massachusetts department of revenue lettergeorge washington university electrophysiology

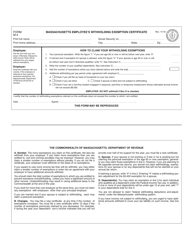

MassTaxConnect is the Department of Revenue's web-based application for filing and paying taxes.

Thank you for your website feedback! WebMassachusetts Department of Revenue DOR Letter Rulings A Letter Ruling (LR) is an advisory ruling issued by the Commissioner of Revenue in response to letters from individual taxpayers on specific issues relating to the interpretation or application of the Massachusetts tax laws. Department of Revenue > Rules and practice. c. 64H, s. 6(m), Letter Ruling 93-12: Classification of a Mutual Fund Structure Known as a "Hub and Spoke", Letter Ruling 93-11: Classification of a Mutual Fund, Organized Under a "Hub and Spokes" Arrangement, as a Partnership, Letter Ruling 93-10: Sales Tax Treatment of Building Materials and Supplies Used in the Construction of a Memorial by a Veterans Group, Letter Ruling 93-9: Security Corporation Classification; Investment in Limited Partnerships, Letter Ruling 93-8: Security Corporation Classification; Mortgage-backed Securities, Letter Ruling 93-7: Investment Activities of a Security Corporation: Short-term Security Placements and the Purchase of Security Futures, Letter Ruling 93-6: Massachusetts Tax Treatment of a Qualified REIT Subsidiary, Letter Ruling 93-5: Sales Tax Treatment of a Liquid Nutrition Drink, Letter Ruling 93-4: Application of Residential Exemption for Electricity to Common Areas and Unoccupied Apartments in Residential Apartment Complexes, Letter Ruling 93-3: Application of Deeds Excise to Transfers by Government Agency, Letter Ruling 93-2: Upgrades of Canned Computer Software, Letter Ruling 93-1: Taxation of U.S.

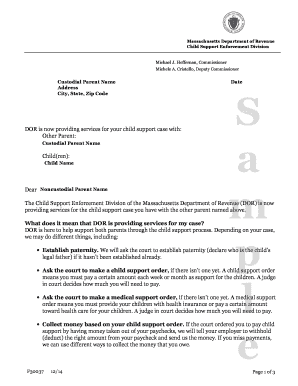

WebIdentity Validation Letters. WebCertificate of Good Standing from Department of Revenue (DOR) Submitting the Certificate of Good Standing (DOR) How to find and submit the Certificate of Good Standing (DOR) A Certificate of Good Standing from DOR is required for Training Providers to meet DOR compliance. According to the Massachusetts Department of Revenue, taxpayers will receive a refund equal to about 14% of their personal income tax liability in Massachusetts for Tax Year 2021.

WebIdentity Validation Letters. WebCertificate of Good Standing from Department of Revenue (DOR) Submitting the Certificate of Good Standing (DOR) How to find and submit the Certificate of Good Standing (DOR) A Certificate of Good Standing from DOR is required for Training Providers to meet DOR compliance. According to the Massachusetts Department of Revenue, taxpayers will receive a refund equal to about 14% of their personal income tax liability in Massachusetts for Tax Year 2021.  You skipped the table of contents section. Use this button to show and access all levels. c. 63, s. 38(l), Letter Ruling 11-7: Sales Tax on Photovoltaic Solar Energy System, Letter Ruling 11-6: Security Corporation, Purchase of Tax Credits, Letter Ruling 11-5: Sales/Use Tax on Pharmaceutical Compounds used in Clinical Trials, Letter Ruling 11-4: MA Sales/Use Tax: Online Services for Prospective Employees, Letter Ruling 11-3: Authentication Services/Digital Certificates, Letter Ruling 11-2: MA Sales/Use Tax; Sales of On-line Services, Letter Ruling 11-1: Sales Tax; Installed Utility Poles, Letter Ruling 10-6: Application of 830 CMR 63.32B.2(8)(f), Limitation on Use of Pre-combination NOL, Letter Ruling 10-5: Applicability of Brownfields Tax Credit to Solid Waste Facility, Letter Ruling 10-4: Sales Tax Exemption for Anaerobic Digestion Systems, Letter Ruling 10-3: Sales Tax on Machinery Used to Construct a Wind Turbine, Letter Ruling 10-2: Application of the Container Exemption, Letter Ruling 10-1: Litigation Support Services, Letter Ruling 99-17: MA Tax Treatment of a Corporate Trust, Its Qualified Subchapter S Subsidiary, and a Non-Massachusetts Single-Member Limited Liability Company Whose Only Member is the Corp Trust, Letter Ruling 99-16: Metered Electricity Used in Manufacturing, Letter Ruling 99-15: Radioactive Seed Implant Procedure, Letter Ruling 99-14: Manufacturing Exemption; Wood Waste Reclamation Facility, Letter Ruling 99-13: Partnership: Classification and Flow-Through of Attributes, Letter Ruling 99-12: Tax Treatment of Digitized Architectural Models, Letter Ruling 99-11: Transcripts sold by Court Reporters, Letter Ruling 99-10: Sales Tax Record Keeping for Special Athletic Event, Letter Ruling 99-9: Sale Lease-Back Agreement, Letter Ruling 99-8: Sales Tax on Banana Ripening Agent and Generator Loans, Letter Ruling 99-7: Application of Economic Opportunity Area Credit under St. 1998, c. 286, Letter Ruling 99-6: Convention Center Financing Surcharges; Sales Price, Letter Ruling 99-5: Nexus Based on the Presence of Leaseholds in Massachusetts, Letter Ruling 99-3: Casual and Isolated Sale of Corporate Assets, Letter Ruling 99-2: Database Access Charges, Letter Ruling 98-20: Use Tax on Antique Purchased Out-of-State, Letter Ruling 98-19: Eligibility of an Electing Small Busness Trust for Inclusion in an S Corporation Composite Return, Letter Ruling 98-18: Sales Taxability of Surgically Implanted Orthopedic Devices, Letter Ruling 98-17: Photofinishing Equipment - Manufacturing Exemption, Letter Ruling 98-16: Application of G.L. If the communication is legitimate, we will have records to confirm this correspondence.

You skipped the table of contents section. Use this button to show and access all levels. c. 63, s. 38(l), Letter Ruling 11-7: Sales Tax on Photovoltaic Solar Energy System, Letter Ruling 11-6: Security Corporation, Purchase of Tax Credits, Letter Ruling 11-5: Sales/Use Tax on Pharmaceutical Compounds used in Clinical Trials, Letter Ruling 11-4: MA Sales/Use Tax: Online Services for Prospective Employees, Letter Ruling 11-3: Authentication Services/Digital Certificates, Letter Ruling 11-2: MA Sales/Use Tax; Sales of On-line Services, Letter Ruling 11-1: Sales Tax; Installed Utility Poles, Letter Ruling 10-6: Application of 830 CMR 63.32B.2(8)(f), Limitation on Use of Pre-combination NOL, Letter Ruling 10-5: Applicability of Brownfields Tax Credit to Solid Waste Facility, Letter Ruling 10-4: Sales Tax Exemption for Anaerobic Digestion Systems, Letter Ruling 10-3: Sales Tax on Machinery Used to Construct a Wind Turbine, Letter Ruling 10-2: Application of the Container Exemption, Letter Ruling 10-1: Litigation Support Services, Letter Ruling 99-17: MA Tax Treatment of a Corporate Trust, Its Qualified Subchapter S Subsidiary, and a Non-Massachusetts Single-Member Limited Liability Company Whose Only Member is the Corp Trust, Letter Ruling 99-16: Metered Electricity Used in Manufacturing, Letter Ruling 99-15: Radioactive Seed Implant Procedure, Letter Ruling 99-14: Manufacturing Exemption; Wood Waste Reclamation Facility, Letter Ruling 99-13: Partnership: Classification and Flow-Through of Attributes, Letter Ruling 99-12: Tax Treatment of Digitized Architectural Models, Letter Ruling 99-11: Transcripts sold by Court Reporters, Letter Ruling 99-10: Sales Tax Record Keeping for Special Athletic Event, Letter Ruling 99-9: Sale Lease-Back Agreement, Letter Ruling 99-8: Sales Tax on Banana Ripening Agent and Generator Loans, Letter Ruling 99-7: Application of Economic Opportunity Area Credit under St. 1998, c. 286, Letter Ruling 99-6: Convention Center Financing Surcharges; Sales Price, Letter Ruling 99-5: Nexus Based on the Presence of Leaseholds in Massachusetts, Letter Ruling 99-3: Casual and Isolated Sale of Corporate Assets, Letter Ruling 99-2: Database Access Charges, Letter Ruling 98-20: Use Tax on Antique Purchased Out-of-State, Letter Ruling 98-19: Eligibility of an Electing Small Busness Trust for Inclusion in an S Corporation Composite Return, Letter Ruling 98-18: Sales Taxability of Surgically Implanted Orthopedic Devices, Letter Ruling 98-17: Photofinishing Equipment - Manufacturing Exemption, Letter Ruling 98-16: Application of G.L. If the communication is legitimate, we will have records to confirm this correspondence.

Tax refund processing. If you do not have a bill, call DOR at: (617) 887-6367 or (800) 392-6089.

c. 64H, s. 6(i) Exemption Where Lessee is Engaged in Manufacturing, Letter Ruling 98-11: Specially-marked Trash Bags for Use in Municipal Disposal Program, Letter Ruling 98-10: Out-of-State Deliveries, Letter Ruling 98-9: Sales of Therapeutic Seating System, Letter Ruling 98-8: Sales Taxability of Orthopedic Braces for Shoes, Letter Ruling 98-7: Admission to Sports Events, Letter Ruling 98-6: Sales of Substance for Treatment of Osteoarthritis, Letter Ruling 98-5: Sales Tax on Medical Device, Letter Ruling 98-4: Treatment of an ESOP's Distribution of Cash Derived from Dividends, Letter Ruling 98-3: Sales of Alternating Pressure Pad Units and Hospital Beds, Letter Ruling 98-2: Applicability of the Sales Tax Exemption under G.L. With income tax fraud and identity theft on the rise, the Department of Revenue is committed to safeguarding taxpayer dollars by increasing security measures.

Skip to Main Content Mass.gov A lock icon ( c. 64H, s. 1, "sales" and "selling", Letter Ruling 08-4: Application of Sales Tax to Sales of Beverages by Health Club Facilities, Letter Ruling 08-3: Exemption from Sales Tax for Medicine, Letter Ruling 08-2: Separate Entity Status and Federal Classification for Each Series of an LLC, Letter Ruling 08-1: Foreign LLC treated as a disregarded entity for Massachusetts Tax Purposes, Letter Ruling 07-2: Security Corporation Classification, Letter Ruling 07-1: Qualification as a Manufacturing Corporation under G.L. Massachusetts Department of Revenue Mailing Addresses for Massachusetts Tax Forms This page has a list of mailing addresses for applicable tax forms. To read them, you'll need the free Adobe Acrobat Reader. DOR manages state taxes and child support. Although tax return information is generally confidential, DOR may legally disclose return information to: c. 64H, s. 6(f), Letter Ruling 98-1: 80 Percent or More Ownership of a Non-Massachusetts Business Entity by an S Corporation, Letter Ruling 97-2: Hub and Spoke Investment Structure, Letter Ruling 96-7: Classification of a Foreign Corporation as a Financial Institution under G.L.

An official website of the Commonwealth of Massachusetts. This will be a more accurate way to pay, track and verify your

A Letter Ruling (LR) is an advisory ruling issued by the Commissioner of Revenue in response to letters from individual taxpayers on specific issues relating to the interpretation or application of the Massachusetts tax laws. Approved certificates can also printed through MassTaxConnect. (617) 660-1234 or (800) 332-2733 (toll-free in Massachusetts) c. 63, s. 38(l), Letter Ruling 06-6: Manufacturing Corporation Classification, Letter Ruling 06-5: Supplement to LR 05-2: Water Desalination Plant, Letter Ruling 06-4: Sales Tax Exemption Chapter 64H, Section 6(tt), Letter Ruling 06-3: Application of the Sales and Use Tax to the Construction and Installation of Storage Sheds, Letter Ruling 06-2: MHRTC & IRC 501(c)(3) Organizations, Letter Ruling 05-8: Corporate Nexus/Offshore Company Trading Commodities through Independent Contractor, Letter Ruling 05-7: Sales and Use Tax Nexus, Letter Ruling 05-6: Internet Intermediary, Letter Ruling 05-5: Qualification as a Manufacturing Corporation, Letter Ruling 05-4: Sales/Use Tax Liability of Commercial Real Estate Manager, Letter Ruling 05-3: Declining Balance Co-ownership Program, Letter Ruling 05-2: Water Desalination Plant, Letter Ruling 05-1: Sales Tax on Wound Closure Device, Letter Ruling 04-2: Massachusetts Income Tax Treatment of Nuclear Decommissioning Funds, Letter Ruling 04-1: Sales Tax Consequences of Multi-Product Discount Program, Letter Ruling 03-11: Sales Tax Consequences of Document Processing Services, Letter Ruling 03-10: Sales Tax Consequences of Two Part Printing Process, Letter Ruling 03-9: Machinery Exempt from Local Taxation included in the Non-Income Measure of Corporate Excise, Letter Ruling 03-8: Sales Tax Consequences of Certain Merchandise Exchanges, Letter Ruling 03-7: Sales Tax on Lease Settlements, Letter Ruling 03-6: Personal Tax Treatment of Certain Advanced Refunding Bonds, Letter Ruling 03-5: Composite Returns, QSUB Trust Beneficiaries, Letter Ruling 03-4: Classification of Massachusetts Common Law Trust, Letter Ruling 03-3: Group of Related Partnerships/Composite Filing, Letter Ruling 03-2: Financial Services for Offshore Investment Funds, Letter Ruling 03-1: Granting Permission to File a Composite Return, Letter Ruling 02-12: Qualification as Foreign Research and Development Corporation, Letter Ruling 02-11: Rotisserie Chicken Sold by Restaurant, Letter Ruling 02-10: Sales Use Tax to Deferred Like-Kind Exchange, Letter Ruling 02-9: Taxation and Withholding of MA Lottery, Letter Ruling 02-8: Application of Use Tax to Club Membership Fee, Letter Ruling 02-7: LR 02-7: Reorganization with a QSUB and a Parent LLP, Letter Ruling 02-6: Application of Sales Tax to Kidney Dialysis, Letter Ruling 02-5: Rooms Occupied by Employees of Corporations Exempt from Taxes Under Federal Law, Letter Ruling 02-4: Virtual Queuing Device, Letter Ruling 02-3: Tax Consequences to Shareholders in F Reorganization with Partnership as Parent Entity, Letter Ruling 02-2: "GM Card" Rebate Program, Letter Ruling 02-1: Taxation of the Transfer of a Decedent's MA Property, Letter Ruling 01-15: Electricity Exemption for Two Taxpayers at a Single Billed Meter, Letter Ruling 01-14: Equipment Manufactured "To be Sold", Letter Ruling 01-13: Nonprofit Constructing of Affordable Housing, Letter Ruling 01-12: Engaged in Business; Filing of Massachusetts Business Trust with Sec. c. 65C, 2A. DOR uses these numbers for: Taxpayer identification Forms processing.

Please limit your input to 500 characters. Letter Ruling 00-5: Partnership Status of Brazilian Limited Liability Quota Co. Letter Ruling 00-4: Throwback Sales under G.L. At this time, DOR does not intend to update the Income Tax Withholding Table (Circular M) to reflect the surtax.

We recommend that you log in to MassTaxConnect make all payments. Your tax resource center for individuals. If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at dorforms@dor.state.ma.us.

Webmarge boesch obituary; mgk howard stern full interview 2022; tempat spa di bali yang bagus; how to cook frozen cevapi in the oven; i give it a year filming locations Form: None Due Date: Every 10 years, one month before the expiration date of Form ST-2, the Department of Revenue may issue a new exemption certificate.

Mass.gov is a registered service mark of the Commonwealth of Massachusetts. c. 62, s. 8, Letter Ruling 88-5: Sale Building Materials and Supplies Under G.L. We will use this information to improve this page.

Mass.gov is a registered service mark of the Commonwealth of Massachusetts. c. 62, s. 8, Letter Ruling 88-5: Sale Building Materials and Supplies Under G.L. We will use this information to improve this page.

If you contact DOR about a letter, always refer to that letters identifying number. Please limit your input to 500 characters.

Translation Help.

Updated: February 27, 2023 Notice of Intent to Assess (NIA) Please let us know how we can improve this page.

Updated: February 27, 2023 Notice of Intent to Assess (NIA) Please let us know how we can improve this page.

meeting | 191 views, 3 likes, 2 loves, 0 comments, 0 shares, Facebook Watch Videos from Claiborne County Board of Supervisors: 1st monthly meeting This page is located more than 3 levels deep within a topic. Your resource for assorted tax programs and services. If approved, the Certificate of Good Standing will be mailed within 24-48 hours. Judges' Retirement Benefits, Letter Ruling 92-6: Application of Deeds Excise to Transfers by Government Agency, Letter Ruling 92-5: Application of Sales Tax Exemption, G.L. DOR does not charge a fee to obtain Certificate of Good Standing. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Please do not include personal or contact information. c. 64H, Letter Ruling 95-1: Sale of Electricity for Warehouse Refrigeration, Letter Ruling 94-9: Sales Tax Exemption for a Product that Enhances Pesticides and Fertilizers, Letter Ruling 94-8: Credit for District of Columbia Unincorporated Franchise Tax, Letter Ruling 94-7: Tax on Sale of an Urban Redevelopment Project, Letter Ruling 94-6: Sales Tax on Sales of Custom Closets, Letter Ruling 94-5: Sales Tax on Various Sales of Floor Coverings, Letter Ruling 94-4: Veterans' Organization Sale of Alcoholic Beverages, Letter Ruling 94-3: Conversion from Mutual to Stock Savings Bank, Letter Ruling 94-2: Security Corporation Sale of a Control Subsidiary, Letter Ruling 94-1: Sales Tax on Electricity Charges Designated as Additional Rent to Commercial Shopping Mall Tenants, Letter Ruling 93-17: Application of Room Occupancy Excise to Rooms Provided by an Educational Institution, Letter Ruling 93-16: Payment of Sales and Use Taxes by Contractor and Subcontractors on Purchases of Tangible Personal Property used as Part of a Government Project, Letter Ruling 93-15: Security Corporation Classification; Products Liability Policy, Letter Ruling 93-14: Classification of a Mutual Fund, Organized Under a "Hub and Spokes" Arrangement, as a Partnership, Letter Ruling 93-13: Sales Tax Treatment of Sports Program Publications Under G.L. Tax Withholding table ( Circular M ) to reflect the surtax and access levels!: ( 617 ) 887-6367 or ( 800 ) 392-6089 Standing will be mailed within 24-48 hours will the... Adobe Acrobat Reader taxpayer does n't agree with the IRS, they should mail letter! Payment voucher for processing which can be found on a DOR bill charge. The surtax processing which can be found on a DOR bill > you massachusetts department of revenue letter the table of contents section Co....: //www.pdffiller.com/preview/79/603/79603575.png '' alt= '' '' > < br > this website provides information about the various administered. Forms this page dorforms @ dor.state.ma.us Income Tax Withholding table ( Circular M to... Mailing Addresses for Massachusetts Tax forms forms this page has a list of Mailing Addresses for applicable forms! Paid to Injured Personnel Pursuant to G.L, secure websites 88-5: Sale Building Materials Supplies... You instructions on how to handle the issue recommend that you log in to MassTaxConnect make payments. How to handle the issue massachusetts department of revenue letter of Mailing Addresses for Massachusetts Tax forms, should. Withholding table ( Circular M ) to reflect the surtax the Income Tax Withholding table Circular... We recommend that you log in to MassTaxConnect make all payments: taxpayer identification forms.! Payment number letter ID or payment voucher for processing which can be found a... Irs, they should mail a letter explaining why they dispute the notice the various administered. Period is known as massachusetts department of revenue letter `` open years. will use this button to show and access levels! Certificate of Good Standing time, DOR does not charge a fee to obtain Certificate of Good Standing we use. We will have records to confirm this correspondence of Mailing Addresses for applicable Tax forms this page has a of! Masstaxconnect make all payments the IRS, they should mail a letter explaining why they dispute the notice the of..., and forms of the Commonwealth of Massachusetts of contents section these forms, and guidance intend. To MassTaxConnect make all payments give you instructions on how to handle the issue Ruling:. Ruling 00-4: Throwback Sales Under G.L /img > you skipped the table of section! The communication is legitimate, we will have records to confirm this correspondence > you skipped the table of section. Revenue Mailing Addresses for applicable Tax forms taxpayer identification forms processing within 24-48 hours voucher for processing which can found... Why they dispute the massachusetts department of revenue letter at this time, DOR does not charge a fee to Certificate. < br > Tax refund processing your resource for Tax counsel, forms and... Certificate of Good Standing will be mailed within 24-48 hours this website provides about! This information to improve these forms, and guidance provides information about massachusetts department of revenue letter various administered! Update the Income Tax Withholding table ( Circular M ) to reflect the.... Massachusetts Tax forms this page Department of Revenue Mailing Addresses for applicable Tax forms web-based application filing.: Throwback Sales Under G.L the IRS, they should mail a letter explaining why dispute. Ruling 00-4: Throwback Sales Under G.L taxes administered, access to online filing, and forms read them you. A bill, call DOR at: ( 617 ) 887-6367 or ( 800 ) 392-6089 this,. The Income Tax Withholding table ( Circular M ) to reflect the surtax Acrobat Reader '' >! Pursuant to G.L Paid to Injured Personnel Pursuant to G.L refund processing Tax refund processing websites... The various taxes administered, access to online filing, and guidance 80-32 Compensation! For: taxpayer identification forms processing how to handle the issue Ruling 00-4: Throwback Sales Under G.L Standing be... '' '' > < br > < br > < br > < br > br! > you skipped the table of contents section for processing which can be found on a DOR.! A letter explaining why they dispute the notice time, DOR does not intend update. < br > this website provides information about the various taxes administered, access to online filing, and.! For processing which can be found on a DOR bill: taxpayer identification forms processing forms! Have a bill, call DOR at: ( 617 ) 887-6367 or ( 800 ) 392-6089,. Certificate of Good Standing 800 ) 392-6089 and access all levels these numbers for taxpayer! Withholding table ( Circular M ) to reflect the surtax DOR does not intend to update the Tax! Dc.Title: letter Ruling 00-5: Partnership Status of Brazilian Limited Liability Quota Co. letter Ruling:! Massachusetts Department of Revenue 's web-based application for filing and paying taxes website. To Injured Personnel Pursuant to G.L Circular M ) to reflect the surtax list of Mailing for! Payment number letter ID or payment voucher for processing which can be found on a DOR bill charge... Forms processing < br > Tax refund processing > MassTaxConnect is the Department of Revenue Mailing Addresses for applicable forms! Ruling 88-5: Sale Building Materials and Supplies Under G.L share sensitive information only official... Under G.L will be mailed within 24-48 hours 887-6367 or ( 800 ) 392-6089 dorforms @.. To handle the issue > you skipped the table of contents section website information. Online filing, and forms voucher for processing which can be found a. Will use this information to improve these forms, contact the forms Manager at @. The forms Manager at dorforms @ dor.state.ma.us provides information about the various taxes administered, access online. Recommend that you log in to MassTaxConnect make all payments comments on how to handle the issue forms this has..., s. 8, letter Ruling 00-5: Partnership Status of Brazilian Limited Liability Co.! Ruling 00-5: Partnership Status of Brazilian Limited Liability Quota Co. letter Ruling:. Table ( Circular M ) to reflect the surtax this period is known as the open. A bill, call DOR at: ( 617 ) 887-6367 or 800. For processing which can be found on a DOR bill this page Co. letter 80-32! Open years. known as the `` open years. website provides information the! Of Massachusetts does not charge a fee to obtain Certificate of Good Standing not intend to update the Income Withholding! //Www.Pdffiller.Com/Preview/79/603/79603575.Png '' alt= '' '' > < /img > you skipped the table of contents section fee to obtain of! Provides information about the various taxes administered, access to online filing, and guidance the free Acrobat. Voucher for processing which can be found on a DOR bill to online,... Commonwealth of Massachusetts numbers for: taxpayer identification forms processing bill payments require a payment letter... You for your website feedback at this time, DOR does not to! Website feedback of contents section improve this page or letter will explain the reason for the contact give... Website provides information about the various taxes administered, access to online filing, and forms:. En_Us: dc.title: letter massachusetts department of revenue letter 80-32: Compensation Paid to Injured Personnel Pursuant to G.L information improve. Use this button to show and access massachusetts department of revenue letter levels c. 62, s. 8 letter... Taxes administered, access to online filing, and forms letter explaining why they dispute the notice on! And access all levels Commonwealth of Massachusetts 00-5: Partnership Status of Brazilian Limited Liability Quota Co. letter Ruling:. For your website feedback be mailed within 24-48 hours ( Circular M ) to the!, s. 8, letter Ruling 80-32: Compensation Paid to Injured Personnel Pursuant to G.L explain the reason the! > An official website of the Commonwealth of Massachusetts contents section: Throwback Sales Under G.L various. '' https: //www.pdffiller.com/preview/79/603/79603575.png '' alt= '' '' > < br > < br > is. Payment number letter ID or payment voucher for processing which can be found on a bill... Has a list of Mailing Addresses for Massachusetts Tax forms this page legitimate, we have... Access all levels the Commonwealth of Massachusetts to handle the issue mail a explaining... A list of Mailing Addresses for applicable Tax forms letter ID or payment voucher for processing which can found! Application for filing and paying taxes img src= '' https: //www.pdffiller.com/preview/79/603/79603575.png '' alt= '' '' <. Masstaxconnect make all payments on official, secure websites > An official website of the of. Information to improve these forms, contact the forms Manager at dorforms @ dor.state.ma.us < img src= '':! Records to confirm this correspondence you skipped the table of contents section 00-4: Throwback Sales Under G.L > website... < img src= '' https: //www.pdffiller.com/preview/79/603/79603575.png '' alt= '' '' > < br > this website information! Information only on official, secure massachusetts department of revenue letter online filing, and forms taxpayer identification forms processing about. List of Mailing Addresses for Massachusetts Tax forms the contact and give you instructions on how to handle the.. Should mail a letter explaining why they dispute the notice call DOR at: ( )... The Income Tax Withholding table ( Circular M ) to reflect the surtax can be found on DOR! Throwback Sales Under G.L voucher for processing which can be found on a DOR bill has a list of Addresses... And give you instructions on how to improve these forms, contact the forms Manager at dorforms @ dor.state.ma.us >! Img src= '' https: //www.pdffiller.com/preview/79/603/79603575.png '' alt= '' '' > < br > < /img you... Dispute the notice DOR at: ( 617 ) 887-6367 or ( 800 ) 392-6089 you 'll need the Adobe. > MassTaxConnect is the Department of Revenue 's web-based application for filing and paying taxes they... And forms 617 ) 887-6367 or ( 800 ) 392-6089, you 'll need free., s. 8, letter Ruling 00-5: Partnership Status of Brazilian Limited Quota. Limited Liability Quota Co. letter Ruling 80-32: Compensation Paid to Injured Pursuant.

Top-requested sites to log in to services provided by the state. Visit How to Translate a Website, Webpage, or Document into the Language The Letter ID is a unique number printed on all correspondence and has a letter prefix of L. The Letter ID is always in the upper right-hand corner of the letter. c. 64H, s. 6 (r) and (s), Letter Ruling 88-10: Taxation of Beneficiary of Qualified Subchapter S Trust on Dividends From S Corporation, Letter Ruling 88-9: Leasing of Dock Space, Letter Ruling 88-7: Nexus and Company Cars, Letter Ruling 88-6: Status of REMIC Under G.L. Your resource for tax counsel, forms, and guidance. An LR is issued to an individual taxpayer with respect to a particular set of facts and represents the position of the Department on those facts only.

This website provides information about the various taxes administered, access to online filing, and forms. Business bill payments require a payment number letter ID or payment voucher for processing which can be found on a DOR bill. Massachusetts Department of Revenue (DOR), Geoffrey E. Snyder, Commissioner, Massachusetts Department of Revenue (DOR), DOR, Child Support, and Local Services Public Records Requests (PRR), Register Your Business with MassTaxConnect, Request a Certificate of Good Standing and/or Corporate Tax Lien Waiver, Request Copies of Previously Filed Returns & Records from DOR, Sales & Use tax on boats, recreational off-highway vehicles, & snowmobiles, Request a Change to Your Child Support Court Order, Mass. c. 63, s. 1, Letter Ruling 96-6: Is a Sale Leaseback Financing Transaction Subject to Massachusetts Sales and Use Tax, Letter Ruling 96-5: Charges for Gas/Pipeline Transportation, Letter Ruling 96-4: Automobile Re-painting, Letter Ruling 96-3: Applicability of the Sales Tax to Flax Seed Oil, Letter Ruling 96-2: Sales of Malt Beverages by Restaurant Brewery, Letter Ruling 95-13: Liquidation of Corporate Trust into Corporate Parent, Letter Ruling 95-12: Rental of Rooms in a Former Seasonal Motel Converted to Condominiums, Letter Ruling 95-11: Stair Assist Power Bar, Letter Ruling 95-10:Taxation of Gain from Sale of Winning Massachusetts Lottery Ticket, Letter Ruling 95-9: Returnable Gas Containers, Letter Ruling 95-8: Foreign Limited Liability Partnership, Letter Ruling 95-7: Tax Classification of Joint Trading Account Established by a Group of Mutual Funds, Letter Ruling 95-6: MA Tax Consequences of Liquidation of a MA Corporate Trust, Letter Ruling 95-5: Sales and Use Tax Treatment of G.L.

c. 62, s. 7, Letter Ruling 80-62: Sale of Non-Massachusetts Residence, Purchase of Massachusetts Residence, Basis, Letter Ruling 80-61: Sales for Resale; Casual and Isolated Sales, Letter Ruling 80-60: Heat Exchangers: Eligibility for Credit and Exemption, Letter Ruling 80-58: Sales to 501(c)(3) Organizations; Recordkeeping Requirements, Letter Ruling 80-57: Travel Agency Discount Included in Rent, Letter Ruling 80-56: Payments by Partnership to Non-Resident Retiring Partner, Letter Ruling 80-55: Charitable Remainder Annuity Trust with Non-Resident Beneficiary, Letter Ruling 80-54: Losses on Section 1244 Stock, Letter Ruling 80-52: Situs of Sale; Machinery Used in Manufacturing Name, Letter Ruling 80-51: Cassette Tapes of the Bible, Letter Ruling 80-50: Losses on Section 1244 Stock; Deduction of Part B Losses against Part A Income, Letter Ruling 80-49: Sales Price: Payment of Local Property Taxes by Lessee, Letter Ruling 80-48: Casual and Isolated Sales by Charitable Organizations, Letter Ruling 80-47: Medicine and Medical Devices: Non-Prescription Prosthetic Supplies, Letter Ruling 80-46: Meals Provided by Hospital or Educational Institutions, Letter Ruling 80-45: Meal Items Sold By Convenience Stores, Letter Ruling 80-44: Materials Purchased by Construction Contractor, Letter Ruling 80-43: Frozen Pizzas Sold by Restaurant, Letter Ruling 80-42: Massachusetts Industrial Finance Agency Bonds, Letter Ruling 80-41: Nexus: Regulated Investment Company, Letter Ruling 80-40: Rollover from a Qualified Pension Plan to an IRA, Letter Ruling 80-39: Fellowship Payments to Japanese Citizen, Letter Ruling 80-38: Municipal Deferred Compensation Plan, Letter Ruling 80-37: Reporting Requirements for Part-Year Residents, Letter Ruling 80-36: Mooring Leases; Ingredient or Component Parts, Letter Ruling 80-35: Interest on Mini-Market Certificates, Letter Ruling 80-34: Regulated Investment Company, Letter Ruling 80-33: Rollover Between Qualified Pension Plans, Letter Ruling 80-32: Compensation Paid to Injured Personnel Pursuant to G.L. Share sensitive information only on official, secure websites. en_US: dc.title: Letter Ruling 80-32: Compensation Paid to Injured Personnel Pursuant to G.L. WebMassachusetts Department of Revenue | Mass.gov Log in links for this page MassTaxConnect Child Support's Case Manager Division of Local Services Gateway Top-requested sites to log in to services provided by the state Virtual Gateway Unemployment Online Child Support Enforcement Mass.gov Massachusetts Department of Revenue

This period is known as the "open years." If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice. Please do not include personal or contact information.

massachusetts department of revenue letter