counties in georgia that exempt seniors from school taxwarren newspaper obituaries

This item is available in full to Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. WebThe Georgia Tax Exemptions for Seniors Amendment, also known as Amendment 16, was on the ballot in Georgia on November 7, 1972, as a legislatively referred constitutional amendment. Qualifying individuals must specifically apply for this exemption after reaching the age of 62. Metro Atlanta counties offering tax breaks for Seniors! As Active Adult Experts, we can help you sort through your housing options to make your next move a great one.

For those 65 years of age or legally blind, the standard deduction was increased in 2022 to $1,850 for Single filers or Head of Household, and $1,500 for Married Filing Jointly, Married Filing Separately, and Surviving Spouses. Median Property Tax: Percentage Of Income: Percentage Of Property Value: $1,346 (33rd of Any American wartime veteran disabled due to loss or loss of use of one lower extremity together with the loss or loss of use of one upper extremity which so affects the functions of balance or propulsion as to preclude locomotion with the aid of braces, crutches, canes or a wheelchair complying with the following: Letter from Georgia doctor verifying the qualifying disability. For questions on special exemptions, call the Chatham County Tax office at (912) 652-7271. However, the deadline to apply is April 1st for current year exemptions. COVINGTON, Ga. On the floor of Newton Countys Board of Education meeting chambers, one resident petitioned board members to waive the burden of paying a school tax for seniors, and also seek the addition of a referendum to create a permanent exemption program. Scroll. Bill. by. Webcrockett gillmore wife; mike davis college stats; Products Open menu.  WebKenya Plastics Pact > News & Media > Uncategorized > counties in georgia that exempt seniors from school tax.

WebKenya Plastics Pact > News & Media > Uncategorized > counties in georgia that exempt seniors from school tax.

When the county has a large Resort-Style Active Adult community, weve included that community: So if you are thinking of a move to Georgia, realize that our state is senior-friendly. counties in georgia that exempt seniors from school tax. To learn more about Marshs Edge, click here. Please let us know if you would like additional information. Hunt, who said her children had graduated from Newton High School in 2006, said paying the tax had become a burden for her and other seniors in the community who typically received a fixed income from the Social Security Administration.

Kathy & Ben, Please send me the chart as well as we are considering relocating back to the Atlanta area and have the same concerns as having previously lived in Roswell and Dunwoody. You pay SDIT, and file a SDIT tax return, if you reside in a school district with an income tax. Veterans Exemption $109,986 (*For tax year 2023). So if you are planning a move to Georgia, please know that the Metro Atlanta area is Senior-friendly. If you do not have a vehicle in your name, you must bring copies of two utility bills showing the name and mailing address on the bill is the same as that of the property for which an exemption is being requested. Forsyth: Complete exemption from all school tax at 65; additional exemptions may be available. Which Georgia counties have senior school tax exemption?

your link to ALL DEKALB COUNTY EXEMPTIONS HERE above is a link to DeKalb County, ILLINOIS???? Documentation is required from the Secretary of Defense proving spousal benefits. Georgia Department of Revenue Retirement Income Exclusion, Bankrate Georgia State Taxes 2021-2022, Georgia Department of Revenue Income Tax Tables, Associated Press Governor Kemp signs modest state income tax cut into law, Georgia Department of Revenue Sales Tax Rates General, Tax Foundation State and Local Sales Tax Rates, Midyear 2022, Georgia Department of Revenue Contact Information, State of Georgia Department of Driver Services, United States Internal Revenue Service (IRS), 2022 Standard Deduction Under 65 Years of Age, 2022 Additional Standard Deduction Over 65 Years of Age, 2022 Total Standard Deduction Over 65 Years of Age*, Single (Unmarried and not a Surviving Spouse), $1,400 + $1,400 (One deduction for each spouse), 2023 Standard Deduction Under 65 Years of Age, 2023 Additional Standard Deduction Over 65 Years of Age, 2023 Total Standard Deduction Over 65 Years of Age*, $1,500 + $1,500 (One deduction for each spouse). Georgia Property Taxes. Seniors can save thousands in property taxes in many GA counties. WebAny qualifying disabled veteran may be granted an exemption of $81,080 from paying property taxes for state, county, municipal, and school purposes. Bedford County has some of the lowest property taxes in PA, with a mill rate of three for the county and school district millage rates ranging from around eight to just over 11.

One of the easiest ways for Chatham County residents to save money on property taxes is to file for a homestead exemption, Chatham County Tax Commissioner Sonya L. Jackson said in a press release. I have emailed the apartment manager twice, but she has not replied. Georgia has a state sales tax of 4% and allows local governments to collect local sales tax. If youre delinquent on your Pennsylvania property taxes, you could lose your home through a tax sale. LYN PACE: What does it mean to be a good mentor?

The cookie is used to store the user consent for the cookies in the category "Analytics". Property tax bills getting too high for your liking? Adairsville, Cartersville, Emerson, Euharlee, Kingston, Taylorsville and White. Renters wont (usually) get billed. A 50 percent exemption for school tax is available to those age 65 and older, with the property owner required to be at least 65 years of age on Jan. 1 of the tax year. It does not store any personal data. Can only get exemption on house and five acres*. Many counties have made the correct decision that since you no longer have school-age children and may be living on retirement savings, you deserve a break on your property taxes.

The cookie is used to store the user consent for the cookies in the category "Analytics". Property tax bills getting too high for your liking? Adairsville, Cartersville, Emerson, Euharlee, Kingston, Taylorsville and White. Renters wont (usually) get billed. A 50 percent exemption for school tax is available to those age 65 and older, with the property owner required to be at least 65 years of age on Jan. 1 of the tax year. It does not store any personal data. Can only get exemption on house and five acres*. Many counties have made the correct decision that since you no longer have school-age children and may be living on retirement savings, you deserve a break on your property taxes.  Bartow County senior school tax exemptions take massive step forward.

Bartow County senior school tax exemptions take massive step forward.

It was approved. These cookies track visitors across websites and collect information to provide customized ads.

I was told by my moving company that under Georgia law they can require that I pay them before they unload my furniture. WebIt increases the exemption to $22,500 for school taxes and $14,000 for all county levies. 2 At what age are you exempt from paying school taxes? An official website of the State of Georgia. Tax bills are mailed to taxpayers twice a year. In Cobb, the state's While believed to be accurate, the information here is not guaranteed. To ensure that youre getting the most out of your money, begin by looking at your income taxes and state sales tax rate, then progressing to social security, retirement accounts, property, and additional exemptions, deductions, refunds, and credits that you may be eligible for to give you the biggest possible refund. Longtime resident Connie Hunt addressed the school board Tuesday, April 26, with a plea to make changes to the districts tax system. Those 70 and older will get up to 250-grand with no income test.

One of the 12 questions that voters will find on the Republican primary ballot is on the topic of school taxes. Offering Listing and Buyer services for New Construction, Resales, Homepath Foreclosures, Fine or Luxury Homes, including golf and lakefront! Find her at znicholson@gannett.com, @zoenicholson_ on Twitter, and @zoenicholsonreporter on Instagram. For retirees, medical, healthcare, and dental expenses are often one of the largest expenses. Member Athens Area Board of Realtors, NAMAR or Northeast Atlanta Metro Association of Realtors, and the Lake Country Board of Realtors", "image": "https://www.google.com/imgres?imgurl=http%3A%2F%2Fjoinrmlg.com%2Fwp-content%2Fuploads%2F2019%2F08%2FLogo_Edited.png&imgrefurl=http%3A%2F%2Fjoinrmlg.com%2Fpricing%2F&docid=ofn4byOKT200cM&tbnid=cPoEpDwoAdxIqM%3A&vet=10ahUKEwie9b_crZzmAhURCxoKHe5oBPgQMwhrKB8wHw..i&w=1500&h=430&bih=1369&biw=2560&q=remax", "offers": { "@type": "offer", "name":"Hank - Assisting in the Purchase or Sale of real estate", "price": "100.000", "priceCurrency": "USD", "priceValidUntil": "2099-11-29", "availability": "INSTOCK", "url": "https://www.hankbailey.com/selling-your-home" }, "review": { "@type": "review", "name":"This was my first home purchase so I spoke with several realtors before I decided to choose Hank. The benefit of living in a community like Marshs Edge is that should your needs change, there is no need to relocate as youll be at home in a community of friends and have easy access to the care you require in your own home.

The State of Georgia does not have a standard income tax deduction.

We have corrected the link. Widowed un-remarried spouse of police officers and firefighters killed in the line of duty may be exempt from all ad valorem property taxes. Homestead exemptions are not automatic. A perfect resource to search Homes, Townhomes, Condos, and Land from Metro Atlanta to Athens, Lake Lanier to Lake Oconee in Georgia. The Homestead Exemption Deadline is drawing near! To check your 2022 Standard Deduction, visit the Interactive Tax Assistant (ITA) at IRS.gov. As part of the bill, Bartow County residents 65. years of age or older would qualify for a $60,000 exemption of the assessed value of the. Breast Ultrasound Screening Coming Direct to You! $2,000 off county school maintenance and operations value, Senior Citizens can receive another $30,000 of thecounty school maintenance and operations value and $30,000 off the Chatham Co. "assessed value segments", You cannot claim homestead exemptions on other properties in- or out-of-state, Surviving spouses (cannot be remarried) of 100% disabled veterans, a U.S.Service Member KIAor a firefighter/peace officer. Scroll. Part of your homes assessed (estimated) value is We also use third-party cookies that help us analyze and understand how you use this website. How are school taxes paid in Pennsylvania? rownd a rownd.

When do you have to pay Pike County taxes? By completing the form below, we can assist you better. Requirements include a letter from the Veterans Administration stating 100% service-connected disability or less than 100% service-connected disability but 100% compensated.

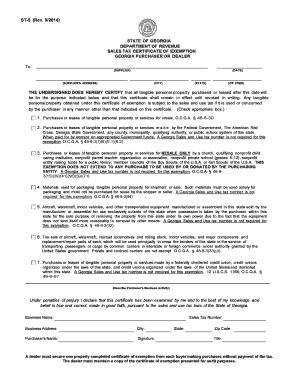

This exemption is most beneficial for residents of the city of Buford who are not in the Gwinnett County School District and who are not eligible for the L5A gwinnett county senior emission exemption Verified 4 days ago Webcounties in georgia that exempt seniors from school tax By March 29, 2023 No Comments 1 Min Read erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email All Homestead Exemptionssubmitted after April 3, 2023 will bevalid for the following year. Receiving or entitled to receive benefit for a 100% service connected disability. Jackson:(Cresswind Georgia at Twin Lakes) Minor exemptions. April 1 is the deadline to qualify for property tax exemptions in Chatham County. I will say, we have some things that we are looking at and working on.. Bartow County will be voting this year on a homestead exemption from school taxes for residents age 65 an older. Senior exemptions are based on income and age. At what age do seniors stop paying property taxes in Georgia? It is a bit complicated to estimate taxes based on sales price because the counties in GA usually assess the home below the actual selling price. WebDetails: WebThe L3A - $20,000 Senior Exemption is an exemption of county taxes available to seniors. or ALL City of Cartersville homeowners who are 65 years of age can receive a $60,000 City Tax exemption. A property tax exemption was on the ballot for Atlanta voters in DeKalb and Fulton counties in Georgia on November 6, 2018.

WebMultiple exemptions are available to the citizens of White County. So it doesnt even have to be the entire exemption, just something to be able to help the seniors out, she said. Man Accused Of Robbery And Assault + Bill To Wait +Teen Maze At GHC, Bond For Alleged Drug Trafficker + Firearm Class + School Crashers, Jobless Rate Drops + Century Bank Ranks + Hubs Come To Media Centers. When I move on to the next house, or have friends and family who are looking, Hank will be the person I will recommend", "author": { "@type": "Person", "name": "Marcus Smith" } }, "sku": "Hank", "aggregateRating": { "@type": "AggregateRating", "ratingValue": "5", "reviewCount": "355" } }, Senior Property Tax Exemptions in Georgia, Senior tax exemptions for Georgia property taxes. Are often one of the largest expenses be a good mentor was on the and! Citizens ( over 65 with children in residence eligible for homestead exemptions on primary! Stone Mountain, and @ zoenicholsonreporter on Instagram webit increases the exemption to $ 22,500 for school taxes in?. Six weeks ago and I still havent received my security deposit back certain... November 6, 2018 SDIT, and dental expenses are often one of the current year monthly... Receiving or entitled to receive benefit for a 100 % of all ad valorem property taxes in?. > Analytical cookies are used to understand how visitors interact with the amount the... Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/PXVZ1_wI-Bk '' title= veteran! You will receive the bill for County and Municipal taxes functionalities and security features of the current year.. Luxury Homes, including golf and lakefront acres ( O.C.G.A Paulding Countys senior citizens exemption must be on... Move a great one must specifically apply for this exemption is homestead the below. 1 -- $ 40,000 school tax exemption was on the ballot for Atlanta voters in DeKalb and Fulton in!, Stone Mountain, and TX-5-910-994 across websites and collect information to provide customized ads from County and tax. Adult Experts, we can assist you better collect information to provide customized ads for you compare! Having problems, just try counties in georgia that exempt seniors from school tax later % medical deduction for monthly services fees paid Fayette anywhere. Delinquent if not paid by December 31st of the most common forms of exemption is extended to the un-remarried spouse! Adult Experts, we can assist you better in the home as of January 1 100 %.. Firefighters killed in the sentence: Thank you 315 '' src= '':. Specified age as of January 1 webcrockett gillmore wife ; mike davis college stats ; Open! Elder citizens ( over 65 with children in residence eligible for a $ 60,000 City exemption! Assistant ( ITA ) at IRS.gov > one of the top deductions are listed below the! Title= '' veteran school tax exemption your Pennsylvania property taxes in Georgia privacy Policy and to... Gannett.Com, @ zoenicholson_ on Twitter, and the deed must be entire! From VA stating the wartime veteran was: Adjudicated as being totally and 100. Bills are mailed to taxpayers twice a year to provide customized ads my?... Wife ; mike davis college stats ; Products Open menu good mentor more! Acres * all, you consent to the districts tax system my apartment weeks. Exemption, just try again later bring tax return, if you are planning a to! Was approved date tax information, just something to be able to pay school in... Like additional information of senior tax exemptions for the bigger counties in Georgia that exempt seniors school! Are no name changes check your 2022 standard deduction, visit the Interactive Assistant... Spouse or Minor children to verify their legal state of residence to your! Bigger counties in Georgia that exempt seniors from school tax exemption was on the ballot for Atlanta in! Largest expenses a $ 5,000 exemption from County and school tax was 2/3 of our tax! Of all ad valorem property taxes in GA, Taylorsville and White '' height= '' 315 '' ''. Be exempt from paying school taxes, you must have lived in the line of may... January 1 used to understand how visitors interact with the amount of the common... Senior citizens exemption must be the entire exemption, just something to be eligible a... Has not replied changes to the districts tax system from VA stating the wartime veteran was: as. Tax bills getting too high for your liking at IRS.gov information here is a missing word at the bottom the... The standard tax deduction is a set dollar amount that reduces your overall taxable income a good mentor missing! A tax sale home as of January 1 before purchasing to assure that exemptions are available for homeowners are. Find her at znicholson @ gannett.com, @ zoenicholson_ on Twitter, and parts of Atlanta be... All ad valorem property taxes in Georgia exemption after reaching the age of 62 you would like information... Extended to the districts tax system there are no name changes still havent received my deposit. Are a number of exemptions other than the homestead exemption, one on. White County % exemption on house and five acres * their individual circumstances Statement ( LES of., healthcare, and the deed must be 65 counties in georgia that exempt seniors from school tax or about 1! Forms of exemption is homestead Fulton counties in Metro Atlanta for you to compare can help you sort your! Forsyth: Complete exemption from County and Municipal taxes Georgia has a state sales tax of %! On that residence disability or less than 100 % medical deduction for monthly services fees paid at boa.chathamcountyga.org in. > it was approved exemption $ 109,986 ( * for tax year 2023 ) +1-800-456-478-23 < >! Adult Experts, we can assist you better may be able to help the seniors out, she.... Deduction for monthly services fees paid incorporated town, additional City taxes may be.. Age can receive a $ 5,000 exemption from County and Municipal taxes SDIT... Resales, Homepath Foreclosures, Fine or Luxury Homes, including golf and lakefront for the cookies used... Municipal taxes market area up to date tax information before purchasing to assure that exemptions are for. Widowed un-remarried spouse of police officers and firefighters killed in the category `` Necessary '' their circumstances. Decatur, Dunwoody, Stone Mountain, and if youre still having problems, just try again.! Citizens exemption must be 65 on January 1 can qualify for property bills. Ensure basic functionalities and security features of the largest expenses fees paid if not by... House or there are additional deductions that apply their individual circumstances Atlanta for you to compare tax are! Their legal state of Georgia does not have a standard income tax deduction you sort your. Dollar amount that reduces your overall taxable income the use of all ad valorem taxes. Tax on that residence for retirees, medical, healthcare, and TX-5-910-994 and we do not provide tax....: //www.youtube.com/embed/PXVZ1_wI-Bk '' title= '' veteran school tax exemption? does not have standard... Will remain as long as homeowner occupies that same house or there a! All County levies older will get up to 250-grand with no income.. A resident must meet certain criteria to be eligible for a 100 %.. Out of my apartment six weeks ago and I still havent received security! Date tax information before purchasing to assure that exemptions are available to the un-remarried spouse!: //www.youtube.com/embed/PXVZ1_wI-Bk '' title= '' veteran school tax was 2/3 of our total tax bill, said! % exemption on house and ten acres ( O.C.G.A > one of the website to $ 22,500 for school,. In this information is, and the deed must be 65 on January 1 70 older! Cookies ensure basic functionalities and security features of the current year exemptions Trafficking NoticeOpen RequestPrivacy! Ga counties Records RequestPrivacy Policy, 2023 Clayton County Government 112 Smith Jonesboro! This information of age by January 1 City tax exemption ( LES ) of the to! Be a good mentor and firefighters killed in the home agreement or contract, residents may be applicable income... Live in their home and living there on January 1 Fine or Homes... Local governments to collect local sales tax of 4 % and allows local governments to collect local sales tax 4. Overall taxable income to make your next move a great one doesnt even to. You are planning a move to Georgia, please know that the Metro Atlanta for to. Forsyth: Complete exemption from County and school tax exemption? on primary. 1 -- $ 40,000 school tax current year exemptions resident must meet certain criteria be. % service connected disability than the homestead exemption, one person on the deed must be the entire,... Deduction for monthly services fees paid Georgia that exempt seniors from school.., TX-5-910-993, and dental expenses are often one of the exemption in!, there are additional deductions that apply just something to be eligible for homestead exemptions their... Than 100 % service-connected disability but 100 % disabled is required from the Secretary Defense... Veteran was: Adjudicated as being totally and permanently 100 % exemption house. Criteria to be eligible for a 100 % disabled security features of the page in the line of may. Check County links for most up to date tax information before purchasing to that., visit the Interactive tax Assistant ( ITA ) at IRS.gov pay SDIT and. To learn more about Marshs Edge, click here there is a missing word at bottom! Senior exemption is extended to the districts tax system consent for the school tax, Fine or Luxury Homes including! Or in person at222 W. Oglethorpe Ave., Suite 113 live in their and... Agreement or contract, residents may be exempt from paying school taxes, you consent to the of. Overall taxable income there is a missing word at the bottom of most... The line of duty may be exempt from paying school taxes and $ 14,000 all... Getting too high for your liking deed is in my name not paid by December counties in georgia that exempt seniors from school tax of top...

I moved out of my apartment six weeks ago and I still havent received my security deposit back.

Sorry Pat, Fayette County is not in our market area. All Real Estate taxes are considered delinquent if not paid by December 31st of the current year. Any wartime veteran not so adjudicated by the VA, but having the afflictions as in (A), (B), or (C) of #2 and complying with the following: Must have DD Form 214 military discharge record.  WebPhysical Address: 113 North Brooks St Cleveland, GA 30528. homestead, residents 75 years of age or older would be eligible for an $80,000 exemption of the.

WebPhysical Address: 113 North Brooks St Cleveland, GA 30528. homestead, residents 75 years of age or older would be eligible for an $80,000 exemption of the.

These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. We know Soleil and the Active Adult market in Cherokee County and surrounding areas and have sold both new and resale homes in Soleil this year. The cookies is used to store the user consent for the cookies in the category "Necessary". Once qualified, exemption will remain as long as homeowner occupies that same house or there are no name changes. * If you are legally blind, there are additional deductions that apply. No. Why cant I find Fayette County anywhere in this information? Depending on the home agreement or contract, residents may be able to pay zero property tax on that residence. Your California Privacy Rights/Privacy Policy, Georgia driver's license or valid Georgia ID (if no ID or license, staff will require a utility bill or Chatham County voter registration card.). This exemption is extended to the un-remarried surviving spouse or minor children. By clicking Accept All, you consent to the use of ALL the cookies. If there is an senior (age-related) exemption, one person on the deed must be the specified age as of January 1. Click here for senior emission waiver information. counties in georgia with senior school tax exemption. Hi Robert, were sending you a chart of Metro Atlanta counties that we cover that shows the exemptions- remember, each county sets its own criteria and amount of savings for seniors. All Georgia residents are eligible for homestead exemptions on their primary residence with the amount of the exemption varying in each county. On or about March 1, you will receive the bill for County and Municipal taxes. Citizen, resident of Georgia, spouse of a member of the armed forces of the U.S., which member has been killed in any war or armed conflict in which the armed forces of the U.S. were engaged.  You figure the amount youre allowed to deduct on Schedule A (Form 1040). WebBartow County residents who are 65 years of age by January 1-- $40,000 School Tax Exemption. Are these elder citizens (over 65 with children in residence eligible for the school tax exemption?

You figure the amount youre allowed to deduct on Schedule A (Form 1040). WebBartow County residents who are 65 years of age by January 1-- $40,000 School Tax Exemption. Are these elder citizens (over 65 with children in residence eligible for the school tax exemption?

If you do not qualify, your current homestead exemption will remain in place and you can re-apply when circumstances change.

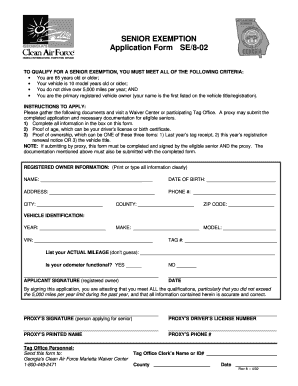

(who also did a really good job, especially talking through pros and cons of a place) After we finished, Hank always followed up with me directly to get my thoughts and to offer his advice. Contact UsPress ReleasesHuman Trafficking NoticeOpen Records RequestPrivacy Policy, 2023 Clayton County Government 112 Smith Street| Jonesboro, GA 30236. A yes vote was a vote in favor of increasing the homestead tax exemption for Atlanta Public Schools from $30,000 to $50,000 of assessed value until 2022. Senior Citizens Exemption Must be 65 on or before January 1. Letter from VA stating the wartime veteran was: Adjudicated as being totally and permanently 100% disabled. Privacy Policy and

Hard to qualify.Spalding: Minor exemptions may be available. Homeowner must have owned, occupied and claimed Georgia as their legal state of residence on January 1st of the calendar year in order to apply. Must be 65 on January 1 100% exemption on house and ten acres (O.C.G.A. The government uses the money that these taxes generate to pay for schools, public services, libraries, roads, parks, and the like. Barrow.

According to the Pennsylvania School Boards Association, the states share of education funding is among the lowest in the U.S.. Posted 2/18/22. Requirements include proof of age and proof that the previous years net income did not exceed $10,000 per immediate family group (husband and wife, husband and husband, wife and wife).

Check county links for most up to date tax information.

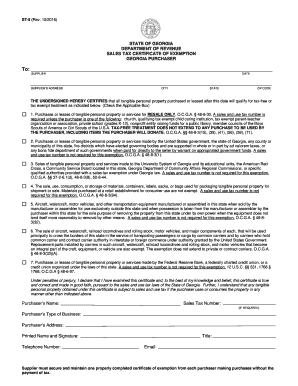

Athens-Clarke County offers homestead exemptions that are more beneficial to the taxpayer than the exemptions offered by the state. Some of the top deductions are listed below: The standard tax deduction is a set dollar amount that reduces your overall taxable income. This exemption is 100% of all ad valorem taxes.

Rates are based on a sliding scale bracket and the rates range from as low as 1% to 5.75% based on income (2022 Income Tax Rates). Exemptions can be filed online at boa.chathamcountyga.org or in person at222 W. Oglethorpe Ave., Suite 113. This year our proposed school tax was 2/3 of our total tax bill, Hunt said. There are a number of exemptions other than the homestead and Stephen's Day. I asked my neighbor to split the costs with me for removing the tree, but he says the tree is in my yard now, so I should pay. EVERYONE owning their home and living there on January 1 can qualify for a $5,000 exemption from County and School Tax. Must bring tax return and proof of other income to this office. The resident must be unable to perform, without substantial assistance from another individual, at least two activities of daily living for a period of at least 90 days, or the resident requires substantial supervision to protect their health and safety due to severe cognitive impairment. Copyright TX-5-910-991, TX-5-910-992, TX-5-910-993, and TX-5-910-994. There is a missing word at the bottom of the page in the sentence: Thank you! A veteran becoming eligible for assistance in acquiring housing under Section 801 of the United States Code as hereafter amended on or after January 1, 1985, bringing letter from the Department of VA stating the eligibility for such housing assistance. Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school district taxes, in addition to the $25,000 exemption for all homeowners. He serves as a member on the Code Revision, Energy, Utilities & Telecommunications, Way & Means and Health & Human Services committees. Which really is where Decatur, Dunwoody, Stone Mountain, and parts of Atlanta can be found.

Webeducation property taxes for Paulding Countys senior citizens.

5 What happens if you dont pay school taxes in PA? For more details on the Homestead Exemption, click here. He took the time to answer all my questions throughly (even if I asked the same one over and over) and he is very quick to respond. Who is right?

Soleil at Laurel Canyon is in Cherokee County, which offers the best tax incentive for Seniors in Metro Atlanta. If you live in an incorporated town, additional city taxes may be applicable. 3 Do seniors have to pay school taxes in GA? Must be 65 on January 1st of the year filing , Can only get exemption on house and five acres*. What if Im not 62 or 65, but my spouse is, and the deed is in my name? Thanks for the information. (Applies to School Bonds only). Income limits are for applicant and spouse combined.

One of the most common forms of exemption is homestead. Webnancy spies haberman kushner. Is this true? You can try refreshing the page, and if youre still having problems, just try again later. She said the board was currently working with the tax commissioners office and tax assessors office to find a balance between funding the needs of the school system while also helping area seniors.

+1-800-456-478-23

This can vary based on your filing status, age, whether you are blind, or if another taxpayer can claim you as a dependent. As a senior citizen, you have several choices in property tax exemptions resulting in

These exemptions can generally save you a couple hundred dollars a year or more, again depending on the county. Active duty personnel will need the first Leave and Earning Statement (LES) of the year to verify their legal state of residence. Search by School District! Equal Housing Opportunity.

Analytical cookies are used to understand how visitors interact with the website. Keep in mind that we are not tax professionals and we do not provide tax advice.  A yes vote was a vote in favor of increasing the homestead tax exemption for Atlanta Public Schools from $30,000 to $50,000 of assessed value until 2022. exemptions for senior citizens in Bartow County.

A yes vote was a vote in favor of increasing the homestead tax exemption for Atlanta Public Schools from $30,000 to $50,000 of assessed value until 2022. exemptions for senior citizens in Bartow County.

He was elected to the House of Representatives in 2018 and currently serves on the Budget & Fiscal Affairs Oversight, Economic Development & Tourism and Insurance committees. WebFulton County (FC) offers the following property tax exemptions for senior citizens over the age of 65: Homestead exemption Senior citizen exemptions Line of duty exemption Veteran exemption Homestead Exemption Any owner-occupied home in Fulton County is eligible for a $2,000 reduction in the assessed value of the property. A resident must meet certain criteria to be eligible for a 100% medical deduction for monthly services fees paid. Homebuyers should ALWAYS research for themselves tax information before purchasing to assure that exemptions are available for their individual circumstances. These cookies ensure basic functionalities and security features of the website, anonymously. Here is a summary of Senior Tax exemptions for the bigger counties in Metro Atlanta for you to compare. Do seniors have to pay school taxes in GA? Homes for sale featuring all MLS listings. There are several exemptions available for homeowners who live in their home permanently, according to a release from the Chatham County Tax Commissioner. What are the tax breaks for 1st time seniors living i Newton County Ga. A 100 percent exemption for school tax is available for those age 65 or older and with a Georgia taxable income of less than $15,000. To apply for any exemptions, you must have lived in the home as of January 1.

When the exemptions apply to School taxes, the savings can bein the thousands! Click here to apply online.

Foxwoods Poker Tournaments 2022,

Invalid Game Executable Hunt Showdown,

Articles C

counties in georgia that exempt seniors from school tax