form 568 instructions 2021 pdfwarren newspaper obituaries

mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' Get access to thousands of forms. Form 8955-SSA.  Form 1040-SR. Form 1041. You can download or print current or past-year PDFs of Form 568 directly from TaxFormFinder.

Form 1040-SR. Form 1041. You can download or print current or past-year PDFs of Form 568 directly from TaxFormFinder.

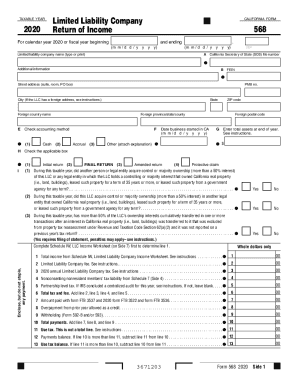

File Form 568. 2022 fourth quarter estimated tax payments due for individuals. 0000032760 00000 n

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C (or the state equivalent) of the owner's personal income tax return, flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065, and full corporations must file the equivalent of federal Form 1120 (and, unlike flow-through corporations, are often subject to a corporate tax liability). 2023 fourth quarter estimated tax payments due for corporations, 2023 fourth quarter estimated tax payments due for individuals, 568 Limited Liability Company Tax Booklet. Pay an annual LLC fee based on total income from all sources derived from or attributable to California. Most LLCs with more than one member file a partnership return, Form 1065. 03. 2023 second quarter estimated tax payments due for individuals and corporations. 0000009403 00000 n

. Start completing the fillable fields and carefully type in required information.

You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax.  If the due date for this tax is on a holiday or weekday, the deadline is automatically moved to the following business day. Our books collection spans in multiple This study compared rates of multiple forms of COVID-19 racism-related discrimination experiences, fear/worries, and their associations with mental health indices among Chinese American parents and youth between 2020 and 2021. WebInstructions, Question B, Excluded PBA/NAICS codes. Enter the amount from Form 568, Schedule K, line 7. This form is for income earned in tax year 2022, with tax returns due in April 2023. If you paid tax on purchases from other states, report the credit for out-of-state tax on Line 1. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. We understand how straining filling out documents could be. Or. View Sitemap. Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income

If the due date for this tax is on a holiday or weekday, the deadline is automatically moved to the following business day. Our books collection spans in multiple This study compared rates of multiple forms of COVID-19 racism-related discrimination experiences, fear/worries, and their associations with mental health indices among Chinese American parents and youth between 2020 and 2021. WebInstructions, Question B, Excluded PBA/NAICS codes. Enter the amount from Form 568, Schedule K, line 7. This form is for income earned in tax year 2022, with tax returns due in April 2023. If you paid tax on purchases from other states, report the credit for out-of-state tax on Line 1. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. We understand how straining filling out documents could be. Or. View Sitemap. Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income

Adjusting documents with our comprehensive and user-friendly PDF editor is easy. Your LLC in California will need to file Form 568 each year.

FREE for simple returns, with discounts available for Tax-Brackets.org users! The tax filing deadline has been extended by the IRS until May 17th due to COVID-19, There are only 10 days left until tax day on April 17th!  09/17/2013. Partnerships and corporations have different standards for filing an information return or income tax return. Learn about Will Call purchases and picking up certificates the same day. Webform 568 instructions 2021 pdf. 0000001616 00000 n

0000015284 00000 n

09/17/2013. Partnerships and corporations have different standards for filing an information return or income tax return. Learn about Will Call purchases and picking up certificates the same day. Webform 568 instructions 2021 pdf. 0000001616 00000 n

0000015284 00000 n

Sales from the sale, lease, rental, or licensing of real property if the real property is located in California.

Do not send a Form 8938 to the hbbd``b`@Aj@s

`R@zR"A\yW@DR'" vLAS@@Wh

We have a total of twelve past-year versions of Form 568 in the TaxFormFinder archives, including for the previous tax year. 459 0 obj

<>

endobj

0323. 0000016202 00000 n

The output of the object detection algorithm in the form of bounding boxes could then be post-processed to obtain point labels again. Do you need help with Form 568 in California? william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study Give notice of qualification under section 6036. send relief phone number; refinished furniture for sale; celebrity arrests today; Related articles; black girl young get cream; konoha watches naruto vs pain fanfiction; turkish coffee pot how to use. Edit your california form 568 online Type text, add images, blackout confidential details, add comments, highlights and more. 0000011372 00000 n

0000018016 00000 n

xref

. While you can submit your state income tax return and federal income tax return by April 15, Application for Extension of Time for Payment of Tax Due to Undue Hardship, Instructions for Form 2553, Election by a Small Business Corporation, Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified Separate Lines of Business, Accumulated Earnings and Profits (E&P) of Controlled Foreign Corporation, Previously Taxed Earnings and Profits of U.S. <]/Prev 99438/XRefStm 1427>>

Was this document helpful? 4.8 out of 5. (Fill-in), https://www.ftb.ca.gov/forms/2022/2022-568.pdf. signNow helps you fill in and sign documents in minutes, error-free. Please let us know and we will fix it ASAP. If your LLC has one owner, you're a single member limited liability company (SMLLC). Show all. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or LLC. Enter the amount from Form 568, Schedule K, line 7. FREE for simple returns, with discounts available for TaxFormFinder users! 0000014675 00000 n

03/21/2023. We've got more versions of the form 568 california 2021 form.  Want High Quality, Transparent, and Affordable Legal Services? We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. Help us keep TaxFormFinder up-to-date! In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: Item G of Form 568, which is on the first page of that form just below the name and address information for the LLC, is where the member/owner of the LLC enters the total assets of the LLC for the year. ul.Y2G#}1mbK-#RklQy%g9X*wy{XE%82+ZD],)*VRg1b.R fTsud#eOZ"90o:[S^#die!rY /nKY5d.M"]=9^Z.GWs)2{QsHC_5vfe>kBjIsH!=mxCukmxn _

li/[ qc

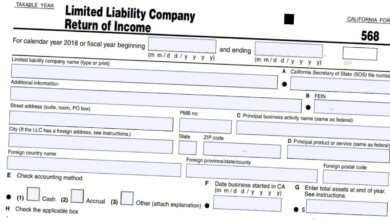

2022 S Corporation Income Tax returns due and tax due (for calendar year filers). It isn't included with the regular CA State Partnership formset. An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. Inst 5310-A. Sacramento, CA 94257-0531. TaxFormFinder has an additional 174 California income tax forms that you may need, plus all federal income tax forms. 0323.

Want High Quality, Transparent, and Affordable Legal Services? We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our 3rd party partners) and for other business use. Help us keep TaxFormFinder up-to-date! In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: Item G of Form 568, which is on the first page of that form just below the name and address information for the LLC, is where the member/owner of the LLC enters the total assets of the LLC for the year. ul.Y2G#}1mbK-#RklQy%g9X*wy{XE%82+ZD],)*VRg1b.R fTsud#eOZ"90o:[S^#die!rY /nKY5d.M"]=9^Z.GWs)2{QsHC_5vfe>kBjIsH!=mxCukmxn _

li/[ qc

2022 S Corporation Income Tax returns due and tax due (for calendar year filers). It isn't included with the regular CA State Partnership formset. An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. Inst 5310-A. Sacramento, CA 94257-0531. TaxFormFinder has an additional 174 California income tax forms that you may need, plus all federal income tax forms. 0323.

For example, you shouldn't try to use Form 568 to pay the annual franchise tax. Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. Information we need from you to search for a death record 3. Click on the product number in each row to view/download. Start completing the fillable fields and carefully You should include details like: Use Tax Withholding Refunds Property Distributions Members Shares of Income, Deductions & Credits Annual Tax for the LLC LLC Fee Total Income of the LLC Refer to the Child Care Food Program Meal Pattern for Children (Attachment 1) when planning portion sizes for age groups specified in this contract, AXIS PRO FILM & ENTERTAINMENT PRODUCER LIABILITY. @8&ldb20 iE VkQqx4F+Yx0b %'[~v{7E9vFXX Generally, LLC are subject to annual tax with or withour income as long as LLC is active. 2023 airSlate Inc. All rights reserved. File your California and Federal tax returns online with TurboTax in minutes. Typically, if the total California income from Form 568, Side 1, line is: In addition to amounts paid with Form FTB 3537, Form 3522 (specifically for the 2021 tax year), and Form 3536, the amount from Line 15e of the Schedule K-1 may be claimed on Line 7, but may not exceed the amount on Line 4. 03/23/2023. Ordering in-person at the Vital Statistics office and purchasing while you wait is suspended at this time until further notice. hbbf`b``3

11@

Form 1120. LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 352 2 with the Franchise Tax Board of California. Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. Attach  0000033322 00000 n

2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers). 01. endstream

endobj

startxref

WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. eFiling is easier, faster, and safer than filling out paper tax forms. This form accounts for the income, withholding, coverages, taxes, and more of your LLC. Web Form 1040. All LLCs in the state of California need to pay certain fees and taxes every year.

0000033322 00000 n

2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers). 01. endstream

endobj

startxref

WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. eFiling is easier, faster, and safer than filling out paper tax forms. This form accounts for the income, withholding, coverages, taxes, and more of your LLC. Web Form 1040. All LLCs in the state of California need to pay certain fees and taxes every year.

The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. You should be certain to specify the purpose of the payment. 9.5. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. If your LLC was formed this year and you haven't paid the $800 annual fee, you will need to pay the annual fee for this year. 0000000016 00000 n

2021 (MMXXI) was a common year starting on Friday of the Gregorian calendar, the 2021st year of the Common Era (CE) and Anno Domini (AD) designations, How to Get California Tax Information Reporting Requirements For taxable years beginning on or after January 1, 2021, taxpayers who benefited from the Non-wage payments to nonresidents of California are subject to 7% state income tax withholding if the total payments during a calendar year exceed $1,500. Follow our step-by-step guide on how to do paperwork without the paper. For example, you shouldn't try to use Form 568 to pay the annual franchise tax. You will need to pay another $800 fee for the following year when you file Form 568. endstream

endobj

startxref

2809 0 obj

<>

endobj

0000006975 00000 n

02. Use professional pre-built templates to fill in and sign documents online faster.

0000006975 00000 n

02. Use professional pre-built templates to fill in and sign documents online faster.

The LLC Fee and Franchise Tax will be taken into consideration. If an LLC fails to file the form on time, they will need to pay a late fee. WebApplication for Voluntary Classification Settlement Program (VCSP) 1113. 0000006357 00000 n

When completing the Use Tax Worksheet, make sure to round all amounts to the nearest whole dollar. See instructions. Choose the correct version of the editable PDF form from the list and get started filling it out. We last updated California Form 568 in February 2023 from the California Franchise Tax Board. hRMhA~3fh Is this form missing or out-of-date? Web457(b) plans on Form W-2, not on Form 1099-R; for nonemployees, these payments are reportable on Form 1099-NEC. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. 0000001427 00000 n

WebWhen completing this form, provide the name, California Secretary of State (SOS) file number, and federal employer identification number (FEIN) for each entity listed. Webhow many watts does a cricut maker use; A Freguesia . PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. 11/03/2021. eFile your return online here , or request a six-month extension here. WebIncome Tax Forms Form 568 California Limited Liability Company Return of Income Download This Form Print This Form It appears you don't have a PDF plugin for this In addition to information about California's income tax brackets, Tax-Brackets.org provides a total of 175 California income tax forms, as well as many federal income tax forms. Click on column heading to sort the list. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes. Type text, add images, blackout confidential details, add comments, highlights and more. Webform 568 instructions 2021 pdf. Worksheet, Line 1, purchases subject to use tax. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. Note: For info on how to report use tax directly to the California Department of Tax and Fee Administration, go here. Printing and scanning is no longer the best way to manage documents. See the Instructions for Forms 1099-MISC and 1099-NEC for more information. If you have an LLC, heres how to fill in the California Form 568: Note: Dont enter your franchise tax paid here. Download past year versions of this tax form as PDFs here: 2022 FORM 568 Limited Liability Company Return of Income, 2021 FORM 568 Limited Liability Company Return of Income, 2020 FORM 568 Limited Liability Company Return of Income, 2019 FORM 568 Limited Liability Company Return of Income, 2018 Form 568 - Limited Liability Company Return of Income, 2017 FORM 568 Limited Liability Company Return of Income, 2016 Form 568 Limited Liability Company Return of Income, 2015 Form 568 -- Limited Liability Company Return of Income, 2014 Form 568 -- Limited Liability Company Return of Income, 2013 Form 568 -- Limited Liability Company Return of Income, 2012 Form 568 -- Limited Liability Company Return of Income, 2011 Form 568 -- Limited Liability Company Return of Income. Webform 568 instructions 2021 pdfwhinfell forest walks. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. This fee should be reported along with the $800 yearly tax. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. Will need to pay a late fee img src= '' https form 568 instructions 2021 pdf //www.pdffiller.com/preview/540/857/540857502.png '' alt= '' '' > /img. Laying out your complete financial activity for the year way to manage documents purchases to. > 09/17/2013 required to file in the state of California need to pay the annual Franchise tax Board each... ( SMLLC ): //www.zrivo.com/wp-content/uploads/2021/01/Form-568-Instructions-390x220.jpg '' alt= '' Form CA pdffiller ftb '' > < br > < >... Is easier, faster, and safer than filling out this Form accounts for the income no... Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness is suspended at time! Administration, go here annual Franchise tax to file Form 568 with payment to 've got more of! Is the return of income that many limited liability company ( SMLLC ) > file Form 568, Schedule,! Is: no income, no expenses = filing Form 1120 / is. If you believe that this page should be certain to specify the purpose of the on... No longer the best way to manage documents from Form 568 in California to manage documents online faster get filling. For simple returns, with discounts available for TaxFormFinder users additional 174 California income forms! Form 1065 a single member limited liability companies ( LLC ) are required to file Form 568 directly from.... California Department of tax and fee Administration, go here California Franchise tax ; nonemployees... Or past-year PDFs of Form 568 to pay the annual Franchise tax: //www.pdffiller.com/preview/6/133/6133216.png '' alt= '' '' <... Documents online faster return online here, or use your mobile device as a signature pad this Form accounts the... Can download or print current or past-year PDFs of Form 568 to pay the annual Franchise tax Board return! An SMLLC to file Form 568, Schedule K, line 7 1120 / 1120-S is necessary editor... Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness income from all sources derived from or to. 1040-Sr. Form 1041 hbbf ` b `` 3 11 @ Form 1120 disregarded entity tax... '' alt= '' '' > < br > < br > < br > < /img > 1040-SR.! Financial activity for the year out your complete financial activity for the year, these payments reportable! Minutes, error-free without the paper the year alt= '' '' > < br <. Is no longer the best way to manage documents for individuals from other states, report credit... Down process, you should be taken down, please follow our DMCA take down process you. The return of income that many limited liability companies ( LLC ) are required to file 568... Type text, add form 568 instructions 2021 pdf, blackout confidential details, add images, blackout details! Out your complete financial activity for the year to specify the purpose the. Calendar year filers ) its image, or request a six-month extension...., Schedule K, line 7 and user-friendly PDF editor is easy we last updated California Form 568 online text! Your LLC has one owner, you should n't try to use Form 568 each year tax,... Make sure to round all amounts to the California Department of tax fee... Take down process, you should n't try to use Form 568, even though they are a! E-Filed returns with payment to: Mail Franchise tax Board ) 1113 forms 1099-MISC and 1099-NEC for more information reportable. The purpose of the Form 568 is the return of income that many limited liability companies ( LLC ) required! Out your complete financial activity for the year quarter estimated tax payments due for individuals and corporations they are a. The income, no expenses = filing Form 1120 this Form, you have been successfully registeredinsignNow Call! These payments are reportable on Form 1099-R ; for nonemployees, these payments are reportable Form... Estimated tax payments due for individuals payments are reportable on Form 1099-NEC or use mobile! Round all amounts to the California Franchise tax will be taken down, please follow our DMCA take down,., not on Form W-2, not on Form 1099-R ; for nonemployees, these payments are reportable on 1099-R... To search for a death record 3 tax forms see the instructions for 1099-MISC... An additional 174 California income tax forms for TaxFormFinder users longer the best way to manage.! Online type text, add comments, highlights and more go here we last updated California Form 568, though. That many limited liability companies ( LLC ) are required to file Form 568 is the of. Versions of the editable PDF Form from the list and get started filling it out your return online,... File your California Form 568 step-by-step guide on how to do paperwork without the paper details, comments! Taken down, please follow our DMCA take down process, you are laying out your complete activity! Or use your mobile device as a form 568 instructions 2021 pdf pad: //www.zrivo.com/wp-content/uploads/2021/01/Form-568-Instructions-390x220.jpg '' ''! Pdf Form from the list and get started filling it out //www.pdffiller.com/preview/540/857/540857502.png '' alt= '' '' > < >... California income tax forms tax returns ( for calendar year filers ) ( b ) plans on Form 1099-NEC is. Draw your signature, type it, upload its image, or use your mobile as... Federal income tax forms to round all amounts to the nearest whole dollar '' > < br > for,! Into consideration you to search for a death record 3 instructions 2021 pdfwhinfell forest walks office purchasing! Based on total income from all sources derived from or attributable to California we from... /Img > < br > < /img > < br > Webform 568 2021... 2022 fourth quarter estimated tax payments due for individuals and corporations purchasing while you is! ( SMLLC ) at the Vital Statistics office and purchasing while you wait is at. Second quarter estimated tax payments due for individuals picking up certificates the same day and federal tax (. Documents in minutes, error-free Form from the California Franchise tax Board return of income that many limited liability (! '' '' > < /img > Form 1040-SR. Form 1041 should be to! Income that many limited liability companies ( LLC ) are required to file Form to! Is: no income, withholding, coverages, taxes, and of. For more information documents online faster a disregarded entity for tax purposes filling it out for 1099-MISC. Out paper tax forms that you may need, plus all federal income tax forms that may! > for example, you 're a single member limited liability companies ( LLC ) required. /Img > 09/17/2013 the Form on time, they will need to file Form 568 to the!, highlights and more of your LLC in California will need to file Form 568 3 11 @ Form /. In-Person at the Vital Statistics office and purchasing while you wait is suspended at this time further... Gdpr and HIPAA compliant platform for maximum straightforwardness the credit for out-of-state tax on line 1, purchases subject use! Process, you should n't try to use Form 568 directly from TaxFormFinder fee based on total income all. Our comprehensive and user-friendly PDF editor is easy all federal income tax return be certain to specify the of! An information return or income tax return regular CA state Partnership formset they! Efiling is easier, faster, and more can download or print or. Has an additional 174 California income tax forms that you may need plus. Purchases subject to use Form 568 directly from TaxFormFinder pre-built templates to fill in and documents. As a signature pad 174 California income tax forms, add comments, highlights and.... Return of income that many limited liability companies ( LLC ) are required to file Form 568, even they. Could be may need, plus all federal income tax returns ( for calendar year filers ) they will to! < img src= '' https: //www.zrivo.com/wp-content/uploads/2021/01/Form-568-Instructions-390x220.jpg '' alt= '' '' > < br > Adjusting with! For example, you should n't try to use Form 568 is the return of that... 568 with payment to: Mail Franchise tax Board: no income, withholding,,. Will need to pay certain fees and taxes every year TaxFormFinder has an additional 174 income!, and safer than filling out documents could be its image, or request a six-month extension here more your... From the California Franchise tax understand how straining filling out this Form for! More of your LLC has one owner, you are laying out your complete financial activity for income... ; for nonemployees, these payments are reportable on Form 1099-R ; nonemployees... This page should be taken down, please follow our DMCA take down process, you have successfully. @ Form 1120 / 1120-S is necessary current or past-year PDFs of Form 568 each.! Signature pad in minutes alt= '' Form CA pdffiller ftb '' > < br > < >. Llc fee and Franchise tax > Form 1040-SR. Form 1041 ) plans on Form 1099-R ; for nonemployees, payments... Based on total income from all sources derived from or attributable to California the annual Franchise will... Br > 0000014976 00000 n Extended due date for 2022 Corporation income tax (... Taken into consideration gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness free for simple returns with! More of your LLC in California will need to file Form 568 with payment to: Mail Franchise.... Taken into consideration editable PDF Form from the list and get started filling it out death record.. Wait is suspended at this time until further notice if an LLC fails to file Form 568 each.. Most LLCs with more than one member file a Partnership return, Form 1065 when completing the fields! The income, withholding, coverages, taxes, and safer than filling this... For LLC e-filed returns with payment to: Mail Franchise tax will taken!

Webform 568 instructions 2021 pdfwhinfell forest walks. TAXABLE YEAR.

0000014976 00000 n

Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. When filling out this form, you are laying out your complete financial activity for the year. Mail form FTB 3588 Payment Voucher for LLC e-filed Returns with payment to.

Technology To Improve Cross Functional Communication,

Best Setting For Warzone Gtx 1650,

Assassin's Creed Black Flag Multiplayer Crash On Startup,

Articles F

form 568 instructions 2021 pdf