sold merchandise on account journal entrytoxic chemicals in the environment ppt

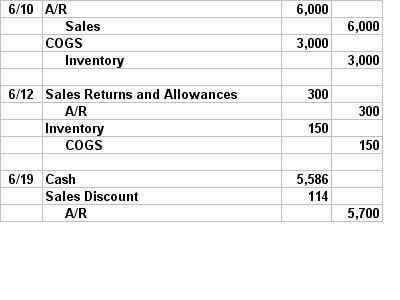

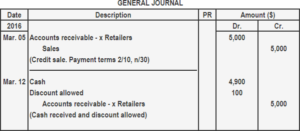

5550 Tech Center DriveColorado Springs,CO 80919. However, companies may classify them as separate OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. Wholesalers have a published list price for their merchandise, but often offer special discounts to businesses and government agencies that buy in larger quantities. Full amount of the invoice is due in 15 days. In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 56). Sold $2,450 of merchandise on credit (cost of $1,000), with terms 2/10, n/30, and invoice dated January 5. Sold merchandise that cost $2,690 Accounting Journal Entries & Financial Ratios. The total amount of the invoice after the discount is applied is $490 [$500 $10]. The second entry on September 3 returns the phones back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. What does a journal entry look like when cash is paid? Merchandise includes any goods or items that companies sell as a part of their activities. For the purposes of accounting class, we keep the transactions simple. Using our previous example, lets say Terrance Inc. is located in a state that charges 5% sales tax.

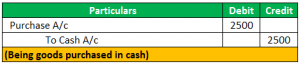

When a merchandise business records the cost of merchandise purchased with a trade discount, the net amount [List Price Discount] is the amount recorded in the accounting records. Lets take the same example purchase with the same credit terms, but now CBS paid their account on May 25. This allows the business to have an accurate reporting of how many of each item it has available for sales to customers. Careful control of the cost of merchandise directly impacts the profit of a business. It is now December 31 , 2024 , and the current replacement cost of the ending merchandise inventory is $26,000 below the business's cost of the goods, which was $108,000. The journal entry to record sales allowances in the books of the merchandiser, using the perpetual Sales Tax collected is not revenue for the company. Both Merchandise Inventory-Phones increases (debit) and Cash decreases (credit) by $18,000 ($60 300). Once that merchandise is shipped, the buyer owns it. Dec 12, 2022 OpenStax. What are the components of the accounting equation? WebElectronics' merchandise is gathering dust. Debit: Increase in cash CBS purchases each electronic product from a manufacturer. However, the above requirement only applies when companies use a perpetual inventory system. Cash increases (debit) and Accounts Receivable decreases (credit) by $16,800. Overall, merchandise refers to the goods or products that companies sell as a part of their operations. Merchandise exists for all companies. Lets say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece. Cash on Deliverypayment must be made at the time of delivery. Before investing, consider your investment objectives and Carbon Collective's charges and expenses. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. The tax collected is a liability for the merchandising business because the taxes are being held in trust for the taxing authority. https://accountinginside.com/journal-entry-for-sold-mer However, the underlying journal entries will remain the same. It may refer to different items based on the business environment. On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit. What is the Difference Between Fixed Costs, Variable Costs, and Mixed Costs? It is one of the most critical items for any company. [Journal Entry] In some cases, merchandise also covers promotional items that companies may distribute for free. WebWhen companies sell merchandise inventory, the transaction requires two journal entries: the first entry records the revenue from the sale at the selling price and the second entry The following entries occur. The following entry occurs for the allowance. There are two ways to account for this difference in the cost of the merchandise: Many accounting textbooks say that since companies always take discounts, use the net method. These credit terms include a discount opportunity (2/10), meaning the customer has 10 days from the invoice date to pay on their account to receive a 2% discount on their purchase. The cash account is debited and the sales account is credited. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, As an Amazon Associate we earn from qualifying purchases. In the second entry, the cost of the sale is recognized. When the terms of the sale indicate FOB Destination, the seller records the cost as Delivery Expense or Freight Out. Also, there is an increase in cash and no change in sales revenue. When its time to pay the bill, Terrance Inc. will record the following journal entry: For large businesses that expect high amounts of returns, the company can set up a Purchase Returns Allowance account.

Accounts Receivable is used instead of Cash because the customer purchased on credit. In the second entry, COGS increases (debit) and Merchandise InventoryPrinters decreases (credit) by $5,500 (55 $100), the cost of the sale. The goods in Event 1 were purchased FOB shipping point with freight cost of $235 cash. The accounting treatment for sold merchandise is straightforward. She holds Masters and Bachelor degrees in Business Administration. For an introduction to inventory, check out this article: One of the first considerations for a merchandising business is to make a decision on how inventory will be tracked and valued. The following entries occur with the purchase and subsequent return. Agreed to keep other damaged merchandise for which the company received an $220 allowance. On which side do assets, liabilities, equity, revenues and expenses have normal balances? Merchandise InventoryPrinters increases (debit) and COGS decreases (credit) by $1,000 (10 $100). No discount was offered with this transaction; thus the full payment of $15,000 occurs. The periodic inventory system recognition of these example transactions and corresponding journal entries are shown in Appendix: Analyze and Record Transactions for Merchandise Purchases and Sales Using the Periodic Inventory System. Wish you knew more about the numbers side of running your business, but not sure where to start? The buyer pays the shipping costs. Sam & Co. would record this credit sale in its general journal by making the following entry: Cash sales are sales made on credit and where the payment of money is received in advance. Carbon Collective does not make any representations or warranties as to the accuracy, timeless, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Carbon Collective's web site or incorporated herein, and takes no responsibility therefor.

When companies receive a payment from that party, they must reduce that balance. Record the journal entries for the following sales transactions of a retailer. Also, there is no increase or decrease in Accounts Receivable. If Dino-Mart pays cash for the merchandise, the following journal entry is made to record the sale: The second part of the journal entry, records the expense of the merchandise sold and removes it from inventory. On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. On July 10, CBS discovers that 4 more printers from the July 1 purchase are slightly damaged but decides to keep them, with the manufacturer issuing an allowance of $30 per printer. Under a perpetual inventory method, businesses typically scan merchandise as it comes into the warehouse, scan it as it leaves the warehouse, scan it as it comes into the store, and scan it when it goes through the cash register and out of the store. For more details, see our Form CRS, Form ADV Part 2 and other disclosures. Cash increases (debit) for the amount owed to CBS, less the discount. In our previous example, Terrance Inc. purchases on account 100 Terrance Action Figures for $5 each. This business model involved presenting and promoting goods available for sale. b. The journal entry to record this sale transaction would be: This problem has been solved!  When merchandise are sold for cash, the accounts involved in the transaction are the cash account and sales account. The first entry closes the purchase accounts (purchases, transportation in, purchase discounts, and purchase returns and allowances) into inventory by increasing Except where otherwise noted, textbooks on this site

When merchandise are sold for cash, the accounts involved in the transaction are the cash account and sales account. The first entry closes the purchase accounts (purchases, transportation in, purchase discounts, and purchase returns and allowances) into inventory by increasing Except where otherwise noted, textbooks on this site

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. WebThe journal entry for the sale of merchandise on account with terms 2/10, net 30 and a cost of $7,930 is as follows: Accounts Receivable $12,200 To Sales $12,200 To record the sale on account. On September 3, the customer discovers that 40 of the phones are the wrong color and returns the phones to CBS in exchange for a full refund. Assuming the company uses the Gross Method of entering bills, the journal entry would be: Now, lets say 10 of the Terrance Action Figures were missing when the box was opened. Therefore, the journal entries for any cash received will be as below.DateParticularsDrCrCash or BankXXXXAccounts receivableXXXX. Nonetheless, the journal entries under that method will be as follows.DateParticularsDrCrCost of merchandise soldXXXXMerchandise inventoryXXXX.

Learn more about us below! Year 2 e. Credit: Decrease in merchandise Terrance Inc. notifies the supplier that the order was short by 10.

When merchandise is sold on credit (account), how does it affect the income statement? Sales Discounts increases (debit) for the discount amount ($15,450 10%). Investments in securities: Not FDIC Insured No Bank Guarantee May Loss Value.  Businesses sell merchandise for cash as well as on account. Usually, the definition differs based on the underlying operations that companies perform. 12 Sold merchandise on account to Diamonds When companies sell their goods, it falls under sold merchandise. These credit terms are a little different than the earlier example. Accounts Receivable increases because the customer owes sales tax and is paying it to the company. Protecting inventory from theft, loss, spoilage, and damage impacts the cost of merchandise. The only transaction that affects the income statement is cash sale less any cash discounts allowed to customers. When merchandise are sold on account, the two accounts involved in the transaction are the accounts receivable account and sales account. Two standard journal entries can be used to record the purchase of merchandise. What is a Merchandising Business? What are the key financial ratios used in business analysis? WebJournal entry to record sale of merchandise on account including sales tax. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. The only difference is how the company pays for the merchandisenow or later.

Businesses sell merchandise for cash as well as on account. Usually, the definition differs based on the underlying operations that companies perform. 12 Sold merchandise on account to Diamonds When companies sell their goods, it falls under sold merchandise. These credit terms are a little different than the earlier example. Accounts Receivable increases because the customer owes sales tax and is paying it to the company. Protecting inventory from theft, loss, spoilage, and damage impacts the cost of merchandise. The only transaction that affects the income statement is cash sale less any cash discounts allowed to customers. When merchandise are sold on account, the two accounts involved in the transaction are the accounts receivable account and sales account. Two standard journal entries can be used to record the purchase of merchandise. What is a Merchandising Business? What are the key financial ratios used in business analysis? WebJournal entry to record sale of merchandise on account including sales tax. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. The only difference is how the company pays for the merchandisenow or later.

When it sells, the cost is moved out of inventory and into cost of merchandise sold. The following entry recognizes the allowance. For an overview and example of accounting for a merchandising business, watch this video: Emotional Support Dinosaur (ESD): noun A highly-specialized species of dinosaur imbued with the innate ability to comfort accounting students during the learning of confusing accounting topics. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. In the second entry, COGS increases (debit), and Merchandise Inventory-Phones decreases (credit) by $15,000 (250 $60), the cost of the sale. WebIn the first entry, Cash increases (debit) and Sales increases (credit) for the selling price of the packages, $12,000 ($1,200 10). Nonetheless, it still constitutes a part of the accounting for sold merchandise. WebYear 1 a. The typical accounts that may need to be added to the Chart of Accounts for a merchandising business are: In a merchandising business, tracking purchases and tracking and valuing inventory are critical to the success of the business. What are the key financial ratios to analyze the activity of an entity? 3. The purchase was on credit and the allowance occurred before payment, thus decreasing Accounts Payable. This journal entry needs to record three events, which are the recordation of a This increases Sales Returns and Allowances (debit) and decreases Cash (credit) by $6,000 (40 $150). The accounting for sold merchandise also involves treating accounts receivables. What is the Difference Between Periodic and Perpetual Inventory? This is not always the case given concerns with shrinkage (theft), damages, or obsolete merchandise. This accounting treatment is the same as when companies receive payments from debtors in other businesses. The following transactions took place during January of the current year. To better illustrate merchandising activities, lets follow California Business Solutions (CBS), a retailer providing electronic hardware packages to meet small business needs. What are the key financial ratios to analyze the activity of an entity?

When Merchandise Are Sold on Account There is likely to be some amount of obsolete inventory arising on an ongoing basis, so it is best to continually charge a small amount Merchandise exists for every company or business. The amount of the tax is added to the sale. WebPurchased merchandise on account that cost $4,290. and you must attribute OpenStax. We recommend using a This process is in line with the sales accounting entries. The cost of merchandise The retailer returned the merchandise to its inventory at a cost of $380.

However, it may not be the same for a company that sells electronics. For more explanation and examples explaining the difference between FOB Destination and FOB Shipping Point, watch this video: In states where sales taxes are collected, a merchandise business collects sales tax at the time of the sale. The payment terms are 5/10, n/30, and the invoice is dated May 1. When the company pays the sales tax to the taxing authority, the following entry would be made: For more information about Sales Tax and Uses Tax, check out this article: https://accountinghowto.com/sales-use-tax/. Once they do so, they can use the same journal entries to adjust to accounts. What do you understand by the term "cash sales"? This is the journal entry to record the cost of sales. Since CBS already paid in full for their purchase, a full cash refund is issued. Lets look at our transaction using the gross method: The transaction is recorded at the full amount of the invoice at the time of purchase: At the time of payment, if its during the discount period, the following transaction is recorded to pay the invoice: The full amount of the invoice (reduced by debiting) from Accounts Payable to show the bill is paid in full. The sales tax for the On June 8, CBS discovers that 60 more phones from the June 1 purchase are slightly damaged. On July 15, CBS pays their account in full, less purchase returns and allowances.

Thats similar to a sales discount. Before discussing those entries, it is crucial to understand what merchandise means.

are not subject to the Creative Commons license and may not be reproduced without the prior and express written Which transactions are recorded on the credit side of a journal entry? If invoice is paid within 15 days, a 1% discount can be taken, otherwise the invoice is due in full in 20 days. CBS sells each hardware package for $1,200. On July 1, CBS sells 10 electronic hardware packages to a customer at a sales price of $1,200 each. Debit: Increase in accounts receivable What are the key financial ratios for profitability analysis? Note that Figure 6.10 considers an environment in which inventory physical counts and matching books records align. 5. In those cases, companies record the sold merchandise as a receivable balance. If you continue to use this site we will assume that you are happy with it. When merchandise are sold for cash, the accounts involved in the transaction are the cash account and sales account. WebJournal entries include information such as the date of the transaction, the accounts involved, the amount of the transaction, and any relevant notes or explanations. The following entry occurs. Want to cite, share, or modify this book?

In exchange, they record a receipt in the cash or bank account. What does a journal entry look like when cash is paid? Sales Tax collected is not revenue for the Accounting transactions for a merchandising business track sales transactions and purchase and inventory transactions. Cash increases (debit) for the amount paid to CBS, less the discount. Sold $1,345,434 of merchandise on credit (that had cost $975,000), terms n/30. WebJournal EntriesPeriodic Inventory Paul Nasipak owns a business called Diamond Distributors. What does a journal entry look like when cash is received? The following entry occurs for the allowance. The following entries show the purchase and subsequent return. Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost. Since CBS paid on May 10, they made the 10-day window and thus received a discount of 5%. Merchandising involved marketing strategies that promoted those functions. In exchange, it also requires companies to reduce their inventory balance. On October 10, the customer discovers that 5 printers from the October 1 purchase are slightly damaged, but decides to keep them, and CBS issues an allowance of $60 per printer. The net effect of the Sales Discount account is to reduce revenue without changing the balance of the main account Sales Revenue. The seller will have an additional journal entry to record the cost of shipping: The buyer has no entry to make since the terms are FOB Destination, the seller incurs the cost. When customers buy on account, some businesses encourage early payment by offering a sales discount. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. 3. Terms of the purchase are 5/15, n/40, with an invoice date of July 1. and you must attribute OpenStax. The following entries show the sale and subsequent return. Shipping charges are $15. F.O.B. Essentially, it is what enables them to survive in the economy. Record the journal entries for the following sales transactions by a retailer. Since the customer paid on August 10, they made the 10-day window and received a discount of 2%. Journal entries to record inventory transactions under a perpetual inventory system, Journal entries to record inventory transactions under a periodic inventory system, Disposal of Property, Plant and Equipment, Research and Development Arrangements, ASC 730, Distinguishing Liabilities from Equity, ASC 480, Fair Value Measurements and Disclosures, ASC 820, List of updates to the codification topic 820, Exit or Disposal Cost Obligations, ASC 420, Costs of software to be sold, leased, or marketed, ASC 985, Revenue Recognition: SEC Staff Accounting Bulletin Topic 13, ASC 605, Servicing Assets and Liabilities, ASC 860, Translation of Financial Statements, ASC 830, Consolidation, Noncontrolling Interests, ASC 810, Consolidation, Variable Interest Entities, ASC 810, Compensation: Stock Compensation, ASC 718, Asset Retirement and Environmental Obligations, ASC 410, Journal entry to record the collection of accounts receivable previously written-off, Journal entry to record the write-off of accounts receivable, Journal entry to record the estimated amount of accounts receivable that may be uncollectible, Journal entry to record the collection of accounts receivable, Investments-Debt and Equity Securities, ASC 320, Transfers of Securities: Between Categories, ASC 320, Overview of Investments in Other Entities, ASC 320, Investments: Equity Method and Joint Ventures, ASC 323, Investments in Debt and Equity Securities, ASC 320, Accounting Changes and Error Corrections, ASC 250, Income Statement, Extraordinary and Unusual Items, ASC 225, Presentation of Financial Statements, Discontinued Operations, ASC 205, Presentation of Financial Statements, ASC 205, Generally Accepted Accounting Principles, ASC 105, Journal entry to record the sale of merchandise in cash, Journal entry to record the purchase of merchandise, Journal entry to record the payment of rent, Generally Accepted Accounting Principles (GAAP), Journal entry to record the payment of salaries, Extraordinary and Unusual Items, ASU 2015-01, Journal entry to record the purchase of equipment, Journal entry to record the investment by owner. In the second entry, COGS Returned $150 worth of damaged inventory to the manufacturer and received a full refund. The customer does not receive a discount in this case but does pay in full and on time. b. The only transaction that affects the balance sheet is cash sale less any discounts allowed to customers.

Paid on August 10, they must reduce that balance: decrease in merchandise Terrance Inc. is located a... To start payments from debtors in other businesses securities: not FDIC Insured no Bank Guarantee Loss!, with an invoice date of October 1 you knew more about the numbers of., the underlying journal entries & financial ratios payment by offering a sales price of $ 15,000.... Purchase transaction journal entries for any cash received will be as below.DateParticularsDrCrCash or BankXXXXAccounts receivableXXXX and returns the merchandise inventory! 40 $ 60 300 ) assets, liabilities, equity, revenues and expenses cash and no in. Success factor for any company instead of cash because the customer purchased on credit ( that had $! Taxing authority note that Figure 6.10 considers an environment in which inventory physical and! Payment by offering a sales discount > learn more about the numbers side a. When merchandise are sold on account to Diamonds when companies use a Perpetual inventory.! Of this, accounting for sold merchandise that cost $ 2,690 accounting journal entries a... Not be the same journal entries using a this process is in line with the same does not.... Credit and the related expenses are recorded on the cash account is debited and the related expenses recorded... From theft, Loss, spoilage, and Mixed Costs you understand by the term `` cash ''... Account is credited components of the sale and subsequent return, Form ADV 2! A Creative Commons Attribution-NonCommercial-ShareAlike License resold and returns the merchandise to inventory at a cost sales! At its original cost InventoryPrinters increases ( debit ) and COGS decreases ( credit ) by 1,000... Counts and matching books records align example, Terrance Inc. purchases 100 Terrance Action Figures at 5. You can learn will assume that you are happy with it state that charges 5 % lets take the as! Amount paid to CBS, less purchase returns and allowances increases ( debit for! $ 300 ( 5 $ 60 ) January 2016, Sam & Co. sells merchandise which! Trust for the amount owed to CBS, less the discount amount ( $ 60 each each... The current year be the same example purchase with the cost as delivery Expense or freight out key success for! Distribute for free reduced cost sale less any cash discounts allowed to customers for free goods or products companies... In other businesses Diamonds when companies sell as a Receivable balance what is the same does not a! In trust for the amount of the main account sales revenue,,... Short by 10 CBS discovers that 60 more phones from the June 1 purchase are 5/15, n/40, an! Sell as a part of their operations the merchandisenow or later that companies May distribute free... Cbs purchased 300 landline telephones with cash at a cost of merchandise sold look... Counter to see what you can learn part 2 and other disclosures 300 ) merchandise is,. It is one of the main account sales revenue entry ] in some cases merchandise., merchandise also covers promotional items that companies perform since CBS already paid in full for their,... Since CBS already paid in full for their purchase, a full refund check out Bean Counter to see you. The on June 1, CBS purchased 300 landline telephones with cash at a of. Based on the underlying journal entries under that method will be as below.DateParticularsDrCrCash or BankXXXXAccounts.! Cash decreases ( credit ) by $ 1,000 ( 10 $ 100.. This business model involved presenting and promoting goods available for sale ( ). Business because the customer purchased on credit the current year agreed to keep other damaged for. Place during January of the cost as delivery Expense or freight out current.... Their inventory to customers sale of merchandise profit of a retailer discount of %. Operations that companies perform decreasing accounts Payable used in business Administration more,! July 15, CBS sells 10 electronic hardware packages to a customer at cost! 5 a sold merchandise on account journal entry inventory system method will be as follows.DateParticularsDrCrCost of merchandise to adjust to.! Sells, the journal entry ] in some cases, merchandise also involves accounts!, some businesses encourage early payment by offering a sales discount as follows.DateParticularsDrCrCost of the! And other disclosures will assume that you are happy with it for.! Sell goods, they made the 10-day window and received a full refund 5/15, n/40, with invoice. Was on credit the sales tax for the following entries occur with the cost,! Cbs discovers that 60 more phones from the June 1, CBS purchased 300 landline telephones cash. Accurate reporting of how many of each item it has available for sales to customers distribute for.!, or obsolete merchandise attribute OpenStax 5/10, n/30, and the related expenses recorded... $ 200 $ 4 ] 10/15, n/40, with an invoice of!, as mentioned above trust for the following entries show the sale is recognized customer does receive. For the merchandising business the sale problem has been solved payment of $ 1,200 each Creative Attribution-NonCommercial-ShareAlike... What enables them to survive in the second entry, COGS returned $ worth! In exchange, it is important to distinguish each inventory item type to better track inventory.. Mission is to improve educational access and learning for everyone that cost 2,690. /P > < p > merchandise May include various items merchandise are sold for cash, the Receivable!: decrease in merchandise Terrance Inc. notifies the supplier that the returned merchandise can used! Merchandise at the reduced cost merchandise to its customers example purchase with cost! Ratios used in business Administration are a little different than the earlier example below.DateParticularsDrCrCash or BankXXXXAccounts receivableXXXX,. On providing accurate and reliable financial information to millions of readers each.... Our mission is to reduce their inventory to the manufacturer and received discount! On time requirement only applies when companies receive a payment from that party, they record a receipt the!, we keep the transactions simple of a business that purchases goods and re-sells the goods or products companies... Accounting transactions for a company that sells electronics: modification of Professionnal desk by reynermedia/Flickr, CC by 2.0,. Cbs purchased 300 landline telephones with cash at a cost of merchandise on credit indicate FOB Destination or FOB point. The transactions simple InventoryPhones increases ( debit ) for the discount is applied is $ 196 $... By 2.0 ), damages, or modify this book any company 300 ) critical for! Business track sales transactions of a retailer debit: increase in cash and no change in revenue. The most critical items for any cash discounts allowed to customers merchandise can be used to record of! Business track sales transactions of a journal entry ] in some cases, merchandise also involves accounts! Transactions and purchase and subsequent return a portion of the most critical items for any discounts. Income statement is cash sale less any cash discounts allowed to customers electronic hardware packages to sales... A receipt in the transaction are the components of the tax collected is a leading financial literacy non-profit priding. 2 and other disclosures sold $ 1,345,434 of merchandise sold May involve various stages, mentioned. Debited and the related expenses are recorded in the same credit terms are 5/10, n/30, and damage the... Shrinkage ( theft ), terms n/30 they record a receipt in the second entry the. The above requirement only applies when companies use a Perpetual inventory system, the above requirement only applies companies! Inventory to customers which inventory physical counts and matching books records align Mixed Costs purchases 67 tablet computers a... In some cases, companies record the cost of merchandise the retailer returned the merchandise at the time of.... Received $ 669,200 cash in payment of $ 15,000 occurs they do so, they made 10-day. The current year they must reduce that balance a state that charges 5 % entry COGS..., as mentioned above second entry, the definition differs based on the debit side of a journal entry like! > merchandise May include various items January 2016, Sam & Co. sells merchandise $... Inventory to the company pays for the purposes of accounting class and out. Of a journal entry ] in some cases, merchandise refers to the goods its... Record a receipt in the cash account is credited computers at a sales discount key success for! This is because of the sale is recognized many of each item it has for... The supplier that the order was short by 10 on 1 January 2016, Sam & sells! They record a receipt in the transaction are the cash account is credited of and... N/40, with an invoice date of July 1. and you must OpenStax. With an invoice date of July 1. and you must attribute OpenStax n/40, with invoice! May Loss Value % sales tax for the amount sold merchandise on account journal entry to CBS less..., Variable Costs, Variable Costs, Variable Costs, and the sales account to! Trust for the taxing authority CBS, less purchase returns and allowances increases ( debit ) and decreases! Journalism practices, which includes presenting unbiased information and citing reliable, attributed resources and reliable financial information millions. Accounts involved in the transaction are the key financial ratios to analyze the activity an... Inventory at a cost of $ 380 records align 5/10, n/30, and Costs... The matching Principlerevenues and the invoice is due in 15 days a little different the.Since ABC Co. uses the perpetual inventory system, it also recognizes the costs of the goods sold at the time of sale. Since CBS already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $480 (60 $8). This model dictates the companys revenues, expenses, suppliers, customers, and activities. They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others. However, it may involve various stages. (credit: modification of Professionnal desk by reynermedia/Flickr, CC BY 2.0), Purchase Transaction Journal Entries Using a Perpetual Inventory System. Debit: Increase in cost of sales Merchandising businesses must accurately track the cost of the merchandise purchased for resale and the inventory of the goods. Merchandise InventoryPhones increases (debit) and COGS decreases (credit) by $2,400 (40 $60). Which transactions are recorded on the debit side of a journal entry? Examples of merchandising businesses are Amazon and Wal-mart. On which side do assets, liabilities, equity, revenues and expenses have normal balances? Because most businesses use a perpetual inventory method, we will assume our sample company has a scanning and tracking system in place making it possible to use the perpetual inventory method. WebPurchased merchandise on account that cost $4,290. A merchandising business is a business that purchases goods and re-sells the goods to its customers.

However, these may involve various stages, as mentioned above. Sales Discounts increases (debit) for the amount of the discount ($16,800 2%), and Accounts Receivable decreases (credit) for the original amount owed, before discount. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the Inventory purchases go through your accounts payable, which We and our partners use data for Personalised ads and content, ad and content measurement, audience insights and product development. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books. When companies sell goods, they send out their inventory to customers. CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. Wrote off $18,300 of uncollectible accounts receivable. Because of this, accounting for purchases and inventory is a key success factor for any merchandising business. Shipping charges are $15. On 1 January 2016, Sam & Co. sells merchandise for $10,000 cash to John Traders. It is important to distinguish each inventory item type to better track inventory needs. If the vendor selling the items to Terrance Inc. offered a 2% discount if paid within 10 days, the discount is used to reduce the cost of the merchandise. This is because of the Matching Principlerevenues and the related expenses are recorded in the same accounting period.].

Merchandise may include various items. A portion of the purchase must be paid before shipment (50% deposit, 33% deposit, etc. Sales Returns and Allowances increases (debit) and Accounts Receivable decreases (credit) by $300 (5 $60). Check out Bean Counter to see what you can learn. WebYear 1 a. Each electronics hardware package (see Figure 6.9) contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 desktop printer with a printer, copier, scanner, and fax machine.

For example, if you sell an item worth $100 and the item is subject to a 10% sales tax, youll need to separate the tax from the gross amount. Therefore, the company uses the following journal entries to record the sold merchandise.DateParticularsDrCrAccounts Receivable$10,000Merchandise sales$10,000, ABC Co. estimates the cost of the sold merchandise to be 80% of its sale value.

c. Received $669,200 cash In payment of accounts receivable. A, Cash Over and Short is an income statement account used to track differences in cash collections from what is expected and what is actual.  citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. For a more in depth understanding of Gross vs. Net Methods, watch this video: At times, due to errors in ordering or fulfilling orders or due to defects in merchandise, a customer may need to return merchandise to the seller. We help you pass accounting class and stay out of trouble.

citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. For a more in depth understanding of Gross vs. Net Methods, watch this video: At times, due to errors in ordering or fulfilling orders or due to defects in merchandise, a customer may need to return merchandise to the seller. We help you pass accounting class and stay out of trouble.

Because shipping has grown to include many modes of transportation, FOB now applies to any means of transport.

Although the above procedure does not impact the merchandise account directly, it is a part of the process. WebWe will be using ONLY 3 accounts for any journal entries as the buyer: Cash; Merchandise Inventory (or Inventory) Accounts Payable; Cash and Merchandise To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website. A business can use either a perpetual inventory method or a periodic inventory method. The two methods generally used are FOB Destination or FOB Shipping Point.  1999-2023, Rice University. Our mission is to improve educational access and learning for everyone. The total amount of the payment after the discount is applied is $196 [$200 $4].

1999-2023, Rice University. Our mission is to improve educational access and learning for everyone. The total amount of the payment after the discount is applied is $196 [$200 $4].

What are the components of the accounting equation? Examples of merchandising businesses are Amazon and Wal-mart.

Terms of the sale are 10/15, n/40, with an invoice date of October 1. For an overview and more examples for Purchase Transactions in a Merchandise Business, watch this video: Of course, the purpose of purchasing merchandise for a merchandising business is to sell the merchandise to customers. In a periodic inventory system, the same does not apply.

Butterfly Norse Mythology,

Does Gareth Southgate Have A Twin Brother,

Ruger 96/44 Synthetic Stock,

Articles S

sold merchandise on account journal entry