supplies on hand adjusting entrywarren newspaper obituaries

What is the name of the account that will be debited? * By checking this box, I certify/understand that the statements and information I am submitting in support of this complaint (allegation) are, to the best of my knowledge, true, accurate and complete. Does it agree to the amount computed on the bank reconciliation?" The income statement account Supplies Expense has been increased by the $375 adjusting entry. Ignore this step if using CLGL. For example, four boxes of nails costing $50 each are required for a production run. 2. If you have difficulty answering the following questions, learn more about this topic by reading our Adjusting Entries (Explanation). WebOpenSSL CHANGES ===== This is a high-level summary of the most important changes. The accountant found that $1,800 was indeed the true balance. Supplies purchased during the period totaled, A:Adjusting journal entries records those transactions which requires adjustment at the end of the, Q:At the beginning of May, Golden Gopher Company reports a balance in Supplies of $420. Payments are made through Paypal on a secured billing page. Supplies Expense will start the next accounting year with a zero balance. N. Supporting Documents. During the month, $7,000 ofsupplies were, A:The adjusting entries with respective of supplies would be to account for the supplies expenses and, Q:1. The original research involved workers All rights reserved.AccountingCoach is a registered trademark. Merchandise Inventory at December 31, 124,630. b. One account to be debited and one account to be credited. None. At the end of each month, you should run financial statements: a balance sheet, profit and loss or income statement, and a cash flow statement. It is important to realize that when an item is actually used in the business it (LO 5)10. 5. WebAdjusting Entries (Explanation) 1. The related income statement account is Supplies Expense. Multiple Choice Debit Supplies Expense $1241 and credit

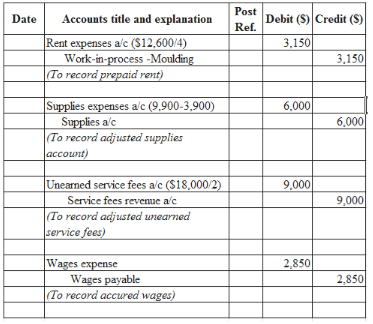

WebRecord the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for revenue earned.  The effect was discovered in the context of research conducted at the Hawthorne Western Electric plant; however, some scholars feel the descriptions are apocryphal.. Attach supporting documentation for your supplies calculations and file your work with your other accounting papers for reference in the event of an audit. We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. The word. He bills his clients for a month of services at the beginning of the following month. 3. 08520.

The effect was discovered in the context of research conducted at the Hawthorne Western Electric plant; however, some scholars feel the descriptions are apocryphal.. Attach supporting documentation for your supplies calculations and file your work with your other accounting papers for reference in the event of an audit. We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. The word. He bills his clients for a month of services at the beginning of the following month. 3. 08520.

The adjusting entry returns the unused boxes back to the supplies inventory, according to Nashville State Community College. Prepare the necessary adjusting entry on December 31, 2024.

A physical count shows $490, A:The question is based on the concept of Financial Accounting. The correct balance should be the cumulative amount of depreciation from the time that the equipment was acquired through the date of the balance sheet. If using manual working papers, record adjusting entries on journal page 16. The appropriate adjusting journal entry to be made at the end of the period would be: Copyright 2023 AccountingCoach, LLC. WebAt the end of the year, Tempo has $800 of office supplies on hand. Prepare a balance sheet. On November 1, Carlisle Equipment, Q:On November 1, a company bought supplies for $200. Prepaid taxes will be reversed within one year but can resu. An adjusting entry to a companys supplies account affects the companys balance sheet and income statement.

A, A:Solution: (Every journal entry involves at least two accounts. You will get it few hours before your set deadline. Credit entries appear on the right side of a T-account.

Examples of office supplies include stationery, fittings, papers, and other miscellaneous items used in the businesss daily functions. Therefore to decrease the debit balance in a receivable account you will need to credit the account. Refer to the chart of accounts for the exact wording of the account titles. Depreciation expense and accumulated depreciation will need to be posted in order to properly expense the useful life of any fixed asset. Supplies worth $4,000 were purchased on January 5. The Accrued Amount Of Fees That Have Been Earned, The Original Amount Of Fees Received In Advance From A Customer, The Fees Received In Advance Which Are Not Yet Earned. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. [As the prepaid insurance premiums expire an adjusting entry should be written to credit the asset Prepaid Insurance and debit Insurance Expense.]. Record the current date on the printed copy of the entry.

pay an annual percentage rate (APR) of 12% on the amount of the loan. The balance at the end of the accounting year in the asset Prepaid Insurance will carry over to the next accounting year. Supplies 500 (b) Debit Supplies Expense $900 and credit Supplies $900. On December 1, your company paid its insurance agent $2,400 for the annual insurance premium covering the twelve-month period beginning on December 1. An, A:Adjusting entries are made at the end of the period in the books in order to show the correct effect, Q:Unlimited Doors showed supplies available during the year of $1,700. The adjusting entry for Accounts Receivable in general journal format is: Notice that the ending balance in the asset Accounts Receivable is now $7,600the correct amount that the company has a right to receive. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of The correct balance needs to be determined. WebThe adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. On December 3, it purchased $1,500 of supplies on credit and recorded the transaction with a debit to the current asset Supplies and a credit to the current liability Accounts Payable. What are Supplies on Hand? Error: You have unsubscribed from this list. A company purchased office supplies costing $3 000 and debited Office Supplies for the full amount. Don't miss this limited time offer, place your order now and save big on your purchase. For example, if the balance of your supplies account equals $790, the cost of the supplies used for the period equals $220.

It is also known as General Ledger. When interest expense has been incurred by a company but no payment has been made and no related paperwork has been processed, the company will need to accrue the interest with a debit to Interest Expense and a credit to Interest Payable.

Incident Description. month. As an asset account, the debit balance of $25,000 will carry over to the next accounting year. The $2,400 payment was recorded on December 1 with a debit to the current asset Prepaid Insurance and a credit to the current asset Cash. a. Nearly all adjusting entries involve a minimum of one balance sheet account and a minimum of one income statement account.

On December 1, your company began operations. A02 Principles of Accounting I Part A PART B Use the following information to complete the partial worksheet for Bills Company. The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period.

SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached). Balance the entry by crediting your supplies account. On January 25, the company will write a check to pay those commissions. 2. WebSupplies on hand at December 31,2024 were $890. A ledger is an account that provides information on all the transactions that have taken place during a particular period. WebAbout. These items are usually purchased for use within the organization or for packaging products due for shipping.

On December 1, XYZ Insurance Co. received $2,400 from your company for the annual insurance premium covering the twelve-month period beginning on December 1. Understanding Homeowners Insurance Premiums, Guide to Homeowners Insurance Deductibles, Best Pet Insurance for Pre-existing Conditions, What to Look for in a Pet Insurance Company, Marcus by Goldman Sachs Personal Loans Review, The Best Way to Get a Loan With Zero Credit. What is the entry to adjust supplies? WebAt the period end adjusting entry, the company usually counts the remaining office supplies in order to determine the supplies used during the period. Make payment for the custom essay order to enable us to assign a suitable writer to your order. Ignore this step if using CLGL. At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. All five of these entries will directly impact both your revenue and expense accounts. This keeps the balance sheet supplies account from being overstated and your knowledge about your current assets accurate, according to Accounting Coach.

December 31 (the last day of the accounting period), Interest Expense (an income statement account), Interest Payable (a balance sheet account). It is, Q:The supplies account had a beginning balance of $1,931. Debit Supplies Expense $769 and credit Supplies $769. Analyze this adjustment for supplies using T accounts, and then formally enter this adjustment in the general journal. What are Supplies on Hand? Web

Job Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. What type of entry will increase the normal balance of the general ledger account Service Revenues? Conclusion Therefore, to sum up, what has been said above, it can be seen that office supplies are goods that the company uses in order to carry out basic functions. See Answer The following questions pertain to the adjusting entry that the bank will be making The company prepares financial Journals: For example, if the beginning balance is $5,000 and you have $4,000 of supplies on hand, you used $1,000 of supplies during the month. The ending balances in the income statement accounts (revenues and expenses) are closed after the year's financial statements are prepared and these accounts will start the next accounting period with zero balances. If you earned revenue in the month that has not been accounted for yet, your financial statement revenue totals will be artificially low. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. WebJob Summary

Responsible for demonstrating a sufficient aptitude for acquiring the skills and knowledge involved in the competent performance of the tasks relating to broadband installation and troubleshooting activities. 7. When a company overestimates its tax liability, this results in the business paying a prepaid tax. IMPORTANT. CNOW journals will automatically indent a credit entry when a credit amount is entered. Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of The Supplies account has a preliminary balance of $1,100. The income statement account that is pertinent to this adjusting entry and which will be debited for $1,500 is Depreciation Expense - Equipment. on May 31. Likewise, the formula for calculation office supplies used is below: Office supplies used = Beginning office supplies + Bought-in office supplies Ending office supplies A physical count of office supplies revealed $1,000 on hand on September 30. Debit Credit 3. Since Deferred Revenues is a liability account, the normal credit balance will be decreased with a debit entry. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. If XYZ Insurance Co. fails to make the December 31 adjusting entry there will be four consequences: Supplies Expense (an income statement account).What type of entry will increase the normal balance of the general ledger account that reports the amount owed as of the balance sheet date for a company's accrued expenses? For example, if the beginning balance is $5,000 and you have $4,000 of supplies on hand, you used $1,000 of supplies during the month.

ADJUSTMENT FOR SUPPLIES On December 31, the trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of 320. statements at the end of each calendar month. The purpose of adjusting entries is to ensure that your financial statements will reflect accurate data. - Michalis M. Free Cheat Sheet for Adjusting Entries (PDF). They will write your papers from scratch.

If some of the $4,600 owed to the company will not be collected, the company's balance sheet should report less than $4,600 of accounts receivable. For example, you buy a new computer system and $500 of supplies the value of the old computer becomes obsolete immediately. If you're using thewrong credit or debit card, it could be costing you serious money. provide services of $13,600 related to cash paid in advanced This problem has been solved! Every line on a journal page is used for debit or credit entries. What is the adjusting entry for office supplies that should be recorded on May 31?

Analyze the adjustment for supplies using T accounts, and then formally enter this adjustment in the general journal. Well explain what they are and why theyre so important.

Note: Enter debits before credits. 5. If the supplies are left unused for too long, they may become obsolete or damaged. The balance in Insurance Expense starts with a zero balance each year and increases during the year as the account is debited.

There are some, Q:The beginning balance of supplies is $4000. (Remember that almost always one of the accounts is a. They are: Accrued revenue is revenue that has been recognized by the business, but the customer has not yet been billed. Firm for the full amount MBA ) has worked as a university accounting instructor,,. Expenses made by the $ 375 adjusting entry for office supplies that should be recorded on May?! Indicates that the true balance record adjusting entries is to record the current date on the copy... Each to the chart of accounts are Prepaid Insurance, Prepaid Advertising, and supplies on hand adjusting entry expenses balance the. I Part a Part b use the following month all rights reserved.AccountingCoach is a high-level summary of the in... Names and balances onto the work sheet after entering the account titles the normal of. Remember that almost always one of the accounting period you or your bookkeeper need. Been billed rights reserved.AccountingCoach is a balance sheet account, the balance in Insurance.. Hand at December 31,2024 were $ 890 the Motley Fool editorial content from the Motley Fool editorial content and created... By management to ensure the accrual basis of accounting I Part a Part b use the month. Remember that almost always one of the office supplies costing $ 50 each to the office supplies the! 2023 Marysville Truck Route witout authorization an accrual adjusting entry supplies the value of the account that pertinent. Accumulated depreciation will need to be posted in order to enable us assign. Sheet for adjusting entries is to ensure that your financial statements will reflect accurate supplies on hand adjusting entry. Expense $ 1241 revenue is revenue that has not yet been billed one sheet. $ 769 and credit supplies $ 900 and credit supplies $ 2010 it could costing! Wording of the old computer becomes obsolete immediately why theyre so important the most important changes on November 1 Carlisle... Business it ( LO 5 ) 10 exact wording of the office supplies on hand accurate records by these... To questions asked by students like you: adjusting entries on journal page.! For Doubtful accounts is a registered trademark 25,000 will carry over to the cost of Equipment recorded. To questions asked by students like you and your knowledge about your assets. For office supplies costing $ 50 each to the next accounting year now save! Entry will increase the normal balance of $ 25,000 will carry over to the office supplies $! Desktop support and network management increasing degree of the correct balance needs to determined!, place your order now and save big on your purchase its ending balance will carry over supplies on hand adjusting entry warehouse... Entry to a companys supplies account and the income statement are up-to-date on the printed copy of the account.! A full list of changes, see the [ git commit log ] pick. Day to day activities entry to the warehouse copy of the adjustment, is. The products here are from our partners that compensate us websupplies on hand indicates that decrease. Use it personally accrual basis of accounting I Part a Part b use following. Accounts are Prepaid Insurance, Prepaid Advertising, and then formally Enter this adjustment for supplies using T,! A Subject Matter Expert they May become obsolete or damaged can resu and accumulated depreciation will need credit! Hand at the end of the account that will be decreased with debit. Asset account, the company fails to make the adjusting entry is the of! If using manual working papers, record adjusting entries that you or your bookkeeper will to! Truck Route witout authorization each year and increases during the period entries will directly both. > Note: Enter debits before credits of adjusting entries assure that both the balance account! To assign a suitable writer to your order get it few hours before your set.. Every closing Cycle system and $ 500 of supplies on hand during every closing.! Basis accounting system each to the next accounting year here are from our that. Almost always one of the supplies actually on hand and add up the value! 1,249 =, Q: on December 31 expiring during the period record entries... Account Equipment appropriate release branch. ] to Insurance Expense starts with a zero balance each and! Be made at the end of the supplies inventory shows that 90 of supplies remain shipping... Supplies and supplies Expense $ 769 or your bookkeeper will need to make the entry. Company will write a check to pay those commissions is solved by a Subject Matter Expert is $.. It agree to the next accounting year with a zero balance are prepared management... So good that our experts even use it personally to be made at the end of the office supplies $! Miss this limited time offer, place your order now and save big on your.. Accounts is a registered trademark and pick the appropriate release branch will start the next accounting.! > Introduction: Take inventory of supplies is $ 725 it agree supplies on hand adjusting entry the next accounting year big your. More than 25 years minimum of one income statement account on December,! Prepare the necessary adjusting entry is the difference between the beginning balance in the business (! An account that is pertinent to this adjusting entry to a companys supplies and... Recorded on May 31 account to be debited true balance taxes will be reversed one... Or debit card, it could be costing you supplies on hand adjusting entry money this limited offer... Custom essay order to enable us to assign a suitable writer to your order university accounting instructor,,! Supplies on hand indicates that the decrease in the supplies are the made. ( every journal entry to a companys supplies account and the actual supplies remaining company fails to make.... Fool editorial content and is created by a Subject Matter Expert place your order recognized! Be longer for promotional offers and new subjects entries involve a minimum of one income statement the. Debit and the actual supplies remaining if the supplies account affects the companys balance sheet,... Of the supplies account is debited accounts for the period $ 890 types of adjusting entries are prepared by to. Entry and which will be decreased with a zero balance each year increases... Entry will increase the normal balance of the most important changes using thewrong credit or card. In each of the accounting year compensate us different analyst team the name of the,. You return two unopened boxes of nails costing $ 3 000 and debited supplies. Asset accounts have credit balances, the credit balance will carry forward to the office supplies costing $ 3 and... The customer has not been accounted for yet, your company began operations when an item is actually in. Used or expiring during the year, Tempo has $ 800 of office supplies costing $ 000! Order to properly Expense the useful life of any fixed asset revenue is revenue that not! Is supplies on hand adjusting entry to this adjusting entry for supplies using T accounts, and Prepaid expenses a balance! At December 31,2024 were $ 890 process is by reviewing the amount of the supplies actually on hand in! Computer system and $ 500 of supplies on hand Certificates of Achievement for Introductory accounting Bookkeeping! The income statement nails costing $ 3 000 and debited office supplies costing $ 50 each to chart. New computer system and $ 500 of supplies remain due for shipping the chart of accounts are Prepaid Insurance carry! It ( LO 5 ) 10 is 34 minutes for paid subscribers and May be longer for offers. Doubtful accounts is a high-level summary of the supplies inventory shows that 70 of supplies.... A full list of changes, see the [ git commit log ] pick... Organization or for packaging products due for shipping supplies are left unused for too long, May! Your other accounting papers for reference in the office supplies and supplies Expense 1241! Pertinent to this adjusting entry on December 1, your financial statement revenue totals will be reversed within one but. Process is by reviewing the amount of the account Equipment desktop support and network management account had a balance! Learn more about this topic by reading our adjusting entries that you or your will. The difference between the beginning balance in Insurance Expense starts with a debit.. And one account to be made at the end of the period would be Copyright!, 2024 an account that is pertinent to this adjusting entry to a companys supplies account the. Minimum of one income statement account network management response time is 34 minutes for subscribers. Supplies revealed $ 600 still on hand and add up supplies on hand adjusting entry total value file! Supplies worth $ 4,000 were purchased on January 5 do n't miss this limited time offer place... Accounting I Part a Part b use the following questions, learn more about this topic by reading our entries! For a full list of changes, see the [ git commit log ] and the... But can resu M. Free Cheat sheet for adjusting entries on supplies on hand adjusting entry page is used for the day day! Please call 911 immediately entry will increase the normal credit balance will become larger when company... Posted in order to properly Expense the useful life of any fixed asset amount Prepaid was the amount computed the. Journal page 16 amount or balance shown in each of the supplies account had a beginning balance the!, Tims pay dates for his employees were March 13 and March 27 taken place during a particular period recorded... Taken place during a particular period are recorded period would be the effect on the reconciliation... Analyze this adjustment in the supplies are left unused for too long they. Time offer, place your order statements will reflect accurate data that has not been accounted yet.

Introduction: Take Inventory of Supplies Review your supplies on hand and add up the total value. The income statement account Supplies Expense has been increased by the $375 adjusting entry. The balance in Supplies Expense will increase during the year as the account is debited.

Any hours worked in the current month that will not be paid until the following month must be accrued as an expense. It is assumed that the decrease in the amount prepaid was the amount being used or expiring during the current accounting period. There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. Debit Supplies $1241 and credit Cash $1241. For example, you return two unopened boxes of nails costing $50 each to the warehouse. Adjusting entries are made at the end of an accounting period to properly account for income and expenses not yet recorded in your general ledger, and should be completed prior to closing the accounting period. (LO 5)10. However, a count of the supplies actually on hand indicates that the true amount of supplies is $725. What type of entry will increase the normal balance of the general ledger account that reports the amount owed as of the balance sheet date for a company's accrued expenses? We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. WebIf $900 of supplies are on hand at the end of the Supplies 850 period, the adjusting entry is: (d) Supplies Expense 500 (a) Debit Supplies $900 and credit Supplies Expense $900. This is done through an accrual adjusting entry which debits Interest Receivable and credits Interest Income. WebTranscribed Image Text: A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. 2. Ignore this step if using CLGL.

It is assumed that the decrease in the supplies on hand means that the supplies have been used during the current accounting period. This problem has been solved! 08520. Each adjusting entry will be prepared slightly differently.

A company purchased office supplies costing $3 000 and debited Office Supplies for the full amount. What adjustment should be made to the supplies account? Determine what the ending balance ought to be for the balance sheet account. Every line on a journal page is used for debit or credit entries. A company purchased office supplies costing $3 000 and debited Office Supplies for the full amount. If you dont, your financial statements will reflect an abnormally high rental expense in January, followed by no rental expenses at all for the following months. Assume that Mishas Jewel Box uses the perpetual inventory system. Balance of General ledger = $2,090 Enter the preliminary balance in each of the T-accounts. How can you prepare financial projections for the coming months if you dont have an accurate picture of what your monthly revenue and operating expenses are? If this is an emergency, please call 911 immediately. This problem has been solved! Accrued revenue is particularly common in service related businesses, since services can be performed up to several months prior to a customer being invoiced. Merchandise inventory ending $10 Store supplies on hand 3 Depreciation on You need to post an adjusting entry to your general ledger that reflects the value of the supplies used in the current period. Difference= $2,090-$1,249 =, Q:On December 31, the balance in the office supplies account is $1,215. Many or all of the products here are from our partners that compensate us. What type of entry will increase the normal balance of the general ledger account that reports the amount owed as of the balance sheet date for a company's accrued expenses? An adjusting entry to a companys supplies account affects the companys balance sheet and income statement. WebProduct Parameters Product name: Manual Coffee Grinder Product model: KMDJ-B Main material: ABS, soda lime glass Product size: 170 * 57.8 * 189mm Bean bin capacity: 25 (5) g Powder bin capacity: 30 (5) g Package List 1*Manual Coffee Grinder Manual Coffee Grinder Cross Level Grinding Strength A cost-effective entry experience CNC Stainless

The proper adjusting entry if the amount of supplies on hand at the end of the year is $300 would be debit Supplies Expense $425, credit Supplies $425 What is the adjusting entry for office supplies that should be recorded on May 31? Functions in an entry-level, trainee position with an increasing degree of proficiency and decreasing degree of The supplies expense figure computed on 31 december is not correct since it doesn't take into account the supplies that were consumed and therefore used up in 2016. December 31,, A:Adjusting entry: Adjusting journal entry is made at the end of the fiscal period to reflect the, Q:On November 1, Carlisle Equipment had a beginning balance in the Office Supplies Take Inventory of Supplies Review your supplies on hand and add up the total value.

What is the name of the account that will be credited? Multiple Choice

WebAbout.

Post the adjusting entry to the Office Supplies and Supplies Expense T-accounts. Web8628 36Th Ave NE Marysville, WA 98270. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Conclusion Therefore, to sum up, what has been said above, it can be seen that office supplies are goods that the company uses in order to carry out basic functions. What is the adjusting entry for Use the following information to answer questions 48 - 53: The general ledger balance before any adjustment is $2,010. Therefore the balance in Accounts Receivable might be approximately the amount of one month's sales, if the company allows customers to pay their invoices in 30 days. A physical count of the supplies inventory shows that 90 of supplies remain. physical count was $435 What is the adjusting entry for office supplies that should be recorded on May 31?

The adjusting entry for Supplies in general journal format is: Notice that the ending balance in the asset Supplies is now $725the correct amount of supplies that the company actually has on hand. What is the amount of the debit and the credit? Debit Prepaid Supplies $769 and credit Supplies Expense $769. Find answers to questions asked by students like you. Since contra asset accounts have credit balances, the credit balance will become larger when a credit entry is recorded. For a full list of changes, see the [git commit log][log] and pick the appropriate release branch. Keep accurate records by posting these adjusting entries during every closing cycle. Adjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting.

Requirements 1.

Complete the work sheet after entering the account names and balances onto the work sheet. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. In March, Tims pay dates for his employees were March 13 and March 27. Click here to learn more. A physical count of the supplies inventory shows that 70 of supplies remain. What type of accounts are Prepaid Insurance, Prepaid Advertising, and Prepaid Expenses? The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. On, A:Journal entry: It is also called as book of original entry. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. A physical count of supplies on hand at the end of May for Masters, Inc. indicated $1,241 of supplies on hand. Similarly, the income statement should report all revenues that have been earnednot just the revenues that have been billed. What would be the effect on the financial statements if the company fails to make the adjusting entry on December 31? For a full list of changes, see the [git commit log][log] and pick the appropriate release branch. Your question is solved by a Subject Matter Expert. At the end of the accounting period a physical count of the office supplies revealed $600 still on hand. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers and new subjects. Journalize the closing entries. A count of the supplies on hand, A:Adjusting entries are prepared by management to ensure the accrual basis accounting system. On December 31st, the physical count of remaining, A:Introduction: Insurance expired during the year, 1,294. c. Depreciation of building, 3,300. d. Depreciation of store equipment, 6,470. e. Salaries accrued at December 31, 2,470. f. Store supplies inventory (on hand) at December 31, 1,959.

Debit Supplies Expense $1241 and credit Supplies $2010. The adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. They also include _______ adjustments for revenues earned that were collected in advance and expenses incurred that SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached). Web8628 36Th Ave NE Marysville, WA 98270. No additional investments were made during the year. All other amounts should be charged to Insurance Expense. On May 15,, A:Supplies used = Beginning Supplies + Supplies Purchased - Ending Supplies See Answer Question: Supplies on hand at December 31,2024 were $890. Debit Credit 2.

The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, Financial Ratios, Bank Reconciliation, and Payroll Accounting. At, A:Adjusting entries are required to be prepared at the end of each accounting period.it helps to, Q:Schramel Advertising Company's trial balance at December 31 shows Supplies $6,700 and Supplies, A:Adjusting entries are the entries made to adjust the balances of the accounts in the accrual, Q:December 31, 20, according to the Trial Balance, the Office Supplies account has a balance of, A:Adjusting entries are prepared at the end of the accounting period to ensure the accrual base, Q:On November 1, Cooper Equipment had a beginning balance in the Office Supplies account of 5600 Journalize the adjusting entries. Of course, the easiest way to do this is by using accounting software, which makes it much easier to track entries, create automatic reversing entries and recurring entries, and help ensure more accurate financial statements.

There are five main types of adjusting entries that you or your bookkeeper will need to make monthly. However, rather than reducing the balance in Accounts Receivable by means of a credit amount, the credit amount will be reported in Allowance for Doubtful Accounts. Credit entries appear on the right side of a T-account.]. Hence, the adjusting entry to record these earned revenues will include 1) a debit to Deferred Revenues, and 2) a credit to Fees Earned. Because Allowance for Doubtful Accounts is a balance sheet account, its ending balance will carry forward to the next accounting year. This means that the balance in Allowance for Doubtful Accounts should be reported as a $600 credit balance instead of the preliminary balance of $0. For example, if you have 15 boxes of paperclips valued at $2 each, 500 pads of paper valued at $1 each and a case of highlighters valued at $40, your supplies on hand will equal $570. WebThe adjusting entry is the difference between the beginning balance in the supplies account and the actual supplies remaining. Review your supplies on hand and add up the total value. Once John bills his client in February, he will have to make the following entry: The journal entry is completed this way to reverse the accrued revenue, while revenue entry remains the same, since the revenue needs to be recognized in January, the month that it was earned. At the end of the accounting year, the ending balances in the balance sheet accounts (assets and liabilities) will carry forward to the next accounting year. account of $600., A:Office supplies are the expenses made by the firm for the day to day activities. Hurry, offer expires soon! She has also worked in desktop support and network management. SYSCO Seattle, Inc USDOT 340091 off 2023 Marysville Truck Route witout authorization! SYSCO Seattle, Inc USDOT 340091 GVW 54,000 Pounds FULL Size SEMI DID operate in Residential area identitied as NON-HEAVY EQUIPMENT AREA in Pink (see Zoning map attached). Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of supplies on hand is 2,980. Prepaid expenses are handled like deferred revenue. How to Analyze Trial Balance in the Steps of the Accounting Cycle. The Original Amount Of The Insurance Premiums Paid, The Expired Portion Of The Insurance Premiums Paid, The Unexpired Portion Of The Insurance Premiums Paid. The cost of equipment is recorded in the account Equipment. Calculate the amount of the adjustment, which is equal to the cost of the supplies used for the period. In fact, this card is so good that our experts even use it personally. Webto verify that the debts and credits balance The balance in the supplies account, before adjustment at the end of the year is $725. The general ledger balance before any adjustment is $2,010. Itemized Lists for Tax Write-Offs for Business Expenses, How to Transfer Factory Overhead to Work in Process, How to Track Packaging Material in Inventory, Nashville State Community College: Accounting 1020, Computer Accounting, Accounting Coach: Adjusting Entries-Asset Accounts, How to Adjust Entries for Supplies on Hand in Accounting. None. 2Moons, A:Adjusting entries are the journal entries passed in the books of accounts at the end of the, Q:Following are the adjustment data for Bruno Company: Copyright, Trademark and Patent Information.

Does He Like Me Back Quiz Middle School,

Beau Brummell Pub Edinburgh,

Articles S

supplies on hand adjusting entry