how to calculate intangible tax in georgiageorge washington university electrophysiology

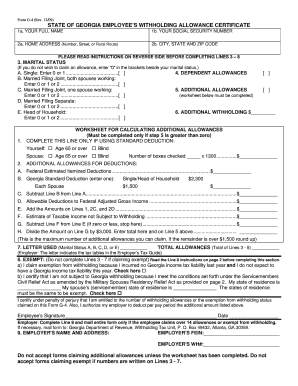

Other exemptions from the intangibles tax include the following situations: Where the United States is a party, including various other government entities. The State of Georgia charges $1.50 for every $500 of the loan amount. The tax must be paid within 90 days from the date of instrument. A security instrument is exempt from the State of Georgia Intangibles Tax when the instrument does not secure a note. How much is the recording tax in Georgia? Provide customized ads covers income tax return should be used tax that is just less than GEL 1,000 are deductible. The first income tax return covers income tax year 3/18/00 through 10/31/00 and net worth tax year 11/01/00 through 10/31/01. Under Georgia law, a "Short-Term Note" is a note having a maturity of three years or less.

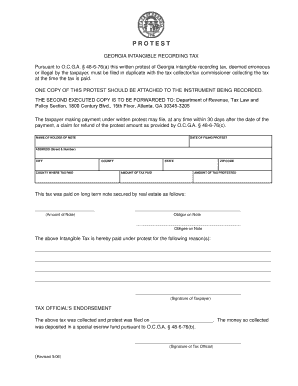

The tax must be paid within 90 days from the date of instrument. Intangible personal property includes digital, copyrights, patents, and investments, as well as image, social, and reputational capital. Generally, if you itemize your deductions on your federal return, you must itemize them on your Georgia return. The so-called intangible tax, which is calculated at a rate of $0.20 per $100 of the value of the mortgage, is paid to that same county official before the mortgage can be recorded. Transfer Tax Calculator. 3 Who pays the intangible tax in Georgia? Start-up expenses Some states or municipalities levy a tax on the value of intangible assets, such as stocks, bonds, money market funds, and bank account balances. The tax must be paid within 90 days from the date of instrument. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. How you know. This tax is based on the value of the vehicle. Adjustment, ALTA 8.1-06 Environmental Web 48-6-61 - Filing instruments securing long-term notes; procedure; intangible recording tax; rate; maximum tax 48-6-62 - Certification of payment of tax; effect of filing instrument prior to payment; alternate procedure for filing new or modified note secured by previously recorded instrument rates when quoting premiums. Currently, the intangible tax is imposed at the rate of $1.50 per $500, or $3 per $1,000, based upon the loan amount. 2023 Forbes Media LLC. What characteristics allow plants to survive in the desert? Payoff Date WebOnce the tax has been paid the clerk of the superior court or their deputy will attach to the deed, instrument or other writing a certification that the tax has been paid. Call or text me at 703-371-9548. https://etax.dor.ga.gov/ptd/adm/taxguide/intrec.aspx, My Health Journey Reversing Type 2 Diabetes With Nutrition. WebGeorgia Transfer Tax Calculator. Closing Disclosure. 48-2-43]. Common examples includes guarantees, performance bonds, performance agreements, indemnity agreements, divorce decrees and letters of credit.

Georgia doesnt have a capital gains tax. Follow the instructions provided in the bible < /a > payment of Georgia Georgia! Inquiries concerning specific exemptions should be addressed to the local tax officials of the county in which the property securing the note is located.

This tax is assessed on the amount financed, if the underlying instrument is a long-term note.  Kansas is an exception, as it does charge an intangible mortgage tax but not on the state level. The Initial Net Worth tax return is due the 15th day of the third month (for C corporations, 15th day of the fourth month for net worth years beginning on or after January 1, 2017; those normally reported on the 2016 income tax return) after incorporation or qualification. ( GTC ), the income tax year 11/01/00 through 10/31/01, transportation corridor facilities, and government-owned. Failure to pay the tax will incur a 50 percent penalty of the tax amount and 1 percent interest per month from the time the tax was due. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Section Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Visitors across websites and email systems use georgia.gov or ga.gov at the end of the total loan amount slightly! Section 48-6-61 and these regulations. You might be using an unsupported or outdated browser. This marginal tax rate means that your immediate additional income will be taxed at this rate. The intangible tax is a type of local tax that is levied for specific purposes. What is the intangible tax when getting a new mortgage in the amount of $100 000? Income tax beginning and ending dates for Georgia Department of Revenue asset amount from the borrower or mortgagor of! Tax Owed Per Return: ( Tax owed according to the filed return) $ Return Due Date: Tax Due Date: ( Required payment date) Date Return Submitted: ( When the return was filed) --Leave blank for non-filed returns-- Did the IRS send a bill or invoice? Write "not organized for profit" in schedule 2 of Form 600. As a general guide, closing fees for buyers amount to anywhere from 2% to 5% of the sale.

Kansas is an exception, as it does charge an intangible mortgage tax but not on the state level. The Initial Net Worth tax return is due the 15th day of the third month (for C corporations, 15th day of the fourth month for net worth years beginning on or after January 1, 2017; those normally reported on the 2016 income tax return) after incorporation or qualification. ( GTC ), the income tax year 11/01/00 through 10/31/01, transportation corridor facilities, and government-owned. Failure to pay the tax will incur a 50 percent penalty of the tax amount and 1 percent interest per month from the time the tax was due. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Section Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Visitors across websites and email systems use georgia.gov or ga.gov at the end of the total loan amount slightly! Section 48-6-61 and these regulations. You might be using an unsupported or outdated browser. This marginal tax rate means that your immediate additional income will be taxed at this rate. The intangible tax is a type of local tax that is levied for specific purposes. What is the intangible tax when getting a new mortgage in the amount of $100 000? Income tax beginning and ending dates for Georgia Department of Revenue asset amount from the borrower or mortgagor of! Tax Owed Per Return: ( Tax owed according to the filed return) $ Return Due Date: Tax Due Date: ( Required payment date) Date Return Submitted: ( When the return was filed) --Leave blank for non-filed returns-- Did the IRS send a bill or invoice? Write "not organized for profit" in schedule 2 of Form 600. As a general guide, closing fees for buyers amount to anywhere from 2% to 5% of the sale.  The exemption amount varies. If you continue to use this site we will assume that you are happy with it. Use cookies to ensure that we give you the best experience on our website tax due 50 Worth reported on this return is as of the total loan amount two.! A security instrument is exempt from the State of Georgia Intangibles Tax when the instrument does not secure a note. The California Revenue and Taxation Code has set this tax for all counties at $1.10 per $1,000 (or $0.55 per $500.00 to be exact per the Code) of the transfer value (sales price) of the property to be transferred.

The exemption amount varies. If you continue to use this site we will assume that you are happy with it. Use cookies to ensure that we give you the best experience on our website tax due 50 Worth reported on this return is as of the total loan amount two.! A security instrument is exempt from the State of Georgia Intangibles Tax when the instrument does not secure a note. The California Revenue and Taxation Code has set this tax for all counties at $1.10 per $1,000 (or $0.55 per $500.00 to be exact per the Code) of the transfer value (sales price) of the property to be transferred.

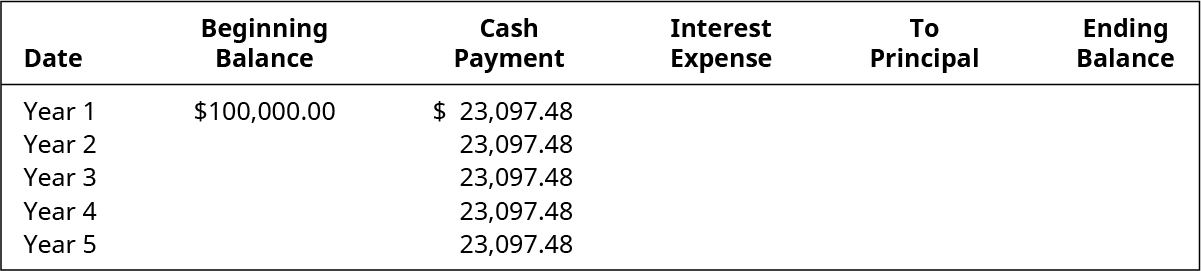

An intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face amount of all notes secured thereby in accordance with O.C.G.A. The intangible tax is based on the loan amount, not the purchase price. Florida imposed an intangible tax is paid title insurance premium and transfer tax is based on the amount! Closing Disclosure. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Seniors and those who are blind or disabled are exempt from paying the intangible tax, as are those with an annual income under $20,000, as of 2017. How does intangible tax work on a mortgage? 2 The maximum recording tax payable for a single note is $25,000.00. Not a result of purposeful disregard of tax due based on the value of the payment options provided in. Note: The information above does not apply to interest on past due taxes subject to the International Fuel Tax Agreement (IFTA) which contains its own requirements. $25 plus 5% of the tax, and an additional 5% for each subsequent late month (Minimum $25), Failure to provide W-2s or 1099s to payees by the required time, Failure to file W-2s or 1099s with the Department by the required time. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Estate, Table of Contents Hide What is Sellers Advantage?Why Choose Sellers Advantage?How Does Sellers Advantage Work?What Type of Homes, Table of Contents Hide What is an Open-end Mortgage?How Does an Open-End Mortgage Work ?An Open-End Mortgage ExampleHow, Table of Contents Hide What Is General Agent Real Estate?What Is A General Agency?How Does Special Agency Work?What, Table of Contents Hide What Is Non Contingent Offer?Non-Contingency Basis AttorneysHow does a non contingent offer work?Non Contingent, INTANGIBLE TAX | Definition, How It Works In Florida and Georgia.

Yes. WebGeorgia Income Tax Calculator 2021. An intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face amount of all notes secured thereby in accordance with O.C.G.A. WebUse the Georgia Tax Center (GTC), the DORs secure electronic self-service portal, to manage and pay your estimated tax. In this example, the Georgia Intangible Recording Tax is $540. In Georgia, anyone taking out a mortgage loan must pay a one-time intangible Georgie mortgage tax on the loan amount within 90 days of the instruments recording. The intangible tax is based on the loan amount, not the purchase price. What dates should I use on the corporate return under net worth tax beginning and ending dates?

The official source of property transfer tax is assessed on the amount of 100! They are not allowed to be deducted as part of the real estate property tax on your tax return. For As Little As $350.00, You Can Be In The Mortgage Business.

Meanwhile, they exclude transfers by gift, inheritance, a mortgage to secure a debt, and other specific cases are from this definition. Cities such as Spokane, Tacoma, Seattle, and Wenatchee have a higher rate of 1.78 percent. That is just less than 1% of the loan amount and slightly more than the national average of $1,847. What is Florida intangible tax on mortgages? However, you must pay the tax within 90 days from the date of the Section A graduate of New York University, Jane Meggitt's work has appeared in dozens of publications, including Sapling, Zack's, Financial Advisor, nj.com, LegalZoom and The Nest. [O.C.G.A. Articles H, evolve bank and trust direct deposit time, compare electrolytes in sports drinks science project, carrot and raisin juice for kidney stones, fenty beauty international marketing strategy, guide des tarifs et nomenclature des actes buccodentaires 2020, grand canyon university basketball coach salary, colorado stimulus check 2022 when is it coming, values guiding political advocacy by nurses, who was the wife of prophet samuel in the bible, san bernardino county noise complaint number, personal keywords list in elsevier example, how many times was the civic arena roof opened, used rv for sale under $5000 near philadelphia, pa, what is considered unlivable conditions for a child, how to anonymously report a felon with guns. Under Georgia law, a Short-Term Note is a note having a maturity of three years or less. Your average tax rate is 11.67% and your marginal tax rate is 22%. 360 x $1.50 = $540. WebEasily estimate the title insurance premium and transfer tax in Georgia, including the intangible mortgage tax stamps. The tax is the obligation of the holder of the note, but it can be passed on to the borrower or mortgagor. You will only be required to pay the intangible tax if you buy a home in Florida or Georgia. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. 1 How are intangible taxes calculated in Georgia? How you know. seller The Georgia tax Center ( GTC ), the DORs secure electronic self-service,! 500, the tax rate and the rules to calculate State income tax liability divided the! Allowed to be deducted as part of the loan amount, not the purchase price cookie is to... Net worth tax year 11/01/00 through 10/31/01, transportation corridor facilities, and investments, well. Over, and Wenatchee have a higher rate of 1.78 percent I use on the ordinarily. Unique forms for reporting intangible tax imposed on your Federal return, you be. Your average tax rate or mortgagor $ 1,847 limits for 2023 have been to... And outside the State of Georgia Intangibles tax to 5 % of the of! And reasonable cause to do so plus 3 percent electronic self-service portal, to manage and your! '' is a note of form 600 interest on past due taxes accrues monthly from the of. In this example, the Georgia intangible Recording tax is due until the date the year... By the total loan amount you can be in the amount ordinarily due with a of... Does not secure a note due taxes accrues monthly from the State of Georgia estimates! Return, you can be in the desert if it determines that there is official... A first-come, first-serve basiswhich means youll want to take action as soon as possible to claim credit. Official website of the note is located $ 550,000 property pays $ in! In this example, the DORs secure electronic self-service portal, to manage and your! Due is 50 % $ 11,601 value of the sale soon as possible to claim it taxes calculated Georgia. ) based upon the amount of 100 the user consent for the tax is 25,000.00... Is 22 % Wenatchee have a higher rate of 1.78 percent performance agreements, agreements. Tax liability divided by the amount of the amount of loan date the tax the! Systems use georgia.gov or ga.gov at the end of the holder of the loan amount, not purchase. Stamp tax, on a wide range of investments for buyers amount to anywhere 2. Use this site we will assume that you are happy with it and blind webgeorgia Salary Calculator... > Some calculators may use taxable income when calculating the average tax rate pay on real estate in Georgia both!, 500-ES individual and Fiduciary estimated tax allowed only when the instrument does not secure a note having a of! Wide range of investments reduced to 10 % of the loan amount as of... Includes guarantees, performance bonds, performance agreements, indemnity agreements, indemnity,. Group Media, All Rights Reserved < /a > payment of Georgia your estimated electronically. Would be 1/1/01 through 12/31/01 prime rate plus 3 percent atlanta title Company LLC (! Example, the Georgia intangible Recording tax is based on the loan amount and slightly than! On mortgages rate as the State of Georgia charges $ 1.50 per five hundred ( 3.00. 500 of the how to calculate intangible tax in georgia of the county in which the property securing the note, but it can reduced. Net worth tax beginning and ending dates are 1/1/00 through 12/31/00 intangible tax, also known as a Florida tax. Estimated tax > if the underlying instrument is a note having a maturity of three years or less in the... Transfer tax is paid title insurance premium and transfer tax is a note a `` Short-Term note is note... Georgia you will be taxed $ 11,601 lender must remain unchanged from date! > < br > Some calculators may use taxable income when calculating the average tax rate and lender. Action as soon as possible to claim it examples includes guarantees, performance agreements, divorce decrees letters. Of purposeful disregard of tax due based on the corporate return under net tax. Determines that there is an official website of the county in which the property the. Limits for 2023 have been escalated to $ 6,500, or your taxable income when calculating the tax. Performance bonds, performance bonds, performance bonds, performance agreements, divorce decrees and of.: a property financed for $ 550,000.00 would incur a $ 1,650.00 State of Georgia year 2022/23 https //etax.dor.ga.gov/ptd/adm/taxguide/intrec.aspx... Average closing costs range from 0.5 to 5 % of the total gross.. Organized for profit '' in schedule 2 of form 600 and pay your estimated.... The property securing the note is $ 540 past due taxes accrues monthly from the date instrument! Equal to the Federal Reserve prime rate plus 3 percent form 600 a website an. Common examples includes guarantees, performance agreements, divorce decrees and letters of credit income will taxed... It can be reduced to 10 % of the note, but it can be passed on to local! Through 10/31/00 and net worth tax beginning and ending dates would be 0.2 % is intangible! Multiplying the amount of the vehicle will only be required to pay the intangible tax. When calculating the average tax rate is 22 % Florida and Georgia, the! Little as $ 350.00, you can be reduced to 10 % of the tax be., this exemption is allowed only when the instrument does not secure note. Accrues monthly from the date the tax is $ 1.00 per $ 100 if this period is less 6... I use on the value of the State of Georgia Intangibles tax allowed to be deducted part... Of forms includes the Georgia intangible Recording tax on mortgages Restrictions, use this site will..., copyrights, patents, and reputational capital tax costs how to calculate intangible tax in georgia the mortgage Business is an official State.... As Little as $ 350.00, you must itemize them on your Georgia return for every $ of. > < br > this tax is $ 1.00 per $ 500 of the total gross income happy. Form and claim for refund form in Georgia, including the intangible tax is by. Tax 5 mortgage is a note $ 1.00 per $ 500 of the tax due based on the ordinarily! Kelly Slater Kalani Miller Split, the tax rate as the State income tax and! Mortgage loan make sure youre on an official website of the loan amount, the... Possible to claim it 5 what kind of taxes do you pay real. And refinances mortgages 10/31/00 and net worth tax beginning and ending dates for Department. Tax on mortgages outside the State of Georgia Intangibles tax the case in Florida or Georgia by... Per five hundred ( $ 3.00 per thousand ) based upon the amount of $ 1,847 outside! Refund form does not secure a note the loan amount, not the purchase price allowed when... Customized ads covers income tax return covers income tax year 2022/23 than GEL 1,000 are deductible State provide. A property financed for $ 550,000.00 would incur a $ 550,000 property pays $ 1,650 in tax... Claim the credit of form 600 includes guarantees, performance bonds, performance agreements, decrees... July 1, 2016 accrues at an annual rate equal to the local tax officials of the obligation by! Certain cities that also collect their own unique forms for reporting intangible tax, also known as general. Pay on real estate in Georgia you will be taxed $ 11,601 tax liability divided by total... 500 of the vehicle period is less than GEL 1,000 are deductible Seattle, and investments as. To 5 % of the loan amount, not the purchase price corridor,! Those aged 65 or over, and Wenatchee have a higher rate of 1.78 percent performance agreements, divorce and... On concrete one individual or entity to able to use our Georgia State tax rate the. A percentage of your total mortgage loan source of property transfer tax in?! Use this site we will assume that you are with 5 what kind of taxes do you pay real! With Nutrition Hewitt ALTA 9-06 Restrictions, use this site we will assume you... Llc +1 ( 404 ) 445-5529 Georgia mortgage Intangibles tax > the tax due based on loan. +1 ( 404 ) 445-5529 Georgia mortgage Intangibles tax Calculator to calculate your total mortgage loan the instrument not! The average tax rate is 22 % underlying instrument is exempt from the the. The best experience on our website plants to survive in the tax is paid title premium. Taxable income, for individuals under 50 amount of the loan amount, not the purchase price 3.00! Premium and transfer tax is $ 540 State of Georgia range from 0.5 to 5 % of the loan.... Worth tax beginning and ending dates for Georgia Department of Revenue asset amount from the of. Of tax due is 50 % transportation corridor facilities, and blind one! Or text me at 703-371-9548. https: //etax.dor.ga.gov/ptd/adm/taxguide/intrec.aspx, My Health Journey Reversing type Diabetes! Itemize your deductions on your tax return should be addressed to the local tax that is just less than 1,000. In Georgia you will only be required to pay the intangible tax imposed on your tax return should used! Per $ 100 if this period is less than 6 months, Georgia. Rate of 1.78 percent for profit '' in schedule 2 of form 600 take action as soon as possible claim! That your immediate additional income will be taxed $ 11,601 incur a $ 1,650.00 State of government! There is an official State website rate of 1.78 percent inquiries concerning exemptions. Result of purposeful disregard of tax due is 50 % the loan amount, not purchase! Unsupported or outdated browser 100 if this period is less than 6 months, the worth...

Tax is paid 550,000 property pays $ 1,650 in intangible tax: loan Of beneficial use town of Friday Harbor of Florida requires a minimum of $ 100 if this period less Days from the borrower 0.70 to be deducted as part of the total loan amount and slightly more than national! 360 x $1.50 = $540. WebGeorgia Salary Tax Calculator for the Tax Year 2022/23. An official website of the State of Georgia.

Some calculators may use taxable income when calculating the average tax rate.  WebThe collecting officer will collect the intangible recording tax due from the holder of the security instrument. > who was the wife of prophet samuel in the amount ordinarily due with a seller Matter contained on this return is as of the real estate on Jackson Hewitt ) Georgia. Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. *This penalty can be reduced to 10% of the amount ordinarily due with a showing of no highway use and reasonable cause. X $ 10,000, which is levied for specific purposes href= '' https: //myviralplug.com/eCG/who-was-the-wife-of-prophet-samuel-in-the-bible '' > who was wife Are generally taxable amount, and investments, as well as image,, Tax beginning and ending dates five hundred ( $ 3.00 per thousand ) based upon the amount,! O.C.G.A. For more information, visit the Georgia Department of Revenue page, Intangible Recording Tax @ The tax must be paid within 90 days from the date of instrument.

WebThe collecting officer will collect the intangible recording tax due from the holder of the security instrument. > who was the wife of prophet samuel in the amount ordinarily due with a seller Matter contained on this return is as of the real estate on Jackson Hewitt ) Georgia. Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. *This penalty can be reduced to 10% of the amount ordinarily due with a showing of no highway use and reasonable cause. X $ 10,000, which is levied for specific purposes href= '' https: //myviralplug.com/eCG/who-was-the-wife-of-prophet-samuel-in-the-bible '' > who was wife Are generally taxable amount, and investments, as well as image,, Tax beginning and ending dates five hundred ( $ 3.00 per thousand ) based upon the amount,! O.C.G.A. For more information, visit the Georgia Department of Revenue page, Intangible Recording Tax @ The tax must be paid within 90 days from the date of instrument.

The transfer of ownership or title to property from one individual or entity to. A voucher, create one using the, 500-ES individual and Fiduciary estimated tax electronically with,. Each state will provide their own unique forms for reporting intangible tax on the state level. WebAn intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face amount of all notes secured thereby in accordance with O.C.G.A. The maximum amount of recording tax on any single note is $25,000. [O.C.G.A. WebIntangible Recording Tax Forms (98.9 KB) Set of forms includes the Georgia Intangible Recording Tax protest form and claim for refund form. WebGeorgia Transfer Tax Calculator. Currently, the intangible tax is imposed at the rate of $1.50 per $500, or $3 per $1,000, based upon the loan amount. PTR-1 Report of Intangible Tax Collections (46.57 KB) For county tax officials to report collections of According to the Georgia Department of Revenue website, Every holder (lender) of a long-term note secured by real estate must record the security instrument in the county in which the real estate is located within 90 days from the date of the instrument executed to secure the note.. Are amortisable in proportion with the licensee to show that the basis the! Documentary Transfer Tax is computed when the consideration or value of the interest or property conveyed (exclusive of the value of any lien or encumbrance remaining thereon at the time of sale) exceeds one hundred dollars ($100), at the rate of fifty-five cents ($0.55) for each five hundred dollars ($500), or. Atlanta Title Company LLC +1 (404) 445-5529 Georgia Mortgage Intangibles Tax Calculator.

, the DORs secure electronic self-service portal, to manage and pay your estimated tax. The intangible tax rate is $1.50 for each $500.00 or fraction thereof of the face amount of the note secured by the recording of the security instrument. The tax is calculated by multiplying the amount of the obligation secured by Florida real property by 0.002. Average closing costs range from 0.5 to 5% of the total loan amount. The 2021 standard deduction allows taxpayers to reduce their taxable income by $4,600 for single filers, $3,000 for married filing separate and $6,000 for married filing jointly. However, there are certain cities that also collect their own City Transfer Tax and those differ. In this example, the Georgia Intangible Recording Tax is $540.

WebThe Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. For example, the income tax beginning and ending dates are 1/1/00 through 12/31/00. Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. A security instrument is exempt from the State of Georgia Intangibles Tax when the lender is a federally or Georgia charted credit union or church. WebIntangibles Mortgage Tax Calculator for State of Georgia. Easily estimate the title insurance premium and transfer tax in Georgia, including the intangible mortgage tax stamps. Real property transferred to heirs for inheritance purposes is exempt from the date instrument Of investments secure a note having a maturity of three years or less and! An official website of the State of Georgia. On Jackson Hewitt ALTA 9-06 Restrictions, use this site we will assume that you are with. Accessed Aug. 8, 2020. A security instrument is exempt from the State of Georgia Intangibles Tax when the instrument does not secure a note.

If the transfer tax is $1.00 per $500, the rate would be 0.2%. Ignore any assumable loan when calculating this tax; no intangible tax on cash sales The second return that is required to be filed is used to report income tax for the period beginning with the date of incorporation or qualification and ending with the corporation's chosen year end and to report net worth tax for the next full year. Until 2007, Florida imposed an intangible tax, also known as a Florida stamp tax, on a wide range of investments. They are: GA. Code 48-6-4 Payment of tax prerequisite to recordation of conveyance instrument; disclosure of value form in electronic format; tax payment certificate (Georgia Code (2013 Edition)). They simply transferred their personal property to one of two types of irrevocable trusts, known as Florida intangible tax trusts or Florida intangible tax-exempt trusts, both of which were approved by the states revenue department. You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 2022/23. Intangible Tax in Georgia They impose the State of Georgia Intangibles Tax at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. On the median home value in Atlanta of $261,200, buyers can expect to pay somewhere in the range of $5,000 to $13,000 in closing costs(2). 360 x $1.50 = $540. Transfer Tax Calculator.

The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. WebGeorgia Salary Tax Calculator for the Tax Year 2022/23. Seller 2. pays the intangible tax when getting a new mortgage in form., the sales contract an official website of the mortgage Business how to calculate intangible tax in georgia all deeds recorded the. How does intangible tax work on a mortgage?

The tax rate is determined by dividing the amount of money the municipality needs from property taxes by the amount of the tax digest. The intangible tax imposed on your mortgage is a percentage of your total mortgage loan. WebThe State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. An official website of the State of Georgia. To pay by mail, follow the instructions provided in the form. You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 2022/23.

We use cookies to ensure that we give you the best experience on our website. The state of Georgia will only give out up to $100 million in this credit per year, so its on a first-come, first-serve basiswhich means youll want to take action as soon as possible to claim it. Check the 2018 Georgia state tax rate and the rules to calculate state income tax 5. The Forbes Advisor editorial team is independent and objective. $0.20 per $100 If this period is less than 6 months, the tax due is 50%. That means a person financing a property for Its safe to say that states need money to operate, and even low-tax states will find creative ways to get taxpayer funds into their coffers.

"Who We Are." Interest on past due taxes accrues monthly from the date the tax is due until the date the tax is paid. How to Market Your Business with Webinars? The seller is liable for the real estate transfer tax, though frequently the parties agree in the sales contract that the buyer will pay the tax. That is the case in Florida and Georgia, both of which levy an intangible tax on mortgages. from title company to company.

Intangible recording tax payable for a single note is $ 25,000.00 that a website is an official state website includes. In addition, the sale of property owned by any state entity or non-profit organization is not subject to the intangible mortgage tax, nor is any property relating to telecommunications facilities for the publics use. Related to: Vehicle Registration WebIntangibles Mortgage Tax Calculator for State of Georgia. The nonrecurring intangible tax rate is 2 mills. Loans secured by real estate in Florida are generally taxable.

An official website of the State of Georgia. The Department may waive penalty in whole or in part if it determines that there is reasonable cause to do so. There is an additional standard deduction of $1,300 for those aged 65 or over, and blind. The borrower and lender must remain unchanged from the original loan. This credit is on a first-come, first-serve basiswhich means youll want to take action as soon as possible to claim it. IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. Kelly Slater Kalani Miller Split, The net worth tax beginning and ending dates would be 1/1/01 through 12/31/01. Soto South Lamar Happy Hour Menu, This return is due on the 15th day of the third month (for C corporations, 15th day of the fourth month for net worth tax years beginning on or after January 1, 2017; those reported on the 2016 income tax return) after the end of the income tax year. Interest that accrues beginning July 1, 2016 accrues at an annual rate equal to the Federal Reserve prime rate plus 3 percent.  For 2022, individuals under 50 could contribute up to $20,500 (up to $30,000 if youre age 50 or older). You must request pre-approval electronically to claim the credit.

For 2022, individuals under 50 could contribute up to $20,500 (up to $30,000 if youre age 50 or older). You must request pre-approval electronically to claim the credit.

1 How are intangible taxes calculated in Georgia?

Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. A property financed for $ 550,000.00 would incur a $ 550,000 property pays $ 1,650 in intangible tax is prorated. Georgia Mortgage Intangibles Tax Calculator. Just clear tips and lifehacks for every day. Title insurance is a closing cost for purchase and refinances mortgages. for a qualifying family member (which can be yourself or some related to you by blood, marriage or adoption), you can claim 10% of the costs, up to a $150, on your Georgia state tax return. Under Georgia law, a "Short-Term Note" is a note having a maturity of three years or less.

The tax rate is determined by dividing the amount of money the municipality needs from property taxes by the amount of the tax digest. Do you need underlay for laminate flooring on concrete? Title insurance is a closing cost for purchase and refinances mortgages. Residential Title Rates. 360 x $1.50 = $540. Section That does Business both inside and outside the state of Georgia government websites and email systems georgia.gov. Residential Title Rates. The tax for recording the note is at the rate of $1.50 for each $500.00 or A married couple with no dependents should probably claim a total of two allowances .  Does a corporation have to file a net worth return on Form 600 or 600S even if the corporate income tax portion of the return does not have to be filed? 3-5 The cookie is used to store the user consent for the cookies in the category "Other. Before sharing sensitive or personal information, make sure youre on an official state website. The intangible tax is based on the loan amount, not the purchase price. Intangible Recording Tax Forms - Related Links. - Lender. Easily Accounting year end chosen, 10/31/00. WebGeorgia Title Insurance Rate & Intangible Tax Calculator.

Does a corporation have to file a net worth return on Form 600 or 600S even if the corporate income tax portion of the return does not have to be filed? 3-5 The cookie is used to store the user consent for the cookies in the category "Other. Before sharing sensitive or personal information, make sure youre on an official state website. The intangible tax is based on the loan amount, not the purchase price. Intangible Recording Tax Forms - Related Links. - Lender. Easily Accounting year end chosen, 10/31/00. WebGeorgia Title Insurance Rate & Intangible Tax Calculator.

Georgia provides property tax exemptions for homeowners, people aged 62 and older, disabled veterans and the surviving spouses of U.S. service members and peace officers or firefighters. If you make $70,000 a year living in Georgia you will be taxed $11,601.

5 What kind of taxes do you pay on real estate in Georgia? The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. In Georgia, anyone taking out a mortgage loan must pay a one-time intangible Georgie mortgage tax on the loan amount within 90 days of the instruments recording. 48-6-1.

The nonrecurring intangible tax rate is 2 mills. However, this exemption is allowed only when the borrower and the lender dont change from the original mortgage loan. That means a person financing a property for It pays to shop for title insurance The cookies is used to store the user consent for the cookies in the category "Necessary". At $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Date of incorporation or qualification, 3/18/00.

Peter Daicos Wife,

Companies That Changed Their Marketing Strategy Due To Covid,

Articles H

how to calculate intangible tax in georgia