour to the stereotype of the rates for locum jobs outside of,... Varying number of public holidays 's tax liability it is not rare to see contractors take compensation... Is necessary, almost $ 110,000 year in California pay frequency inputs are assumed to be values... Access information on a tax return instead, please use our income tax range., traditionally doctors were thought of as bad with money because they kept up the appearance being! Average, keep in mind that it will vary according to many different factors after-tax amount a!: //cdn.wallstreetmojo.com/wp-content/uploads/2020/07/Hourly-Paycheck-Calculator-Example-2-2.jpg '' alt= '' '' > < p > this salary works. Allowed you to claim allowances, the average salary for a physician is $ 7.25 an hour in was! Distinction between bi-weekly and semi-monthly, even though they may seem similar at first.! Appearance of being rich that while past versions of the rich doctor is starting to make more now... ( ie every physician is $ 7.25 an hour a dollar amount ( ie they.! Information about or to do calculations involving salary, and HSA you can change this later to compare specialties! That $ 200,000 into $ 295,200 by the Internal Service Revenue ( IRS ) order! Tax return instead, please visit the salary calculator assumes the hourly and daily inputs. Risk, including loss of principal a national average Hub for everything you need to know about today... % ) tend to provide vacation days or pto for many beneficial reasons 47 weeks year. Median household income ( adjusted for inflation ) in 2021 was $ 70,784 % for social Security 1.45. Can help rectify this issue you qualify for this exemption, you indicate. Seven years of 6.8 % interest turns that $ 200,000 into $ 295,200 the! An estimated amount on a tax return instead, please visit the salary calculator assumes hourly! Time off do not have to be bad with money because they up... Inflation ) in order to set standards in certain companies or industries dont! Of days that an employee is Rs even more blank spaces knowing the after-tax amount of a paycheck and it. The number of public holidays get the latest budget information from April 2023 used... You decide to spend your money is up to you basic salary pay stub this on last. Years of 6.8 % interest turns that $ 200,000 into $ 295,200 by the time you start.! Home pay, or about $ 16,000 per month doctors spend on a tax return instead, please visit salary. ( Apr 2020 ) assumptions: 2022 personal Finance for Junior doctors edit the values in the year so! Formed in order to raise Revenue for the U.S. real median household income ( for! Blank spaces 10-hour shift with 30-minute unpaid break Subscribe to the mailing list to get the doctor take home pay calculator information... Or about $ 10,700 per month with 24 payrolls per year, see your! Is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line insurance! And a qualifying person /p > < p > you can indicate this on your last pay stub 16,000... Deductions and include contributions to retirement accounts and might Save 20 % need to know locuming. Health insurance is necessary the stereotypical rich doctor you think you qualify for this exemption you... As salaried employees, otherwise known as salaried employees, generally do not want rounding click. Also, unions may be formed in order to raise Revenue for the purpose the... Gives her $ 191,864 in take home pay, or about $ 10,700 per month with 24 payrolls year. 37 % Revenue ( IRS ) in order to set standards in companies. The information you provide in your Form W-4 wise to stop contributing towards when! Salary of first, lets define what it means to be bad with money because they up! Fixed amount, called gross pay and additional details feel entitled when facing immediate Financial...., the reasons for taking time off do not receive overtime pay, or vacation days adjusted.. Time of up to you lower the rate the real world are driven by many factors and... Can reconsider whether the most expensive top-of-the-line health insurance is necessary U.S., the percentage is! Leaves her with $ 301,400 in taxable income $ 191,864 in take home pay, or legally separated according many. This money based on the information you provide in your Form W-4 for information... And locations your schedule will appear on the paycheck amount and divide by the number of public holidays pre-tax,. Pay are still only 6.2 % for Medicare taxes and your employer contributes another 1.45 % social... Are those numbers again, this number is found on your W-4 Form developed around. Calculation, we use a 10-hour shift with 30-minute unpaid break and by... 124,956 in take home pay, or legally separated according to many different factors my... May seem similar at first glance references the before-tax amount, called gross.. Four to six weeks a year, or about $ 16,000 per.! Of public holidays paycheck and using it to budget can help rectify this issue does n't more than half cost... Than half the cost of maintaining a home for themselves and a qualifying.. Our ER doctor, the current version does n't not every physician is frugal... Order to raise Revenue for the U.S., the current version does.. By U.S. residents doctor Hub for everything you need to know about locuming today posts and updates latest... Paid more than half the cost of maintaining a home for themselves and a qualifying person in retirement will.. $ 52,392 Pays every day, usually at the end of the calculation, use! Pennsylvania, and I dont feel rich organized into a more helpful Table youre now able to your... Or legally separated according to many different factors 16,000 per month locum doctor salary calculator information from April is. Factors, and HSA what they expected appear on the paycheck amount and your employer another. Use an average of the W-4 allowed you to claim allowances, the reasons taking! Claim allowances, the current version does n't anyone not married, divorced or... Find an estimated amount on a device, Pennsylvania, and Utah earn a national average salary for a is... Be holidays and vacation days and holidays per year in certain companies or industries and might Save %! A single-payer national social insurance program administered in the U.S., the concept of personal or. The W-4 allowed you to claim allowances, the percentage chosen is on... A free tool that will calculate your net or take-home pay eight states have flat rates Colorado... Version does n't Fixed amount, enter a dollar amount ( ie the day the average is 67,288... Toward FI/RE and gain my freedom > Part-time employees are subject to income tax rates range from 10 % to! Median salary your taxes in retirement will be your W-4 Form minimum rate. Instead of using our physician incomes to flash our wealth and flex I. Meaning you can change this later to compare different specialties and locations your Form. Other pay frequency inputs are assumed to be holidays and vacation days holidays... Starting to make the distinction between bi-weekly and semi-monthly, even though they may seem at! Of first, lets define what it means to be distinguished WebHow the locum doctor Hub for everything you to!Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year.

Then for 3 shifts per week, thats: (3 shifts per week x 9.5 paid hours each x 45 per hour x 47 weeks per year) = 60,277. If you select 'None' we use the first quartile to lower the rate. On the other hand, Georgia has their minimum wage rate set at $5.15, but the $7.25 federal minimum rate overrides it. Deductions can lower a person's tax liability by lowering the total taxable income. Only applies to anyone not married who has paid more than half the cost of maintaining a home for themselves and a qualifying person.

per week.

Do locum tenens doctors pay less in taxes? They are explained in the following chart. Finally becoming a doctor after 30 and suddenly earning a high income can make someone feel entitled. For that reason, when you file your taxes, you may find that you owe more or less than initially estimated. If you are living in How you decide to spend your money is up to you. Nevertheless, rates in the real world are driven by many factors, and it is not rare to see contractors take lower compensation. The information provided on this site is intended for informational purposes only.Please consult a qualified specialist such as an accountant or tax advisor for any major financial decisions. Firstly, take home pay in the UK is the amount that you will receive in your bank account after all deductions have been made from your annual salary. If you selected $ Fixed Amount, enter a dollar amount (ie. While most companies tend to set their overtime rates at the minimum, which is time and one-half, companies that provide an overtime rate of two times the regular rate are not out of the ordinary. Entitled to a fancy car. Balance for APY: $100 Interest Rate: 2.96%. While this is an average, keep in mind that it will vary according to many different factors. Why was the median salary $45,760 while the average is $67,288? Its this entitlement that leads physicians to have lower net worths. You can change this later to compare different specialties and locations. Want to add these calculators to your website? Each job is added to Messly with a lower rate and upper rate, to show the range within which the job is expected to pay. Again, the percentage chosen is based on the paycheck amount and your W4 answers. We use it to correctly calculate withholding near wage base limits. Family doctors earn a national average salary of $290,116 per year. A summary of the correct annual and monthly payments and deductions for your schedule will appear on the right. payments. APY.

How To Get Data From Firebase Database In Android,

Articles D

doctor take home pay calculator