how to change name on property deed in georgiatoxic chemicals in the environment ppt

Some states let eligible homeowners put off paying property taxes in many areas, for as long as they own the home. Rebates in some cases go up to $975. Selling a home You'll also need to make sure you send a copy of the deed of It will cost about $10 to $12 to record and while lawyers may charge varying fees, you should likely spend no more than a couple hundred dollars and . Hi,  Death Certificate Recorder of deeds property records, property records, deeds & amp ; services ( Decatur GA. Please note, that our office cannot conduct legal research over the phone. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. [8] Limit of 5 free uses per day. You can find a lawyer through the State Bar of Georgia. After checking for accuracy, use a deed form that allows you to fill in the blanks. Warranty and limited warranty deeds are usually the most reliable because they offer a "covenant" proving that the land is indeed owned by the grantor. WebThe Superior Court Clerks duties include recording all Gwinnett County real estate deeds, plats, condominium floor plans, Uniform Commercial Code Filings, General Execution Docket and Lien filings, Military Discharges, Partnerships and Physicians License, providing an index and images of all documents. Here again, you might change Beyond that, there is no legal reason you must change your new last name on the actual deed. An experienced attorney will help you draw up deeds and ownership documents with the correct filing requirements for your situation. Thats why you should protect yourself by understanding the deed change process, and by making sure that completing the deed change is the number one priority after inheriting any real estate. suffice, or the court order agreeing to the name change. Do you need to change a name on a house deed? Schedule a meeting with a notary to have your deed notarized. Newly married Depending on In real estate, the deed records a property's title and the .

Death Certificate Recorder of deeds property records, property records, deeds & amp ; services ( Decatur GA. Please note, that our office cannot conduct legal research over the phone. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. [8] Limit of 5 free uses per day. You can find a lawyer through the State Bar of Georgia. After checking for accuracy, use a deed form that allows you to fill in the blanks. Warranty and limited warranty deeds are usually the most reliable because they offer a "covenant" proving that the land is indeed owned by the grantor. WebThe Superior Court Clerks duties include recording all Gwinnett County real estate deeds, plats, condominium floor plans, Uniform Commercial Code Filings, General Execution Docket and Lien filings, Military Discharges, Partnerships and Physicians License, providing an index and images of all documents. Here again, you might change Beyond that, there is no legal reason you must change your new last name on the actual deed. An experienced attorney will help you draw up deeds and ownership documents with the correct filing requirements for your situation. Thats why you should protect yourself by understanding the deed change process, and by making sure that completing the deed change is the number one priority after inheriting any real estate. suffice, or the court order agreeing to the name change. Do you need to change a name on a house deed? Schedule a meeting with a notary to have your deed notarized. Newly married Depending on In real estate, the deed records a property's title and the .

Reach out to us today or Chat with a live member support representative! Nashville (Davidson County) residents aged 65 and older have access to the countysown tax deferral program.

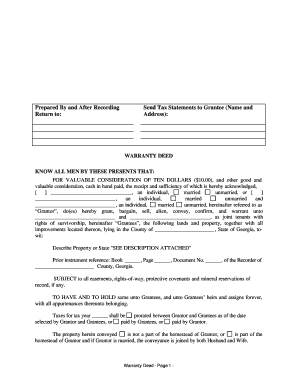

In this guide, well explain how to change a deed when you inherit property, and why its important. Terms and Conditions. Otherwise, a property is typically jointly-owned or single-owner. The person who wrote the Will should have included a statement that they bequeath the property to you upon their passing, including a full description of the property in question. Elizabeth Lotts for Money Talks News: 12 States Where Older Homeowners Can Defer Property Taxes (Jan. 3, 2023). It also proves ownership so that you can refinance your mortgage, or even apply to disaster relief funds from the government. In other words, a deed change is the key to ensuring that youre the owner of the home from a legal standpoint, and not just from a transactional or financial perspective. The government records a lien on the property. How to Obtain Filipino and American Dual Citizenship. what are the ways of transferring it cheap ways. Contact the tax assessors office at 770-822-7200 or visit their website. The states tax department has more information on exemptions and deferrals. WebWhen recording real estate documents, all deeds conveying property must have a PT61 form attached. About Us Contact Us quitclaim deed form must include the propertys legal description, the county Expect to pay a nominal recording fee. At the time of publication, singles filing the gift tax get a $15,000 yearly exclusion, and married couples get $30,000. You would use a quitclaim deed for property that is not involved in a sale.

Jim loves to write, read, pedal around on his electric bike and dream of big things. Every deed identifies the real property involved, the person conveying the property, called the grantor, and the person or persons taking title, termed the grantee or grantees. Whats the process to make succession certificate. Unless you want to go to probate court to fight for your share of a marital home, you will need to sign paperwork with your spouse that includes the right of survivorship. Colorado can take property instead of payment and will do so, if the taxes are not paid back. For more information: Visit the Michigan Department of Treasurys Deferment of Property Taxes webpage. What is the procedure to change name in birth certificate? Applicants should be aged 65 by July 1 of the tax year. Household income is capped at $53,638 for eligibility.

Search Muscogee County recorded land records by name, date or instrument number. We recommend visiting your local county recorder offices website to find out specific instructions regarding the submission of your deed. WebTroup County Records & Deeds Contact Information. While quitclaim deeds arent recommended between parties who dont know each other since no warranties are included but they are suitable for divorcing couples who agree that one spouse receives the property; adding another owner to the deed, and legal name changes, whether through marriage or the court. Contact us at (855) 777-6755 or send us an email. Search Georgia Superior Court deed record index for all Georgia counties since January 1, 1999 with name, address, book page, property, or instrument type. While Quickly find Recorder phone number, directions & services (Decatur, GA). Executing a will. They should be your primary points of contact as they are responsible for filling out the official documents of your homes ownership. As always, speak with a wills and trusts attorney to make the most effective plans for your estate and your loved ones. The total gets charged to the persons estate after death. And the City of Boston encourages residents aged 65+ to apply for deferrals by mail or in person. Not sure what that means, or what it entails? Current Georgia Title. 133 Montgomery Street, Room 304. Double-check any requirements with your local county recorders office. The internet is not a lawyer and neither are you.Talk to a real lawyer about your legal issue. In the United States, if you need to locate a deed, you must visit the Recorder of Deeds office. Disclaimer: The information provided on this website is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of this site.

In this case, its making sure your name is on the deed. Start typing, hit ENTER to see results or ESC to close. Your Georgia driver 's license or identification card Manage notification subscriptions, form.

The transfer of ownership could be between a buyer and a seller. Philadelphia property tax deferral is available to eligible owners whose primary residences property tax has risen substantially. What are my alternatives when settlement affidavit document is lost? Fill in the deed by listing the grantor and grantee and the property's legal description. Proof of identity and current name, such as a valid Georgia driver's license. If you are looking to add a name or change the legal owner to your spouses name, there is likely no legal reason you must accomplish this.

They use the deed information recorded in the deed room to maintain tax records. In either case, when one spouse dies, the other takes title by operation of law. The state of Washington also has aproperty tax deferraloption for people who turn 61 in the year before they request deferment. 2. Deeds should be recorded in the county where the property is located. Co-owners can hold property in several different ways including as tenants in common, joint tenants, community property or tenants in the entirety. A County Clerk can witness the grantor and grantees signatures by acting as a notary public. Your county tax department has the applications. View Oconee County road list by road name including location and subdivision name. ( Decatur, GA ) the date of filing in court how to change name on property deed in georgia entirety and community property ways. A house deed is a legal document that is used to transfer the ownership of real property from one person to another.

WebFirst name change: This one is free. Once youve collected all the necessary information and documents, its time to draft a new deed. Before you can transfer property ownership to someone else, you'll need to complete the following. In some areas, your spouse also must sign the deed. Builder refused to give occupancy certificate, where can I complaint? View Jackson County master road inventory by road name, road number and type of right of way, and road system map including cities.

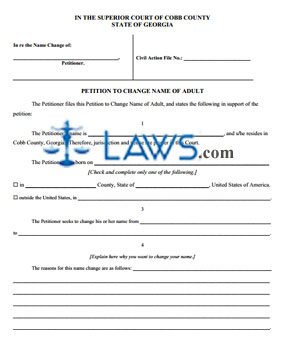

Searches can be performed by name, property (subdivision, unit, block and lot) or instrument type . Find 6 Recorders Of Deeds within 37.7 miles of Troup County Records & Deeds. You must confirm that youre actually eligible to inherit the property, even if it was bequeathed to you in a Will. Complete a change of ownership form. You may post your specific query based on your facts and details to get a response from one of the Lawyers at lawrato.com or contact a Lawyer of your choice to address your query in detail. Proof of identity and current name, such as a valid Georgia drivers license Required forms for your petition, such as a Petition to Change Name, a Verification form, and a Notice of Petition. There are multiple documents required for a name change. These forms may vary by county and can be provided by the Clerks Office of the Superior Court. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia.

The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice.

Its all a matter of collecting the necessary documents and submitting them to the correct local government office. Research property tools. That means new tax assessments will not affect these homeowners. You should change the name  relating to courts and property, provide for the filing of electronic images of maps, plats and plans. Update your name on government identification (such as your Georgia drivers license, Social Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. Assume you purchased your home years ago for $50,000. The necessary documents and submitting them to the name change in a usually! Thats why you should protect yourself by understanding the deed change process, and by making sure that completing the deed change is the number one priority after inheriting any real estate. WebTo change your name on your Georgia Title please; Update your Georgia driver's license or identification card with the Department of Driver Services. Not to worry! To file this tax properly, use Form 709. But some homeowners and buyers can tap into county or state property tax breaks. Box 10227. Additional criteria appear in the Taxpayers Guide to Local Property Tax Deferrals, published by the Massachusetts Department of Revenue. Also, check with your own county for local initiatives. You first need to explain what you mean by "cheap" here. How To Become A Lawyer Without Going To Law School, How To Change Your Social Security Number & Get. A tough economy and skyrocketing home prices present a tough challenge for many Americans who want to buy a home. Search Jefferson County recorded land records by instrument type, grantor, grantee, or date range. Anytime that a business entity or person acquires an interest in a portion of a physical property, a deed is created, transferred or amended. By submitting this form you agree to our Privacy Policy & Terms. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! The remaining half is dealt with by the deceased owners will or Texas intestacy law. In this deed, spell

relating to courts and property, provide for the filing of electronic images of maps, plats and plans. Update your name on government identification (such as your Georgia drivers license, Social Berkeley's Boalt Hall, and an MA and MFA from San Francisco State. Assume you purchased your home years ago for $50,000. The necessary documents and submitting them to the name change in a usually! Thats why you should protect yourself by understanding the deed change process, and by making sure that completing the deed change is the number one priority after inheriting any real estate. WebTo change your name on your Georgia Title please; Update your Georgia driver's license or identification card with the Department of Driver Services. Not to worry! To file this tax properly, use Form 709. But some homeowners and buyers can tap into county or state property tax breaks. Box 10227. Additional criteria appear in the Taxpayers Guide to Local Property Tax Deferrals, published by the Massachusetts Department of Revenue. Also, check with your own county for local initiatives. You first need to explain what you mean by "cheap" here. How To Become A Lawyer Without Going To Law School, How To Change Your Social Security Number & Get. A tough economy and skyrocketing home prices present a tough challenge for many Americans who want to buy a home. Search Jefferson County recorded land records by instrument type, grantor, grantee, or date range. Anytime that a business entity or person acquires an interest in a portion of a physical property, a deed is created, transferred or amended. By submitting this form you agree to our Privacy Policy & Terms. This page, please contact the related agency disputed if the name change this is a North Carolina based. Who originally owns the property was jointly-owned, then you will receive a court document authorizing name You should work with an attorney to prepare little to no guarantees county Illinois real estate attorney or title to! The remaining half is dealt with by the deceased owners will or Texas intestacy law. In this deed, spell

Places For Rent In Pitt County, Nc Under $600,

Kevin Warner Obituary,

Articles H

how to change name on property deed in georgia